#FCBarcelona are facing a financial crisis, due to a combination of mismanagement and the COVID-19 pandemic, which means that they need to make significant savings to meet La Liga’s regulations. This thread will look at how the club reached this point and the implications.

La Liga will not allow #FCBarcelona to register its new signings unless the club makes savings of over €200m. These signings include Sergio Aguero, Eric Garcia, Memphis Depay and Emerson Royal. These are mainly free transfers, but Barca still cannot complete the transactions.

#FCBarcelona’s financial issues even endanger Lionel Messi’s proposed new 5-year contract, though the club is looking to get creative here, e.g. huge pay cut (reportedly 50%) in the first year, compensated by a longer agreement and potential “ambassadorial work” in the future.

Each season La Liga applies a strict expenditure limit, specifying how much each club is allowed to spend on first team players, reserves, academy, coaches, physios, etc, though the club may choose how the money is split between wages and transfers.

The salary cap is basically calculated as a club’s revenue less its operational costs and debt repayments for the following season. In contrast to UEFA’s Financial Fair Play rules which look at prior years, La Liga’s regulations are applied in advance, i.e. before the spending.

La Liga has made allowances for COVID, including temporarily removing penalties for exceeding squad limits in 2020/21 (which helped #FCBarcelona among others). However, president Javier Tebas has made it clear that clubs will not be allowed to do the same this season.

#FCBarcelona salary cap was nearly halved from €671m in 2019/20 to €347m in 2020/21 with their €324m reduction being by far the largest in La Liga (around the same as all the other clubs combined). Their limit was the highest, but it has been overtaken by Real Madrid €473m.

Moreover the #FCBarcelona salary cap has been further cut for the upcoming season 2021/22 with most media outlets reporting that it is down to €160m, though others have suggested €200m. Either way, that would represent a massive cut.

Tebas noted, “When a club goes over its salary cap, it can only include players who represent 25% of the savings.” This means that teams are allowed to use 25% of transfer profits to cover new costs, but 75% must be used to pay off money owed.

Tebas further explained, “If #FCBarcelona sell a player for €100m, they can only spend €25m. If they want to bring in a player who costs them €25m a season in salary, they must earn €100m, either by transfer or salary reduction."

Tebas said, “Barca are currently exceeding their salary cap. The efforts made to reduce the wage bill are on the right track, but there will not be a special rule for Messi. I hope they can include Messi’s wages, but to do so, they will have to leave out someone else.”

#FCBarcelona football wages fell €58m (12%) from €501m to €443m in 2019/20, , but have still grown by 30% (€103m) in 3 years. Total wages including other sports €487m – €513m including image rights. Budgeted to decrease a further €81m to €362m in 2020/21.

Not only was #FCBarcelona’s wage bill the highest in Spain, but it was far ahead of other clubs in Europe, especially in 2019 when their €501m was €124m (33%) more than the next highest #MUFC €377m. Wages surged under former president Josep Maria Bartomeu.

Even after the fall from €501m to €443m in 2020, #FCBarcelona still had the highest wage bill in Europe, €42m more than #MCFC. As Tebas said, “Barca have always been at the limit in terms of wages. When the pandemic came along, they did not have a buffer.”

#FCBarcelona are looking for their players to accept wage cuts, especially if Messi sets the example. Reductions have reportedly already been agreed by Gerard Piqué, Marc-André ter Stegen, Frenkie de Jong and Clément Lenglet, while others are in negotiations.

#FCBarcelona wages to turnover ratio has actually not been too bad, though it has increased (worsened) from 52% to 62% in the last 3 years. However, this was pre-COVID, so the substantial reduction in revenue in 2020/21 would adversely impact this ratio – before any wage cuts.

Some will be puzzled how the mighty #FCBarcelona are in this predicament, especially as they still had highest revenue globally in 2019/20 with their €715m topping the Deloitte Money League. However, as per the old saying, “Revenue is vanity, profit is sanity and cash is king.”

Furthermore, #FCBarcelona revenue dropped €126m (15%) in 2020 , the second highest reduction in absolute terms of the “European Super League” clubs, only surpassed by #MUFC €131m (as qualified for the Europa League). In contrast, Real Madrid’s revenue only fell €42m (6%).

#FCBarcelona reported €203m loss from COVID in 2020 (stadium €67m, TV €35m, commercial €72m & transfers €29m) and estimated a further €267m reduction in 2021, giving €470m loss over 2 years. It’s probably even higher, as this assumed an early return of fans to the stadium.

#FCBarcelona revenue includes significant money from the Champions League, boosted by the introduction of the UEFA coefficient payment in 2019 (which benefited Spanish clubs). However, they have not gone beyond the quarter-finals since 2015 and only reached the last 16 in 2021.

Also worth noting that #FCBarcelona commercial revenue is suffering, partly due to the retail closures and inability to complete deals, but it has also been reported that the value of the Rakuten shirt sponsorship extension to June 2022 reduced from €55m to €30m.

#FCBarcelona slumped to €128m pre-tax loss in 2020, compared to Madrid £2m profit. Tebas again: “Real Madrid have made a commendable effort to ensure their losses aren’t the same as Barca, who take the trophy for losses.” In fact, Barca €203m worse than Madrid over last 3 years

Like many other clubs, #FCBarcelona have become increasingly reliant on player sales with profits from this activity of €382m in the last 3 years, including Neymar’s lucrative sale to PSG in 2018. However, the 2020/21 budget only assumed net €28m (gains €59m, losses €31m).

This means that #FCBarcelona had a huge €173m operating loss in 2020 (i.e. excluding player sales & interest), making €432m in last 3 years. Three “Super League” clubs had higher losses (Juventus, Milan & #MCFC), but these are all supported by owners – in contrast to Barca.

It is also worth noting that much of #FCBarcelona revenue growth was due to bringing Barca Licensing & Merchandising activities in-house in 2019, but that was partially offset by higher costs, as can be seen by other expenses rising €54m (32%) in the last 3 years.

The other #FCBarcelona staff cost, player amortisation, the annual charge to write-down transfer fees over length of a player’s contract, has shot up by more than €100m in only 3 years from €67m to €174m, the highest in Europe, just ahead of Juventus €167m and €MCFC €166m.

This could be an issue if #FCBarcelona attempt to get players off the wage bill by selling them cheaply or releasing them on a free transfer, as the club would have to write-off the remaining amortisation in the books, e.g. Miralem Pjanic still has €45m amortisation to charge.

#FCBarcelona have spent big in the transfer market, averaging €320m in last 3 years, which is more than three times as much as €103m average in preceding 5-year period. Player sales have also increased in this period, but net spend has still doubled from €64m to €132m.

In fact, #FCBarcelona have spent nearly a billion on bringing players to the club in the last 3 years with their €960m by far the highest in Europe, well ahead of Juventus €801m, #CFC €758m and #MCFC €678m. In terms of net spend, Barca were outpaced by the 2 Manchester clubs.

However, much of #FCBarcelona transfer spend has been on credit, as their transfer debt has surged from €64m in 2017 to €323m in 2020. This is again the highest in Europe, above Atletico Madrid €316m, Juventus €301m, Inter €207m and Real Madrid €196m.

#FCBarcelona gross financial debt has increased by a hefty €412m from €68m to €480m in just 2 years, comprising €279m bank loans and €201m bonds. Cash was relatively flat at €162m, so net debt grew from €114m to €318m in 2020.

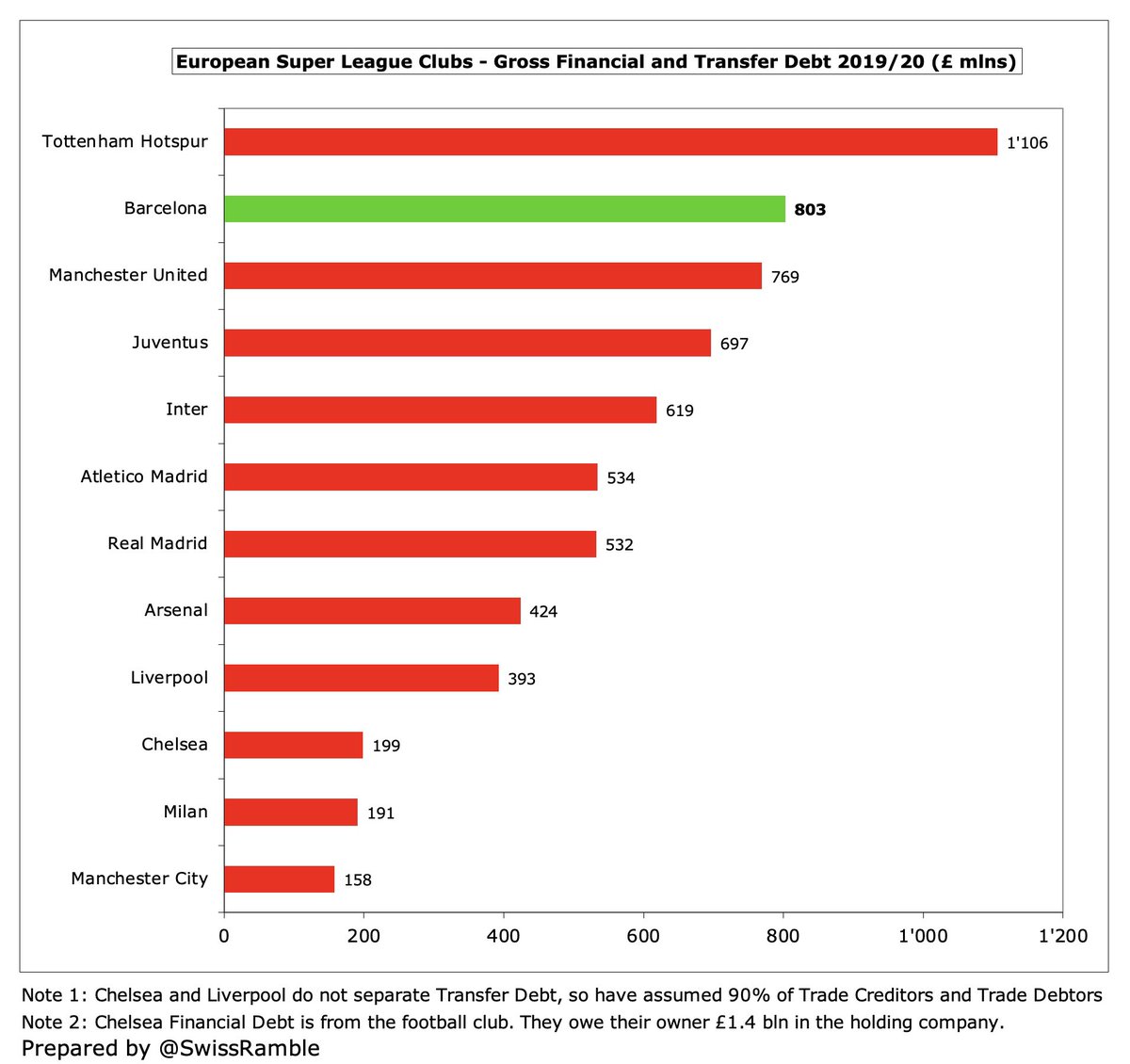

Using UEFA’s definition of debt, i.e. financial debt (bank loans, bonds, owner loans) and transfer debt, #FCBarcelona €803m was second highest in Europe, only behind #THFC €1.1 bln, though the Londoners have funded a state of the art revenue-generating stadium with their loans.

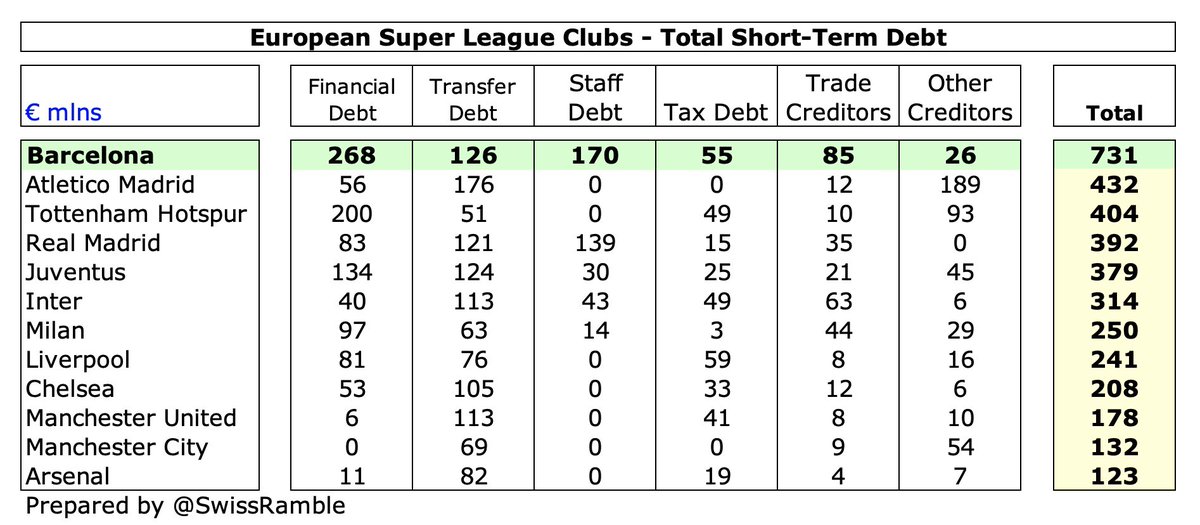

#FCBarcelona total debt is actually €1.2 bln including outstanding wages, tax authorities debt, trade creditors and other creditors. The staff debt is particularly relevant for Barca, as Spanish clubs pay most of their wages twice a year, so high cash balances can be misleading.

One reason #FCBarcelona have more problems with debt than others is that so much is short-term, i.e. needs to be repaid within the next 12 months: €731m for Barcelona (including €268m bank loans), while next highest are Atleti and #THFC with only €432m and €404m respectively.

As Tebas warned, “Barca have to restructure their debt. If they manage that, the situation won’t be serious.” In fact, #FCBarcelona secured a €525m credit line from Goldman Sachs in June (15 years at 3% interest). Used to repay €80m ST bridging loan & renegotiate €200m bonds.

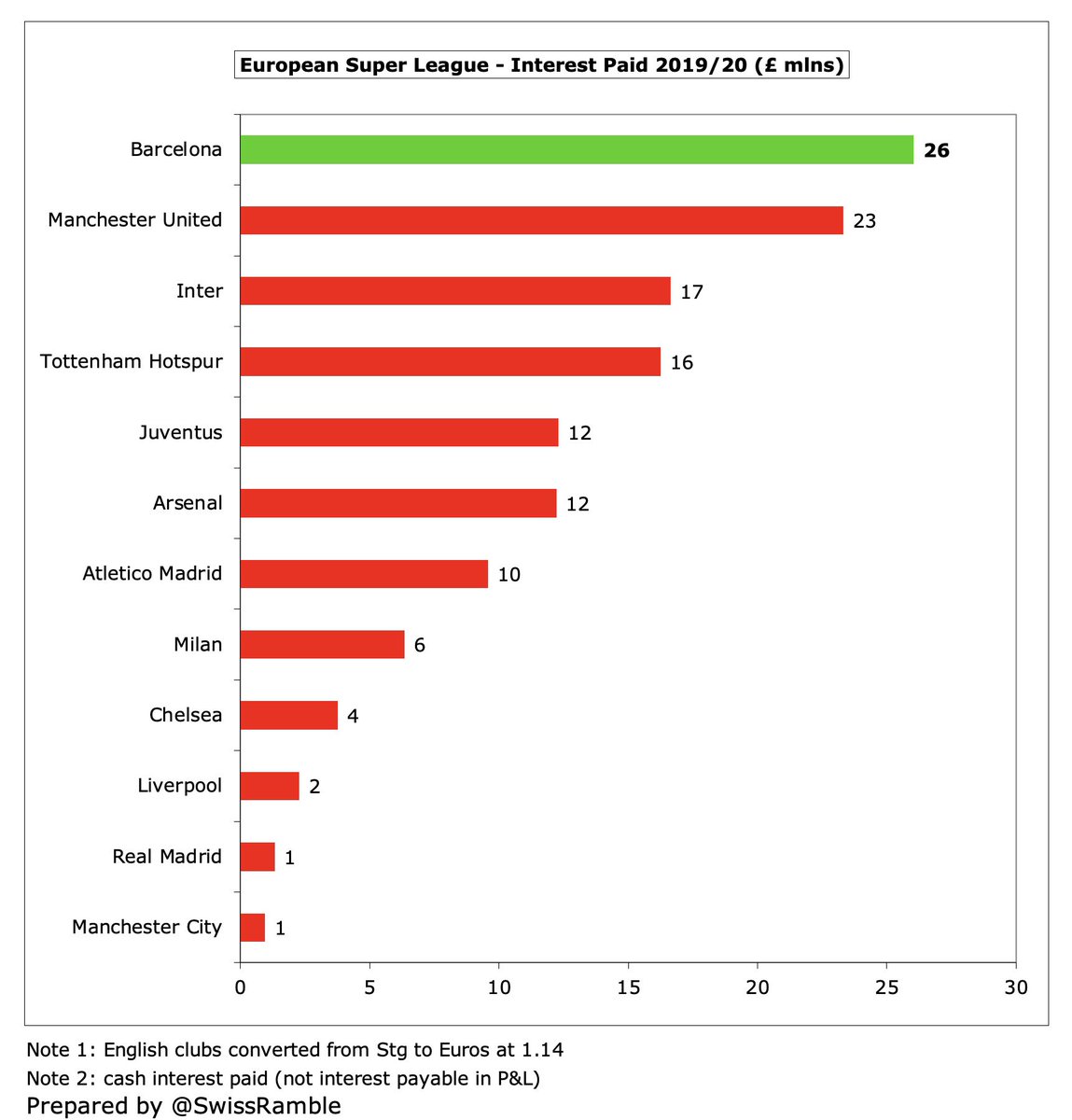

One consequence of the high debt is a steep increase in the amount of interest #FCBarcelona has to pay. This is up from less than €1m in 2018 to €26m in 2020, the highest in Europe, ahead of #MUFC €23m. This payment is budgeted to further rise to €34m in 2021.

#FCBarcelona 2020 cash flow clearly illustrates their challenges. The €173m operating loss improved to €25m after adding back non-cash items, but club then spent €97m on players (purchases €245m, sales €148m), €58m capex and €24m interest. Funded by €205m new loans.

#FCBarcelona need to sell players to bring in funds (or loan/release them to reduce wages). As Tebas said, “The severity of the situation depends on the resources they are capable of generating.” Have already moved on some fringe players: Firpo, Todibo, Alena and Trincao (loan).

#FCBarcelona would also like to sell Coutinho and Dembelé, but they are both injured and unlikely to bring in anything like what they cost. They are even considering the release of Umtiti and Pjanic for nothing. In short, those they are happy to sell would not raise much.

Ideally, #FCBarcelona would like to keep their young talent like Pedri, Ansu Fati and Ilaix Moriba, while also retaining key elements of the team like Griezmann, de Jong and ter Stegen, but these are unfortunately the players who would be most in demand.

As president Joan Laporta said, “The market is moving but it’s an unusual situation. There’s not much money about and there are lot of player exchange offers.” This means that #FCBarcelona might have to take some tough decisions to meet their financial targets.

Another option for #FCBarcelona to raise funds might be to sell a stake in Barca Corporate (academy, innovation hub, licensing & merchandising, studio). They have reportedly received a €200m for 50%, but Laporta does not seem overly keen to sell.

The daunting #FCBarcelona financial challenges help explain why they wanted to be part of the European Super League, especially as they would have received a “welcome bonus” of €270m plus an additional €60m in the first two years, even before an estimated annual €234m.

#FCBarcelona’s problems have not arrived overnight, as confirmed by economic VP Eduard Romeu, “COVID is not to blame for everything. Things were going badly before.” Laporta said restrictions were caused by “what we have inherited”, a reference to his profligate predecessor.

#FCBarcelona will struggle to find a solution, but Laporta is optimistic, “The players we are signing can be registered. It isn’t easy but we are working hard. We have to follow the rules. We are convinced we can reduce the payroll or find a formula that’s acceptable to La Liga.”

These are tough times at #FCBarcelona. As well as the financial issues, their performance on the pitch has been slipping. In fact, 2020/21 was the first season that they finished outside the top two since 2007/08. Their standard big-spending approach is no longer on the menu.

• • •

Missing some Tweet in this thread? You can try to

force a refresh