The infrastructure bill's bad crypto regulations risks turning cryptos into banks. Not good!

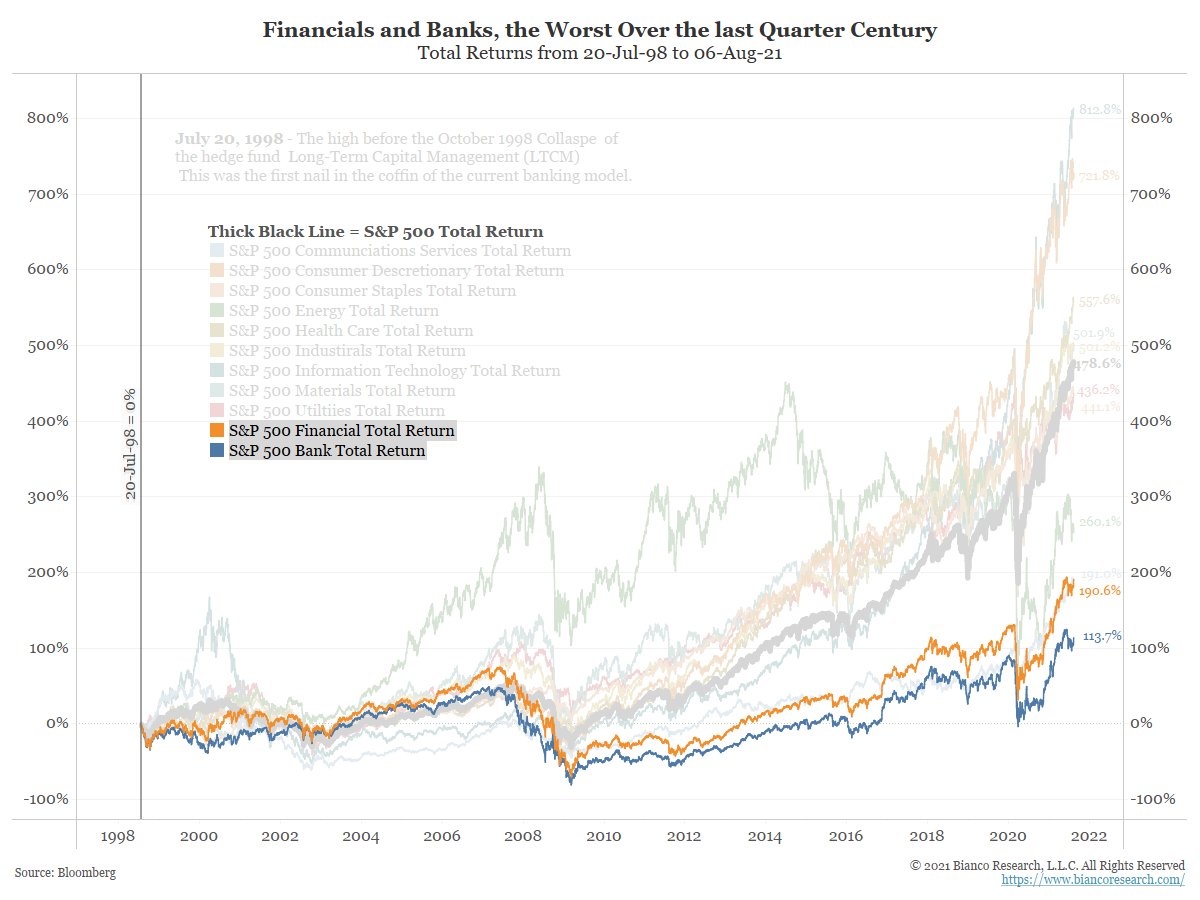

Below are the 10 sectors of the S&P 500, Highlighted are financials (orange) and banks (blue). Since LTCM in 1998, they have been last in returns!

en.wikipedia.org/wiki/Long-Term…

1/4

Below are the 10 sectors of the S&P 500, Highlighted are financials (orange) and banks (blue). Since LTCM in 1998, they have been last in returns!

en.wikipedia.org/wiki/Long-Term…

1/4

Same chart as above since the Global Financial Crisis in 2008.

Again financials and banks are the worst possible investments. But now energy (green), after its epic collapse the last few years, joins the bottom of the return list.

en.wikipedia.org/wiki/Financial…

2/4

Again financials and banks are the worst possible investments. But now energy (green), after its epic collapse the last few years, joins the bottom of the return list.

en.wikipedia.org/wiki/Financial…

2/4

Finally, since the Wells Fargo scandal in 2016, banks, financials and energy again are the worst possible investments.

en.wikipedia.org/wiki/Wells_Far…

Wells surviving could be bad for banks. Criminal activity on this scale needed to be punished. It really was not.

3/4

en.wikipedia.org/wiki/Wells_Far…

Wells surviving could be bad for banks. Criminal activity on this scale needed to be punished. It really was not.

3/4

This is crypto's future should regulation turn them into banks. Entities that crush world economies, employ thousands to steal from millions, and constantly disappoint investors with horrible returns.

Why willingly do this to new promising technologies?

4/4

Why willingly do this to new promising technologies?

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh