Thread on #Nykaa DRHP Findings - Business & Valuations

Nykaa has hogged a lot of limelight as it will be the first Indian beauty retailer to list on the exchanges and it is profitable too! (FY21 was profitable, not earlier)

Hit the Retweet to spread this thread about Nykaa :)

Nykaa has hogged a lot of limelight as it will be the first Indian beauty retailer to list on the exchanges and it is profitable too! (FY21 was profitable, not earlier)

Hit the Retweet to spread this thread about Nykaa :)

1/

About Nykaa -

- Incorporated in 2012

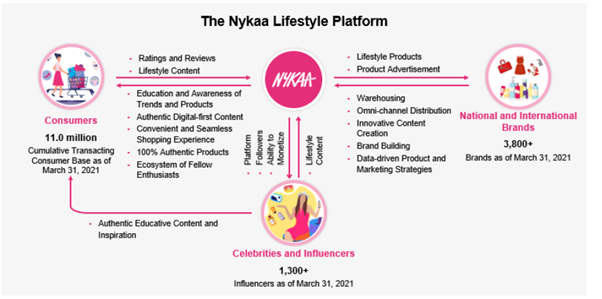

- Evolved from a beauty retailer to a lifestyle focused tech platform

- As of FY21, they offered ~2.0 million SKUs from 3,826 national and international brands

About Nykaa -

- Incorporated in 2012

- Evolved from a beauty retailer to a lifestyle focused tech platform

- As of FY21, they offered ~2.0 million SKUs from 3,826 national and international brands

2/

- They have a diverse portfolio of beauty, personal care, and fashion products, including owned brand products (Portfolio of 13 owned brands) manufactured by them. They have an Omnichannel presence

- They have a diverse portfolio of beauty, personal care, and fashion products, including owned brand products (Portfolio of 13 owned brands) manufactured by them. They have an Omnichannel presence

3/

Online - Mobile Apps, websites, and mobile sites. Total Downloads 43.7 mn, 86.7% online GMV came from mobile apps. RedSeer says this puts them amongst leading platforms (FY21)

Offline - 73 physical stores across 38 cities in India over three different store formats (FY21)

Online - Mobile Apps, websites, and mobile sites. Total Downloads 43.7 mn, 86.7% online GMV came from mobile apps. RedSeer says this puts them amongst leading platforms (FY21)

Offline - 73 physical stores across 38 cities in India over three different store formats (FY21)

4/

Some More Facts -

- Contribution to GMV sales in Tier 2 and Tier 3 cities collectively has increased from 56.9% in FY19 to 64% in FY21

- share of prepaid orders has increased from 42.3% in FY19 to 57.3% in FY21

Some More Facts -

- Contribution to GMV sales in Tier 2 and Tier 3 cities collectively has increased from 56.9% in FY19 to 64% in FY21

- share of prepaid orders has increased from 42.3% in FY19 to 57.3% in FY21

5/

- They do not control the pricing strategies of sellers/brands and typically contract on a non-exclusive basis

- They rely on third-party couriers, such as Aramex, Blue Dart, Delhivery, Ecom Express, ExpressBees, and Shadowfax to deliver orders from warehouses to consumers

- They do not control the pricing strategies of sellers/brands and typically contract on a non-exclusive basis

- They rely on third-party couriers, such as Aramex, Blue Dart, Delhivery, Ecom Express, ExpressBees, and Shadowfax to deliver orders from warehouses to consumers

6/

Beauty and Personal Care Offering

- 197,195 SKUs | 2,476 brands

- make-up, skincare, haircare, bath and body, fragrance, grooming appliances, personal care, and health and wellness categories (FY21)

Beauty and Personal Care Offering

- 197,195 SKUs | 2,476 brands

- make-up, skincare, haircare, bath and body, fragrance, grooming appliances, personal care, and health and wellness categories (FY21)

7/

Fashion Offering

- Launched in 2018

- assortment of offerings, across price points

- housed 1,350 brands, 1.8 mn SKUs with fashion products across 4 divisions: women, men, kids, and home (FY21)

Fashion Offering

- Launched in 2018

- assortment of offerings, across price points

- housed 1,350 brands, 1.8 mn SKUs with fashion products across 4 divisions: women, men, kids, and home (FY21)

8/

- Includes western wear, Indian wear, lingerie, footwear, bags, jewelry, accessories, athleisure, home décor, bath, bed, and kitchen

- Mix of brands across established national brands, international brands, luxury brands, and emerging labels and designers

- Includes western wear, Indian wear, lingerie, footwear, bags, jewelry, accessories, athleisure, home décor, bath, bed, and kitchen

- Mix of brands across established national brands, international brands, luxury brands, and emerging labels and designers

9/

Nykaa Prive - consumer loyalty program

- for the beauty and personal care vertical

- Exclusive offers/discounts, gifts, free shipping, access to exclusive content, priority access to the consumer service team

- FY21 - 2.1 million Nykaa Prive members

Nykaa Prive - consumer loyalty program

- for the beauty and personal care vertical

- Exclusive offers/discounts, gifts, free shipping, access to exclusive content, priority access to the consumer service team

- FY21 - 2.1 million Nykaa Prive members

10/

Nykaa TV (YouTube based content platform)

- Watch time of 1.3 mn hrs

- 39,498 posts on Insta + FB

- RedSeer Report says they are one of the most influential lifestyle platforms in India with over 12.6 mn followers across leading SM platforms as of FY21

Nykaa TV (YouTube based content platform)

- Watch time of 1.3 mn hrs

- 39,498 posts on Insta + FB

- RedSeer Report says they are one of the most influential lifestyle platforms in India with over 12.6 mn followers across leading SM platforms as of FY21

12/

The most important metric for them - the orders!

- Order volumes for different verticals

- Gross merchandise value (GMV)

- Avg order value (AOV)

Only 7 qtrs data is shown, so is it a trend that is here to stay or just because of lockdowns? Nobody knows!

The most important metric for them - the orders!

- Order volumes for different verticals

- Gross merchandise value (GMV)

- Avg order value (AOV)

Only 7 qtrs data is shown, so is it a trend that is here to stay or just because of lockdowns? Nobody knows!

13/

Marketing costs - again reduced, for tech companies this was a good year as they could achieve more incremental sales on lesser marketing costs, we will get more clarity about this on the IPO meet

Marketing costs - again reduced, for tech companies this was a good year as they could achieve more incremental sales on lesser marketing costs, we will get more clarity about this on the IPO meet

14/

This image is interesting because it shows that Nykaa has a sticky customer base

55% existing customers in FY19 to 70% existing customers in FY21 - A loyal customer base is definitely beneficial!

This image is interesting because it shows that Nykaa has a sticky customer base

55% existing customers in FY19 to 70% existing customers in FY21 - A loyal customer base is definitely beneficial!

15/

Quick Facts -

- GMV from Top 3 Vendors - 34.2%, 27.1%, and 24.4% of total GMV in FY19, FY20, FY21 respectively

- As of Fy21 they had a network of 1363 influencers, including Gen Z trendsetters, beauty, fashion, and lifestyle bloggers, makeup artists, celebrities

Quick Facts -

- GMV from Top 3 Vendors - 34.2%, 27.1%, and 24.4% of total GMV in FY19, FY20, FY21 respectively

- As of Fy21 they had a network of 1363 influencers, including Gen Z trendsetters, beauty, fashion, and lifestyle bloggers, makeup artists, celebrities

16/

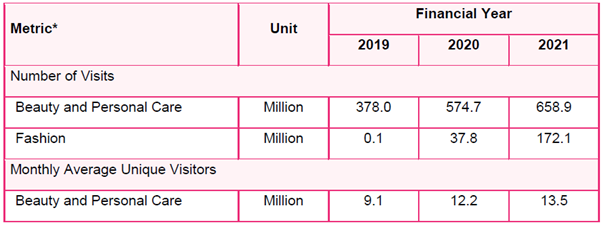

- Hosted 38 Cr, 57 Cr, and 66 Cr Visits on beauty and personal care websites and mobile applications for FY19, FY20, and FY21 respectively

- Small Pledge as well

- Hosted 38 Cr, 57 Cr, and 66 Cr Visits on beauty and personal care websites and mobile applications for FY19, FY20, and FY21 respectively

- Small Pledge as well

18/

Key Operating and Financial Metrics

- Hyper scale-up has happened

- AOV gone up

- GMV has gone up

- Unique visitors also up

Key Operating and Financial Metrics

- Hyper scale-up has happened

- AOV gone up

- GMV has gone up

- Unique visitors also up

19/

Financials

FY21 – EPS Rs 1.31 | RoE – 8.34% | BV – 16 | Sales – 2453 Cr

At 3 bn $ Valuation - 9x P/S , 362.6x P/E, 30x P/BV

At 6 bn $ Valuation - 18x P/S , 725.2x P/E, 60x P/BV

Financials

FY21 – EPS Rs 1.31 | RoE – 8.34% | BV – 16 | Sales – 2453 Cr

At 3 bn $ Valuation - 9x P/S , 362.6x P/E, 30x P/BV

At 6 bn $ Valuation - 18x P/S , 725.2x P/E, 60x P/BV

20/

No comments on valuations. Can they do a 10x revenue 12x EBITDA and a 15x net profit in the next decade or two? Maybe, maybe not.

We really do not know.

No comments on valuations. Can they do a 10x revenue 12x EBITDA and a 15x net profit in the next decade or two? Maybe, maybe not.

We really do not know.

21/

Competition -

In India, no one is a direct competitor except Sephora

Globally Sephora, Sally Beauty, Ulta Beauty, Nordstrom, and Macy's.

Purplle, plum sell their own products

Competition -

In India, no one is a direct competitor except Sephora

Globally Sephora, Sally Beauty, Ulta Beauty, Nordstrom, and Macy's.

Purplle, plum sell their own products

22/

Sally Beauty Holdings has a 2.2 USD Billion mcap, 9x PE Ratio. For full-year 2020, sales were 3.5 bn USD, so 0.63x P/S

Ulta Holdings has a 20 USD billion mcap, 42x P/E, and full-year 2020 sales of 6.2 USD bn, so 3.2x P/S

Sally Beauty Holdings has a 2.2 USD Billion mcap, 9x PE Ratio. For full-year 2020, sales were 3.5 bn USD, so 0.63x P/S

Ulta Holdings has a 20 USD billion mcap, 42x P/E, and full-year 2020 sales of 6.2 USD bn, so 3.2x P/S

23/

Nordstrom - 6 USD bn mcap, 2020 sales of 10.7 USD bn, so 0.56x P/S

Macy's sells Clothing, footwear, beauty items, etc, so can't compare

Sephora is owned by LVMH (LVMH owns many other brands so can't compare)

(Thank you @aaravmeanspeace for telling the competitors)

Nordstrom - 6 USD bn mcap, 2020 sales of 10.7 USD bn, so 0.56x P/S

Macy's sells Clothing, footwear, beauty items, etc, so can't compare

Sephora is owned by LVMH (LVMH owns many other brands so can't compare)

(Thank you @aaravmeanspeace for telling the competitors)

24/

A really cool unheard story of Nykaa and the founder Falguni Nayar!

A really cool unheard story of Nykaa and the founder Falguni Nayar!

https://twitter.com/aditya_kondawar/status/1423605817220079617

• • •

Missing some Tweet in this thread? You can try to

force a refresh