Crystal Palace’s 2019/20 financial results covered a season which ended in “a relatively disappointing 14th place following a run of bad results after lockdown”, according to chairman Steve Parish. Financial results were adversely impacted by COVID-19. Some thoughts follow #CPFC

#CPFC swung from £5m pre-tax profit to £58m loss, mainly due to profit on player sales dropping from £46m to only £0.5m. Revenue fell £13m (8%) from club record £155m to £142m, partly due to COVID, while expenses increased £5m (2%), including an additional month.

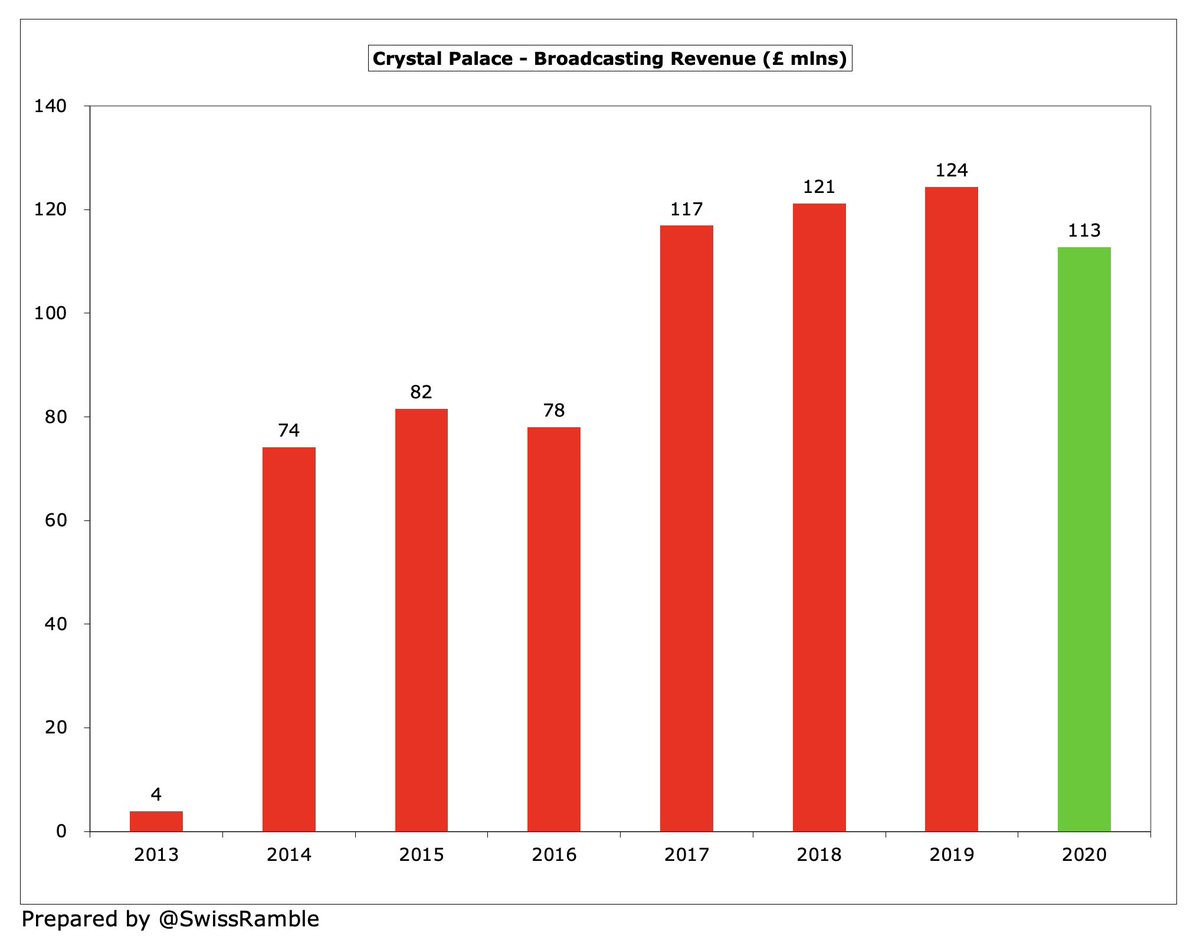

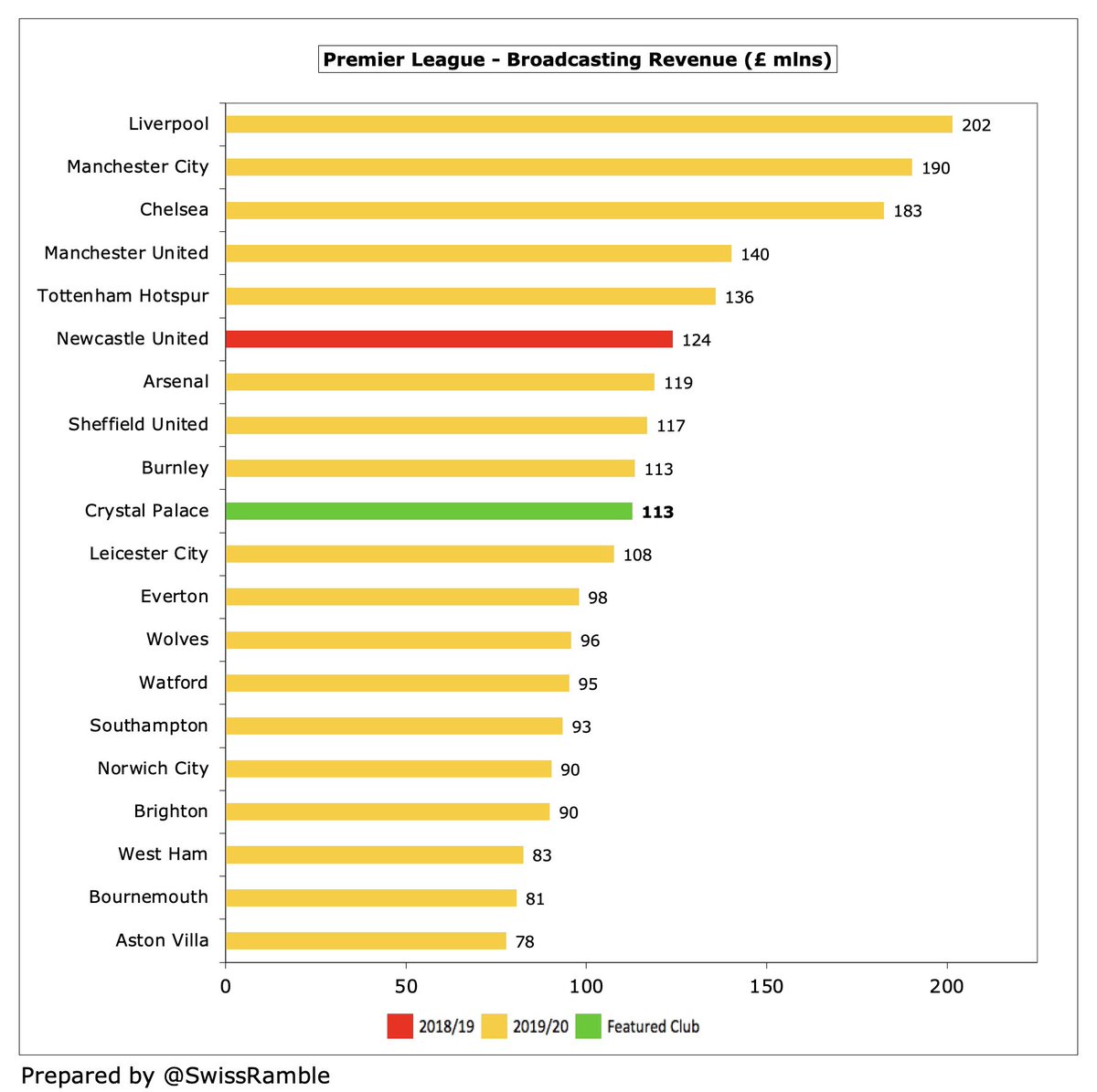

Main driver of #CPFC revenue reduction was broadcasting, which fell £11.7m (9%) from £124.4m to £112.7m, while match day dropped £2.8m (19%) from £14.6m to £11.8m. However, commercial rose £1.4m (9%) from £16.4m to £17.8m. Note: this revenue split is from club’s Annual Review.

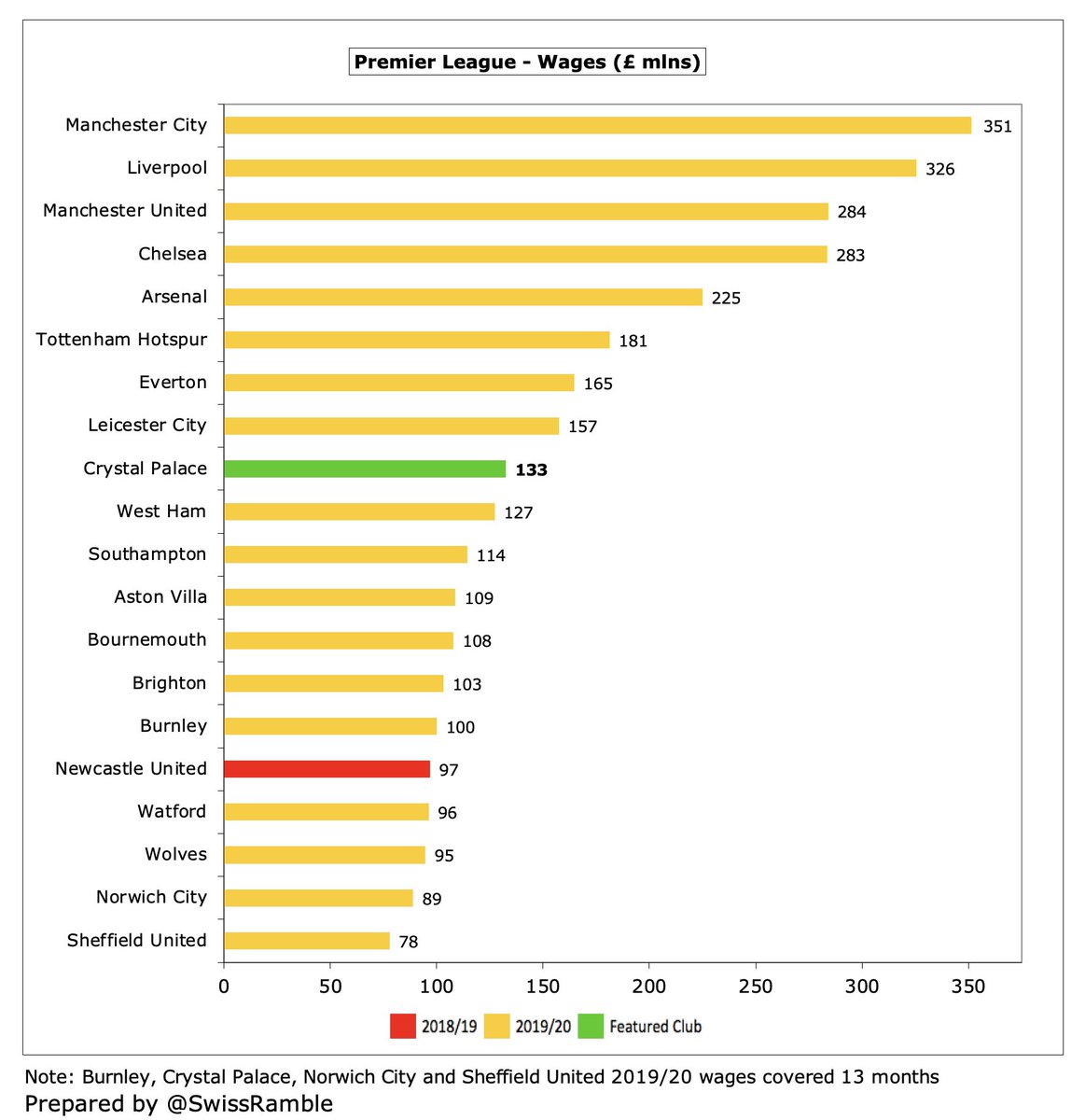

Despite the revenue decrease, #CPFC wage bill increased £13m (11%) to £133m, while other expenses rose £2m (9%) to £21m, mainly due to 13-month accounts. Player amortisation fell £7m (13%) to £43m, but no repeat of £2m impairment charge. Interest payable down £1.4m to £0.9m.

Although #CPFC £58m loss is obviously not great, it is only mid-table in the Premier League, as all clubs have been adversely impacted by COVID with no fewer than 9 of them posting higher losses than the Eagles in 2019/20, including #EFC £140m, #MCFC £125m and #AVFC £99m.

Without COVID, #CPFC revenue would have been £11.7m higher at £154m, due to broadcasting rebate and lost match day income. Along with £14.1m extra costs incurred for additional month in accounts less £0.7m net cost savings, this would have resulted in a smaller loss of £33m.

It is worth noting that #CPFC extended their accounting close to 31st July 2020, a period of 13 months, in order to “cover the extended timeframe to complete the season.” This meant the revenue impact of the COVID-19 pandemic on their accounts was smaller than most other clubs.

However, the main reason for #CPFC worse bottom line was profit on player sales, which declined from £46m to just £539k, as prior year included lucrative Wan-Bissaka transfer to #MUFC. This was 3rd lowest in the Premier League, far below #CFC £143m, #LCFC £63m and #AFC £60m.

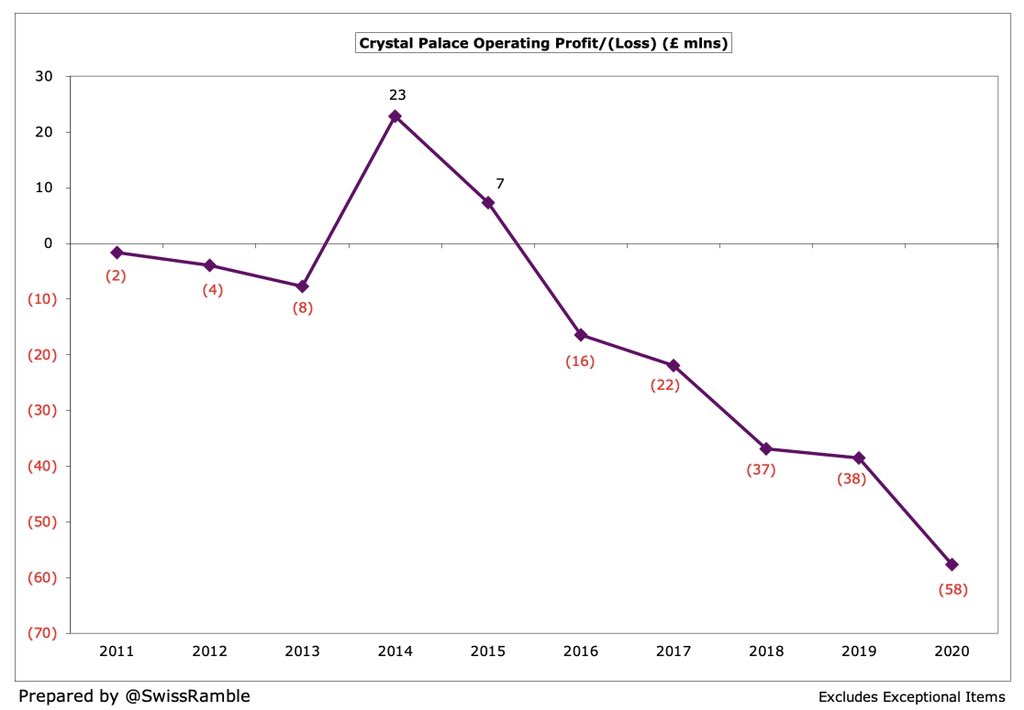

Since promotion to the Premier League in 2013, #CPFC have made money in four out of seven seasons, though they have made an overall £52m loss in that period, due to the hefty deficits in 2018 (£36m) and 2020 (£58m).

However, Parish noted that “strong results in 18/19 allowed us to cope with the impact of COVID-19 in much better shape than might have been the case otherwise.” It is clear that #CPFC have been run sensibly, effectively breaking-even in the top flight before the pandemic hit.

#CPFC could also have improved profitability with more player sales, but they have opted to retain their talent. That said, they still averaged £21m from this activity in last 4 years (compared to £4m in preceding 6-year period). 2020/21 will include Sorloth to RB Leipzig.

#CPFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales, dropped from £17m to £(12)m, the club’s worst in the Premier League. This is in the bottom half of the top flight, far below #MUFC £132m and #THFC £106m.

At an operating level (i.e. excluding player sales and interest), #CPFC loss widened from £38m to £58m. This is the club’s worst ever performance, but is still in the top half of the Premier League with no fewer than 5 clubs having operating losses above £100m.

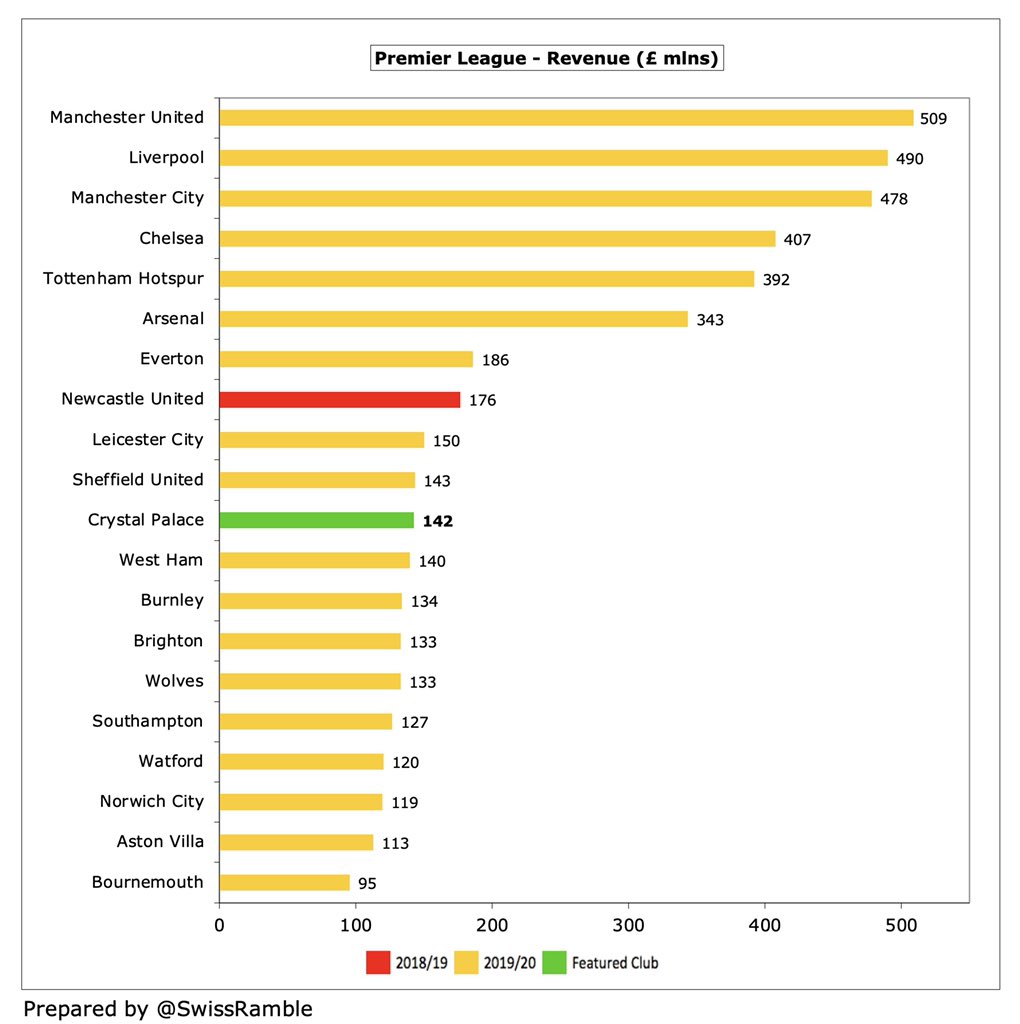

Despite the decline in 2020, #CPFC revenue has still grown by £52m (57%) since 2014 from £90m to £142m, their first season following promotion to the Premier League. Much of that growth is due to new Premier League TV deals, but commercial has also shot up.

Even after the steep decrease in broadcasting income, this was still by far the most important revenue stream for #CPFC, accounting for 79% of total revenue, followed by commercial 13% and match day 8%.

#CPFC £142m revenue was 11th highest in the top flight, though the gap to the Big Six is enormous, as Palace are more than £200m behind #AFC £343m. For more perspective, it’s less than a third of #MUFC £509m, #LFC £490m and #MCFC £478m.

Most clubs’ revenue was significantly down in 2019/20, averaging decreases of £39m and 13% due to COVID, so #CPFC £13m (8%) reduction was one of the best performances. Helped by extending accounts to 31st July, whereas others with May/June closes had to defer revenue to 2020/21.

In fact, #CPFC revenue was actually 25th highest in the world in 2019/20 per the Deloitte Money League, five places better than their prior year ranking. Their £141m (slightly lower than the figure in the club accounts) was ahead of both Ajax £136m and Milan £130m.

#CPFC broadcasting income fell £11m (9%) from £124m to £113m, due to a rebate to broadcasters and a lower merit payment for finishing two places worse. Other clubs also had to defer some revenue into 2020/21, as season extended beyond their 31st May & 30th June accounting close.

Much of Premier League TV deal is distributed equally, but part based on league position (merit payments, growth in overseas rights) & number of times shown live (facility fees). From 2019/20 each league place worth around £3m, so fall from 12th to 14th cost #CPFC around £6m.

#CPFC match day income fell £2.8m (19%) from £14.6m to £11.8m, as they played 4 home games behind closed doors due to COVID. Firmly in bottom half of the Premier League, only 8% of #THFC £95m after their stadium move. Note: Palace gate receipts in accounts were only £8.6m.

#CPFC average attendance fell slightly from 25,455 to 25,060 (for games played with fans), the 4th lowest in the Premier League, which helps explain the decision to build a new main stand at Selhurst Park. Crowds have grown by nearly 8,000 (45%) since promotion.

#CPFC stadium project expected to cost £130m, though negotiations for land still need to be resolved. The club say it “will offer a step change in revenue potential with over 8,300 new seats, up to 3,000 new premium covers and major opportunities for non-matchday revenue.”

Despite COVID delays, Steve Parish previously said that the stadium development “is a long-term plan for the future of the football club. To be competitive, we need as much revenue as possible and other Premier League clubs have £20m-£30m more revenue than #CPFC.”

#CPFC commercial income rose £1.4m (9%) from £16.4m to £17.8m, mainly due to sponsorship. This revenue stream has grown four years in a row, but is still only 17th highest in the Premier League, behind the likes of Norwich City, Sheffield United and Southampton.

W88 became #CPFC shirt sponsor for 2020/21, replacing ManBetX. No financial details divulged, though previous deal was reportedly worth £6.5m a year. Puma replaced Macron as kit supplier in 2018/19. Palace also had a new sleeve sponsor in 2020/21 with Iqoniq replacing Dongquidi.

#CPFC wage bill increased £13.3m (11%) from £119.3m to £132.6m, mainly because accounting period was extended to 31st July, thus covering 13 months. Increase would have only been £3m to £122m if adjusted for 12 months. Almost tripled since first season after promotion in 2014.

Unlike most clubs #CPFC also break out player wages, which grew £5m to £90m on an adjusted 12-month basis (£97m for full 13 months). Including social security and agents’ fees, total player compensation was £107m, which worked out to 75% of turnover.

#CPFC reported £133m wage bill was 9th largest in the Premier League, probably higher than most fans would expect. Even if it were adjusted to £122m, based on 12-month period, the Eagles would still be in 10th place. Either way, around £200m below #MCFC £351m and #LFC £326m.

#CPFC wages to turnover ratio increased from 77% to 93%, 4th highest in the Premier League, though this would fall to 86% based on 12-month wages. If we further adjust for the COVID £11.7m revenue loss, the ratio would fall to 79%, though still in top 10.

Remuneration for #CPFC highest paid director, Steve Parish, decreased from £2.6m to £802k, mid-table in the Premier League, miles below Ed Woodward #MUFC and Daniel Levy #THFC (around £3m). Any bonus received by the chairman has been reinvested into the Academy development.

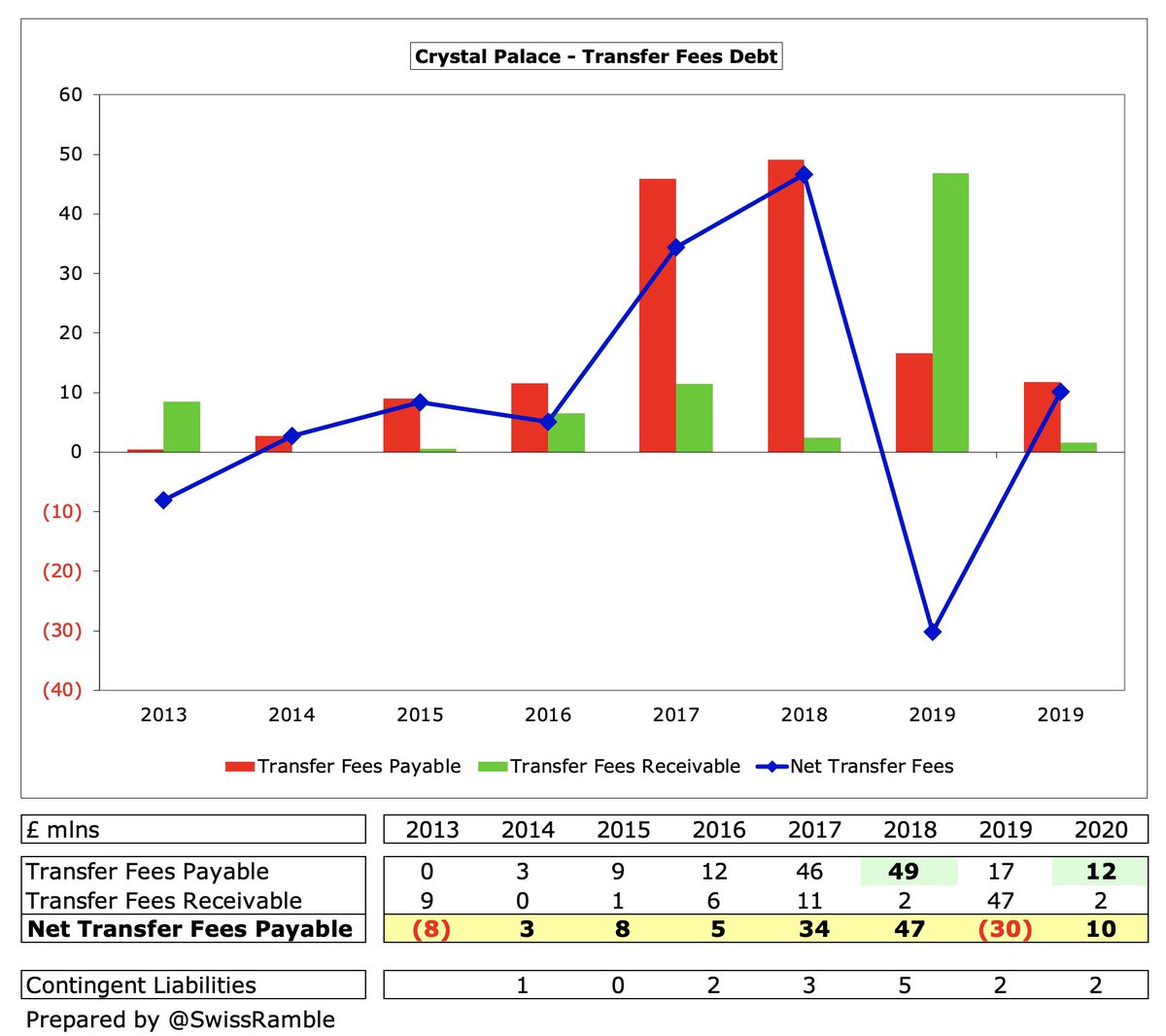

#CPFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £7m (13%) from £50m to £43m. Reinforced their position as one of the lowest in the Premier League, despite booking 13 months in 2020. No repeat of prior year’s £2.3m impairment.

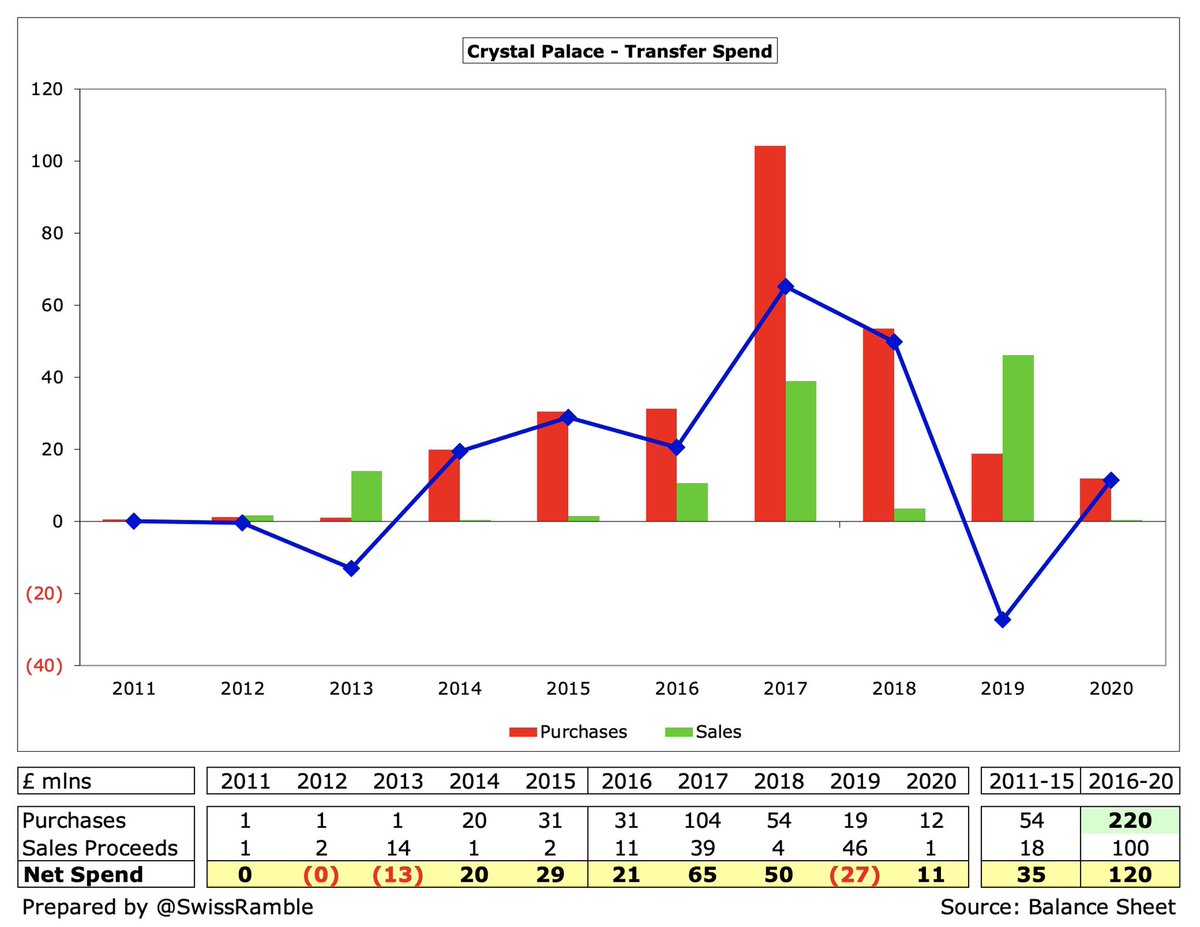

#CPFC only spent £12m on player purchases, including James McCarthy and Jordan Ayew. This was the second year in a row that Palace had the lowest gross spend in the Premier League, way below #MUFC £183m, #AFC £182m and #MCFC £180m in 2019/20.

#CPFC have spent £220m on new players in last 5 years, but gross outlay has fallen 3 years in succession with a steep drop in last two seasons (£104m in 2017, £54m in 2018, £19m in 2019 and £12m in 2020). Club now seems to be spending again under new manager Patrick Vieira.

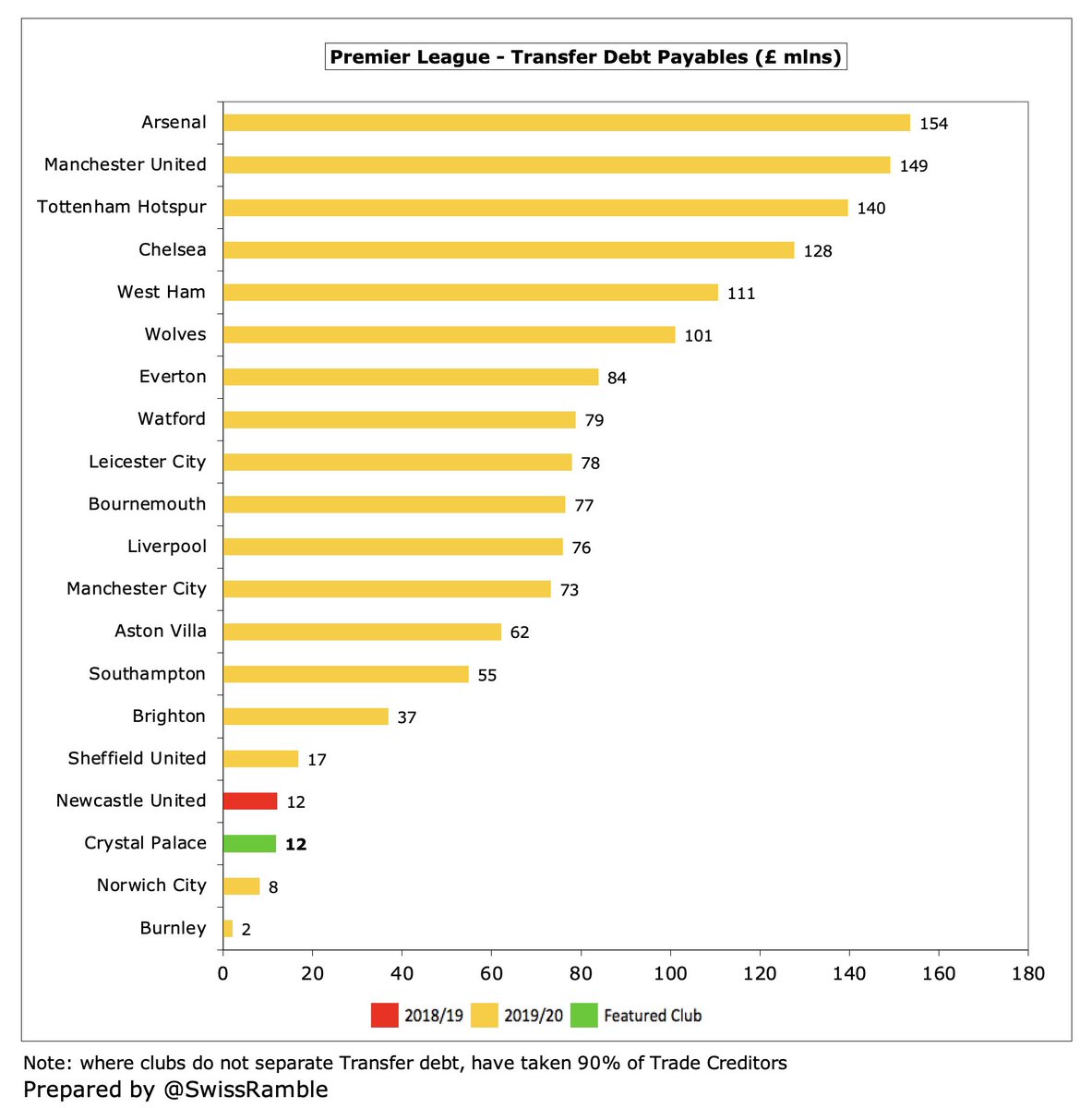

However, it is worth noting that #CPFC have used a lot of cash to pay stage payments from previous years’ transfers, thus significantly reducing transfer debt from £49m in 2018 to £12m in 2020, one of the lowest transfer payables in the Premier League, e.g. #AFC had £154m.

#CPFC gross financial debt also decreased from £84m to £77m, including £45m from the owners. The funding facility was reduced from £37m to £30m in 2020. Since the accounts, shareholders have raised £12.4m, but it is not clear whether this is additional loans or equity.

Following the decrease, #CPFC £77m gross debt is very much in the bottom half of the Premier League, though it will surely rise as stadium development progresses. Far below the likes of THFC £831m (stadium), #MUFC £526m, #EFC £409m and #BHAFC £306m (stadium/training ground).

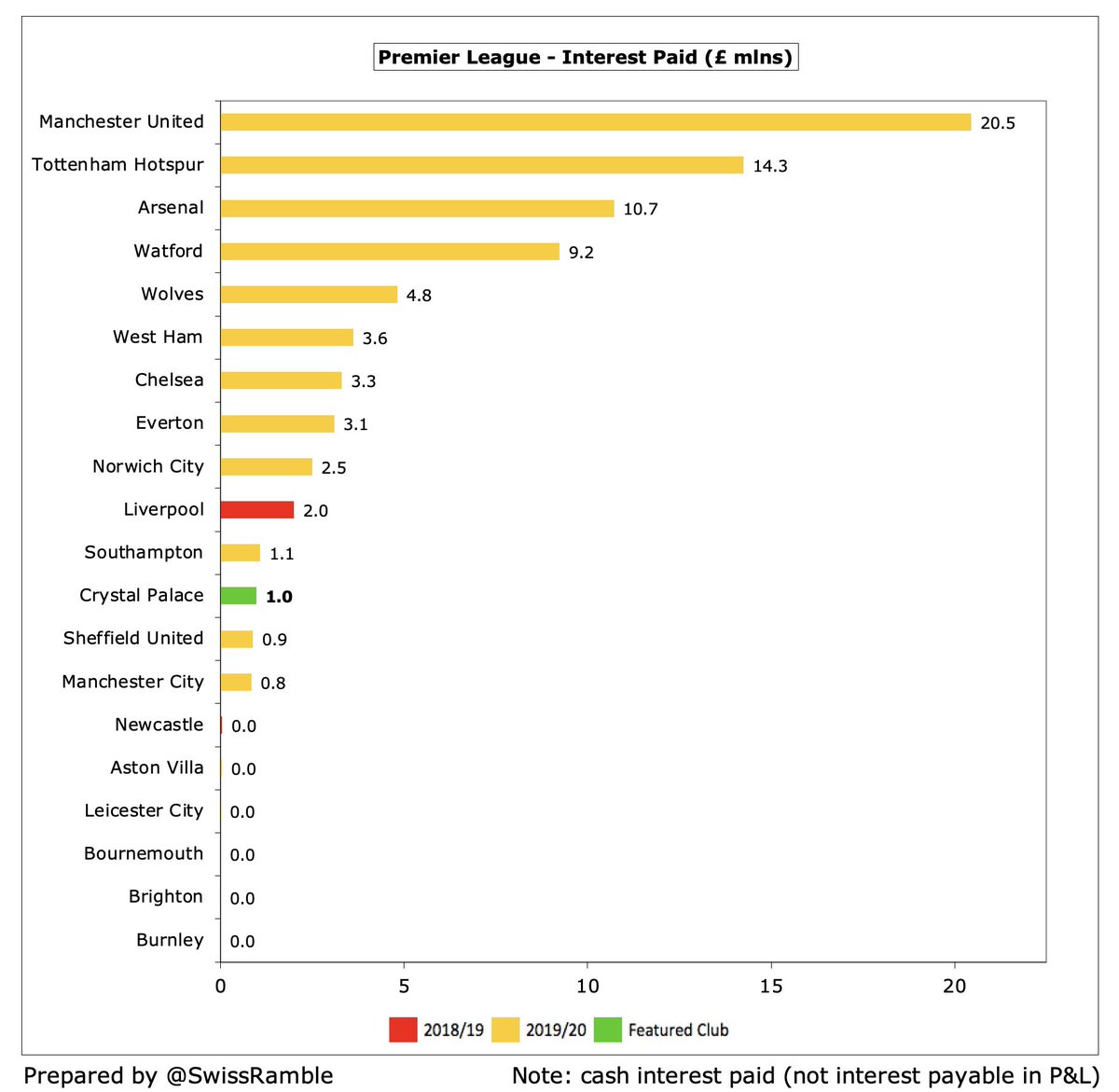

#CPFC paid £1.0m interest, less than half of prior year £2.3m, mainly on the loan from Aldermore bank. Shareholder loans are interest-free. This was far below the highest in the Premier League (#MUFC £20m, #THFC £14m and #AFC £11m), but maybe the best comparison is Watford £9m.

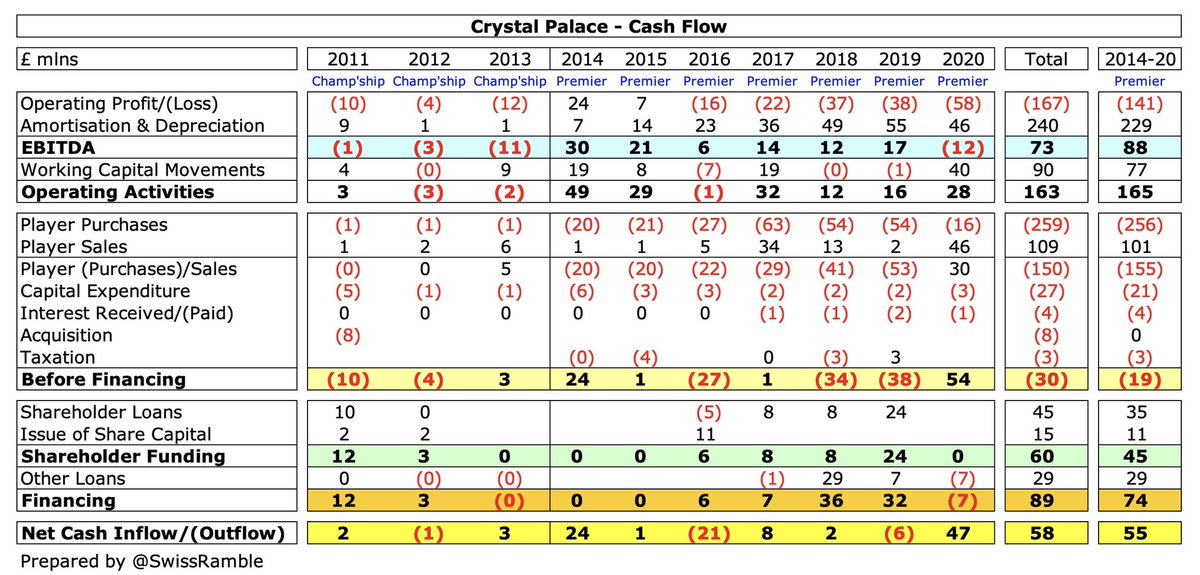

#CPFC £58m operating loss resulted in £28m cash flow after adding back £46m amortisation/depreciation and £40m working capital movements. Received £30m for players (sales £46m, purchases £16m), then spent £3m capex and £1m interest, before making £7m external loan repayments.

As a result, #CPFC cash balance increased from £12m to £58m, the 6th highest in the Premier League, though the club noted, “this is largely supported by the borrowing taken out during the year.”

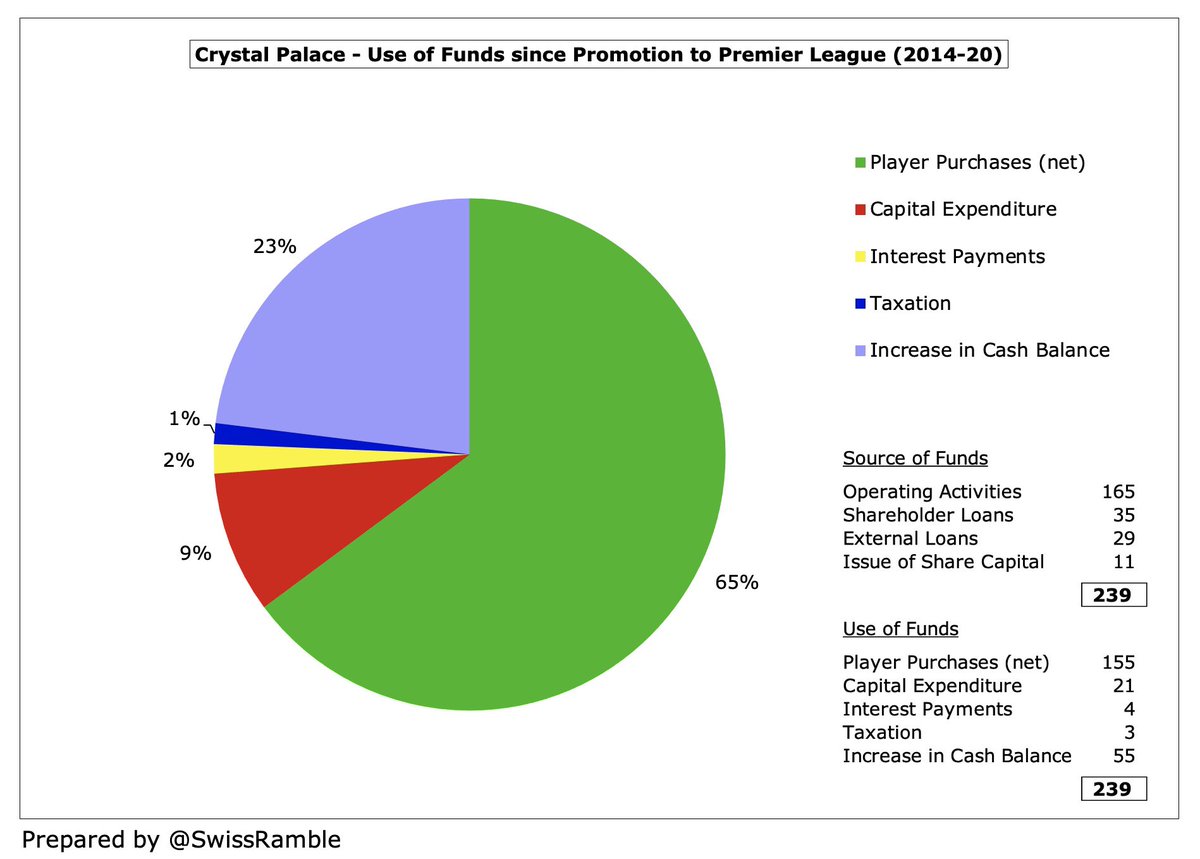

Since promotion to the PL, #CPFC have generated £165m from operations, with £46m provided by the owners (loans £35m and share capital £11m) plus £29m external loans. Most (£155m) can be seen on the pitch, while £18m went on infrastructure with cash balance up by £55m.

#CPFC will continue to focus on the Academy, targeting the upgraded facilities to be open this summer to benefit from “some of the best natural talent in the country, if not the world, on our doorstep in south London”, as seen with last season’s emergence of Tyrick Mitchell.

Steve Parish said, “Premier League survival remains our primary objective”, but added, “#CPFC is well placed to look forward to the 21/22 season, having seen out what we all hope is the worst of the economic impact of the pandemic.” Purse strings are being loosened for Vieira.

• • •

Missing some Tweet in this thread? You can try to

force a refresh