The best analysis combines fundamental factors in its outlook.

+ bonus points for a holistic world-view

#Bitcoin & #crypto

/thread

+ bonus points for a holistic world-view

#Bitcoin & #crypto

/thread

/2.

Case-Study

March of 2020 (pre-covid crash & around time of last $BTC halving) : hype was ~ATH, no one would have thought to call for a ~$4k price just 2 days after.

The unthinkable happened, world markets experienced a liquidity event, & that impacted the crypto market.

Case-Study

March of 2020 (pre-covid crash & around time of last $BTC halving) : hype was ~ATH, no one would have thought to call for a ~$4k price just 2 days after.

The unthinkable happened, world markets experienced a liquidity event, & that impacted the crypto market.

/3.

No amount of TA could have predicted this -

Markets tend to move together, and crypto in 2021 is no different - many of the same holders of crypto (funds, retail, c.o's) also hold equities.

Because of this, bringing a world / macro view into the equation is critical.

No amount of TA could have predicted this -

Markets tend to move together, and crypto in 2021 is no different - many of the same holders of crypto (funds, retail, c.o's) also hold equities.

Because of this, bringing a world / macro view into the equation is critical.

/4.

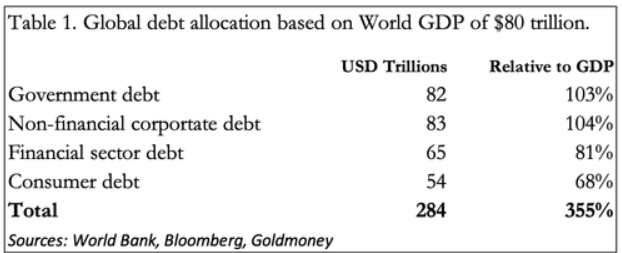

Moving into Q3, liquidity will become tight across global markets (contrary to popularly thought), at a time when leverage debt is @ ATH.

Global Debt to GDP is also highest on record

Acting as a net on sustained inflation, resulting in a shorter term deflationary tailwind.

Moving into Q3, liquidity will become tight across global markets (contrary to popularly thought), at a time when leverage debt is @ ATH.

Global Debt to GDP is also highest on record

Acting as a net on sustained inflation, resulting in a shorter term deflationary tailwind.

/5.

We can start to see this in many areas:

- Reverse repo facility passing $1T

- Chinese tech stocks, massive R.E. etfs (chart)

- Eviction moratoria ending, increasing housing supply net net, placing downward pressure on values

- Cessation of stimulus programs (neg for incomes)

We can start to see this in many areas:

- Reverse repo facility passing $1T

- Chinese tech stocks, massive R.E. etfs (chart)

- Eviction moratoria ending, increasing housing supply net net, placing downward pressure on values

- Cessation of stimulus programs (neg for incomes)

/6.

Any one of these factors taken alone should give one pause, but let's dig a bit further into the first item - Reverse Repo.

(Banks use rev. repo in order to avoid penalization / avoid becoming a systemic risk to global financial system post '08, by size of their accounts)

Any one of these factors taken alone should give one pause, but let's dig a bit further into the first item - Reverse Repo.

(Banks use rev. repo in order to avoid penalization / avoid becoming a systemic risk to global financial system post '08, by size of their accounts)

/7.

Just passing $1T for the first time ever, this facility is acting in complete contrast to ' QE ', by trapping / sucking bank reserves away.

Chillingly, top analyst on the repo market Zoltan Pozsar had predicted this weeks earlier, & predicts further utilization up to $2T+.

Just passing $1T for the first time ever, this facility is acting in complete contrast to ' QE ', by trapping / sucking bank reserves away.

Chillingly, top analyst on the repo market Zoltan Pozsar had predicted this weeks earlier, & predicts further utilization up to $2T+.

/8.

What does it mean?

More drain on bank reserves = More deflation - at a time when liquidity is already becoming tight.

What does it mean?

More drain on bank reserves = More deflation - at a time when liquidity is already becoming tight.

/9.

There are also a few potential ' Black Swans ' that could negatively affect sentiment (globally & crypto-specific) going forward in the short-term :

- Tether D.O.J. litigation / insolvency

- Forced-tax KYC compliance (US Intrastructure Bill)

- Delta strain / supply-chain

There are also a few potential ' Black Swans ' that could negatively affect sentiment (globally & crypto-specific) going forward in the short-term :

- Tether D.O.J. litigation / insolvency

- Forced-tax KYC compliance (US Intrastructure Bill)

- Delta strain / supply-chain

/10.

Sentiment (& anything that could impact it) is important to pay attention to -

All it takes is one significant hit to sentiment to positively or negatively influence group psychology.

Sentiment (& anything that could impact it) is important to pay attention to -

All it takes is one significant hit to sentiment to positively or negatively influence group psychology.

/11.

Group psychology right now of many in the crypto market - from an objective observer point-of-view is clear :

- Many are ' All in '

- Many believe remainder of 2021 must only be a bull market (4-year cycle theory)

- Many are very hopeful

- Hype & Excitement is very high

Group psychology right now of many in the crypto market - from an objective observer point-of-view is clear :

- Many are ' All in '

- Many believe remainder of 2021 must only be a bull market (4-year cycle theory)

- Many are very hopeful

- Hype & Excitement is very high

/12.

While history has upheld the 4-year cycle to-date, we (as the crypto market) are also as connected as ever to other global markets, as our maturity & liquidity has increased substantially.

While history has upheld the 4-year cycle to-date, we (as the crypto market) are also as connected as ever to other global markets, as our maturity & liquidity has increased substantially.

/13.

To quantify this in real-terms, all one needs to do is turn to the ' Buffet Indicator '

Market Value to GDP ratio recently reached 235%, never before in history has the market been this stretched from its historical trend line.

To quantify this in real-terms, all one needs to do is turn to the ' Buffet Indicator '

Market Value to GDP ratio recently reached 235%, never before in history has the market been this stretched from its historical trend line.

/14.

Regardless of whether or not you think the crypto market will continue a bull trend through year end, it's important to have a hedge.

Easiest way to do this is simply to keep some cash on side (25-50%).

So no matter what happens, you can feed yourself / family, pay debts

Regardless of whether or not you think the crypto market will continue a bull trend through year end, it's important to have a hedge.

Easiest way to do this is simply to keep some cash on side (25-50%).

So no matter what happens, you can feed yourself / family, pay debts

/15.

Rather than remain myopic to the crypto sandbox -

It is important to keep macro risks in mind.

Formulate any risk strategy with an overlay of the current psychological landscape, as well as a view to global macro market risk.

It's always a good idea to have a hedge.

Rather than remain myopic to the crypto sandbox -

It is important to keep macro risks in mind.

Formulate any risk strategy with an overlay of the current psychological landscape, as well as a view to global macro market risk.

It's always a good idea to have a hedge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh