Crystal Palace accounts for 2019/20 published, covers 13 months to include whole of season which ended in July:

Highlights #CPFC

Revenue down 8% to £142m

Wages up 11% to £132m (mainly due to 13 months)

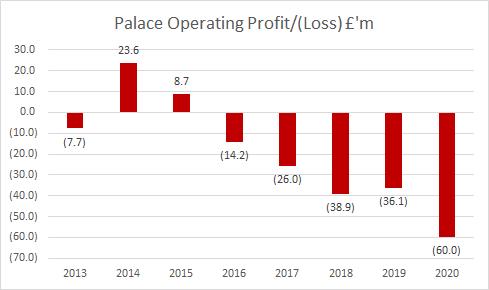

Operating loss £60m

Player sale profits £0.5m

Highlights #CPFC

Revenue down 8% to £142m

Wages up 11% to £132m (mainly due to 13 months)

Operating loss £60m

Player sale profits £0.5m

Total income includes all matches from 19/20, down a bit but expected due to loss of matchday & broadcast rebate.

Palace matchday down 19%. In bottom six of EPL which reinforces view that stadium expansion & new stand needed. #CPFC

Broadcast income down mainly due to rebate. For reasons only known to itself @premierleague no longer believes in transparency & does not disclose breakdown of TV monies. Palace 1 place lower than 18/19 cost about £2m.

Palace wages up but distorted by 13 month accounting period. Weekly wage constant. Wages 93% of revenue but again distorted by accounting period to an extent. #CPFC

Other main player cost is amortisation (transfer fees spread over contract length). This fell reflecting relatively modest investment in players in last few years.

Lower revenues & higher costs usually result in red ink and Palace made an operating loss of £60m in 19/20. Total losses in EPL £1,206 million and likely to rise once Mike Ashley gets his finger out publishes #NUFC numbers #CPFC have made significant losses for last 5 seasons.

Player sales can offset losses. Palace sold AWB on last day of 18/19 which turned numbers around but in 19/20 profits were only £0.5m #CPFC

Looks as if Palace chairman Steve Parish only was paid £913k in 20/20, a big drop on previous season.

Palace bought players for £12m in 2019/20. Their record since promotion to EPL is purchases £271m and sales £100m. Squad cost a total of £197m at 31 July 2020.

• • •

Missing some Tweet in this thread? You can try to

force a refresh