Why #JubilantIngrevia can be next big growth story?

Here is the thread.

Pharma serving to regulated market are under stress due product price erosion. Market is comfortably giving higher multiples to step down segment in value chain i.e. raw material suppliers.

Here is the thread.

Pharma serving to regulated market are under stress due product price erosion. Market is comfortably giving higher multiples to step down segment in value chain i.e. raw material suppliers.

eg. Alkyl & Balaji Amine. Very few Pharma are growing well. But again, they can’t grow in isolation as the question is what makes them so special other than promoters? Stagnancy is imminent after certain size.

Hence investing in Raw material supplier (KSM) companies’ de-risk your portfolio. They don’t deal directly with FDA. End users (Pharma players) can’t afford to lose them due to regulatory issues and delays due to vendor switch.

KSM producers has multiple buyers & applications of their products hence don’t get affected if any one pharma finds price erosion. KSM business is mostly bulk scale, hence there is less risk to them from their peers, its tough for new players to reduce the cost further.

Though over the longer run prices goes down by extensive research & new processes.

Jubilant Ingravia has posted superb Q1 numbers which fetched my attention. Stock is trading below one year forward 15x PE multiples & 2x of sales.

Jubilant Ingravia has posted superb Q1 numbers which fetched my attention. Stock is trading below one year forward 15x PE multiples & 2x of sales.

Its super cheap for specialty chemical company with minor debt

Key points:

Super diversified product & client portfolio

Leadership position for many products in India and in the World

Last year company reduced debt by 600 Cr while lined up 900 Cr Capex for next 3 years

Key points:

Super diversified product & client portfolio

Leadership position for many products in India and in the World

Last year company reduced debt by 600 Cr while lined up 900 Cr Capex for next 3 years

Company is vertically integrated, makes raw materials needed in-house. This makes them competitive. This means new players must establish similar manufacturing set up to sustain against Jubilant.

Example of Vertical integration of Ethanol value chain:

1.Molasses to Ethanol to Acetaldehyde to Pyridine derivatives to Nutritional products

2.Ethanol to acetic anhydride

3.Ethanol to ethyl acetate

4. Ethanol to acetic acid to ketene to Diketene

1.Molasses to Ethanol to Acetaldehyde to Pyridine derivatives to Nutritional products

2.Ethanol to acetic anhydride

3.Ethanol to ethyl acetate

4. Ethanol to acetic acid to ketene to Diketene

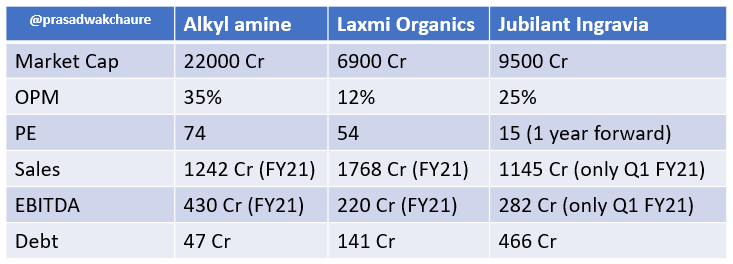

We need to compare Jubilant Ingrevia with companies like Alkyl amine, Laxmi Organics and Deepak nitrite to see the larger picture. Jubilant is working in Specialty chemicals, Pharma raw materials & Nutritional products.

Alkyl amine is serving Pharma while Deepak is in Specialty chemicals, all three have narrow range of products with diverse applications. Jubilant have diverse products with diverse applications. Laxmi organics has two products overlap with Jubilant i.e. Ethyl acetate and Diketene

I see striking difference in valuations between Jubilant and Alkyl amine. For the former I have extrapolated numbers like Q1 while laters I think are already at their peak of margins.

Investor presentation is well explanatory.

jubilantingrevia.com/Uploads/image/…

Research report by @VineetGala is nice read

vid.investmentguruindia.com/report/2021/Ju…

jubilantingrevia.com/Uploads/image/…

Research report by @VineetGala is nice read

vid.investmentguruindia.com/report/2021/Ju…

• • •

Missing some Tweet in this thread? You can try to

force a refresh