A company was a biggest wealth creator between year 2013-17, stock price moved 60x. Went into downtrend/consolidation for 4 years, now trying to move up.

Summarizing some reasons how this break out is supported by fundamentals.

A thread on #Caplin #CaplinPoint

Summarizing some reasons how this break out is supported by fundamentals.

A thread on #Caplin #CaplinPoint

What has changed in last 4 years?

Criticism on cash flow seems well addressed in FY2021. Biggest positive thing I see.

Management Walk the Talk: Top line of 2015 becomes bottom line of 2021

Company have always grown exponentially without taking any debt

Criticism on cash flow seems well addressed in FY2021. Biggest positive thing I see.

Management Walk the Talk: Top line of 2015 becomes bottom line of 2021

Company have always grown exponentially without taking any debt

Last 5 years, company have done Capex of 800 Cr and still managed to remain debt free

300 Cr ongoing Capex: 160 Cr for Oncology segment, 100 Cr for API backward integration

Spent 275 Cr in R&D last 4 years

Scientists count increased by 3x to 300+ Big positive sign for future

300 Cr ongoing Capex: 160 Cr for Oncology segment, 100 Cr for API backward integration

Spent 275 Cr in R&D last 4 years

Scientists count increased by 3x to 300+ Big positive sign for future

470 Cr cash despite ongoing expansions

Company aspires to grow faster than industry average

Focusing on products which are in continuous shortage in US markets

Establishing fully integrated value chain from KSM to API to Formulation to Online retail sale.

Company aspires to grow faster than industry average

Focusing on products which are in continuous shortage in US markets

Establishing fully integrated value chain from KSM to API to Formulation to Online retail sale.

Though online retail sells will contribute less, other segment will led them to fetch even higher margins.

Remember, only low cost producers survive over longer run.

Clean USFDA/EU records past 4 years. Launched 8 products in US.

Remember, only low cost producers survive over longer run.

Clean USFDA/EU records past 4 years. Launched 8 products in US.

Eying niche injectables & ophthalmic products in US

3x Capacity expansion in Sterile plant & backward integration of API for US market is coming online in 4-6 months

Capacity expansion will let them serve 3 billion USD market size over current 700 million USD. Big scope.

3x Capacity expansion in Sterile plant & backward integration of API for US market is coming online in 4-6 months

Capacity expansion will let them serve 3 billion USD market size over current 700 million USD. Big scope.

I think with all the Capex towards backward integrations & number of product launches in US & other regulated markets, company will fetch industry leading margins in near future.

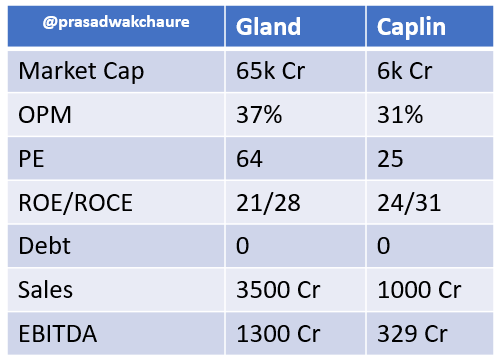

I think it's rerating candidate.

I think it's rerating candidate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh