Car Trade Tech is an online + offline seller of new cars/used cars/bikes, etc

Prima facie looks interesting given how people are preferring used vehicles

Everything you need to know about the IPO 👇

Retweet so that maximum people get to learn about this company :)

#IPOwithJST

Prima facie looks interesting given how people are preferring used vehicles

Everything you need to know about the IPO 👇

Retweet so that maximum people get to learn about this company :)

#IPOwithJST

1/

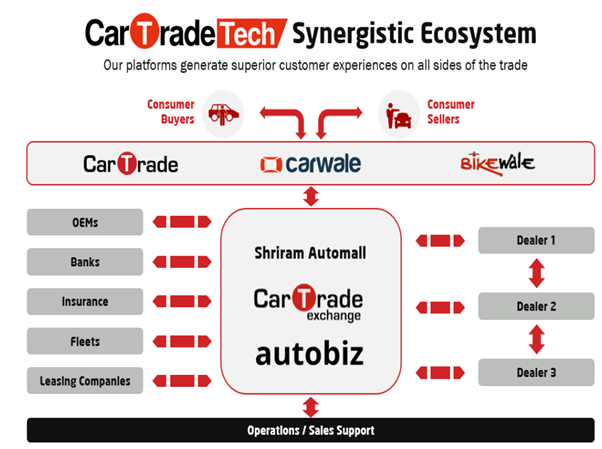

About the Company

- A multi-channel auto platform

- Presence across vehicle types and value-added services

- Marketing, buying, selling, and financing of new and pre-owned cars, two-wheelers, pre-owned commercial vehicles, and farm & construction equipment.

About the Company

- A multi-channel auto platform

- Presence across vehicle types and value-added services

- Marketing, buying, selling, and financing of new and pre-owned cars, two-wheelers, pre-owned commercial vehicles, and farm & construction equipment.

2/

- As of June 2021, they had 2221 employees (703 in main and 1518 in subsidiaries). They have 75 trademarks and 105 domains

- As of June 2021 consumer platforms, CarWale, CarTrade, and BikeWale together had avg of 27.11 mn unique visitors per month (88.14% organic visitors)

- As of June 2021, they had 2221 employees (703 in main and 1518 in subsidiaries). They have 75 trademarks and 105 domains

- As of June 2021 consumer platforms, CarWale, CarTrade, and BikeWale together had avg of 27.11 mn unique visitors per month (88.14% organic visitors)

4/

How does it earn money?

Transactions - Take rate/commissions on transactions, and auctions/trade-ins

Media - Listing subscriptions, ad revenues from OEMs, dealerships/advertisers

How does it earn money?

Transactions - Take rate/commissions on transactions, and auctions/trade-ins

Media - Listing subscriptions, ad revenues from OEMs, dealerships/advertisers

5/

Software services - Marketplace and software solutions for OEMs, dealerships, and banks

Others/Value-added services: Auto finance, automotive insurance, accessories, servicing, and inspections

Software services - Marketplace and software solutions for OEMs, dealerships, and banks

Others/Value-added services: Auto finance, automotive insurance, accessories, servicing, and inspections

6/

About the Issue

Dates – 9 to 11 August

Prices – 1585 to 1618

Pure OFS, no fresh money being raised by the company

MCap post listing – Rs 7410 Cr

About the Issue

Dates – 9 to 11 August

Prices – 1585 to 1618

Pure OFS, no fresh money being raised by the company

MCap post listing – Rs 7410 Cr

7/

Risks -

- Ride-Hailing Services (Uber Ola)

- People check online but end up buying offline

- In the past, some of the vehicles sold through their websites and apps were stolen vehicles

- Competition from dealers, OEMs, other online aggregators (we will see soon)

Risks -

- Ride-Hailing Services (Uber Ola)

- People check online but end up buying offline

- In the past, some of the vehicles sold through their websites and apps were stolen vehicles

- Competition from dealers, OEMs, other online aggregators (we will see soon)

8/

Key operational metrics for their businesses -

- MAU

- Unique Visitors

- Vehicles Listed

- Auctioned

- Organic visitors %

Key operational metrics for their businesses -

- MAU

- Unique Visitors

- Vehicles Listed

- Auctioned

- Organic visitors %

9/

- Used Car Market (Present & Future)

In India, the parc turn rate, which is the total no. of used cars sold divided by the total volume of cars, is approximately 16%, indicating significant headroom for used car sales

- Some Quick Facts

- TAM (Total Addressable Market)

- Used Car Market (Present & Future)

In India, the parc turn rate, which is the total no. of used cars sold divided by the total volume of cars, is approximately 16%, indicating significant headroom for used car sales

- Some Quick Facts

- TAM (Total Addressable Market)

10/

Acquisitions

They acquired Automotive Exchange Private Limited (CarWale and BikeWale) in 2015 and 55.43% of the outstanding equity interest in Shriram Automall India Limited (SAMIL) in 2018 and successfully integrated these businesses

Acquisitions

They acquired Automotive Exchange Private Limited (CarWale and BikeWale) in 2015 and 55.43% of the outstanding equity interest in Shriram Automall India Limited (SAMIL) in 2018 and successfully integrated these businesses

11/

Shriram Automall - The interesting piece in Car Trade Tech

It is the main contributor to profits of Car trade tech

It is basically in the operations of physical Auto malls that sell vehicles.

Shriram Automall - The interesting piece in Car Trade Tech

It is the main contributor to profits of Car trade tech

It is basically in the operations of physical Auto malls that sell vehicles.

12/

In FY20, 39% of profits were by Sriram Automall with 30% from other non-controlling subs

We are taking FY20 numbers as the auto malls were open that time, the stores and all were open too. Massive 39% contributor to profits!

In FY20, 39% of profits were by Sriram Automall with 30% from other non-controlling subs

We are taking FY20 numbers as the auto malls were open that time, the stores and all were open too. Massive 39% contributor to profits!

13/

Also in fy21 offline number shifted to online, so the Automall number came down.

But also notice how the auto mall number comes up from Dec 2020 to March 2021 (from 12.45% to 15%) as again opening up took place

In 2018 they had 74 auto malls, now 114.

Also in fy21 offline number shifted to online, so the Automall number came down.

But also notice how the auto mall number comes up from Dec 2020 to March 2021 (from 12.45% to 15%) as again opening up took place

In 2018 they had 74 auto malls, now 114.

14/

Will the number for Sriram auto mall go up more now? That has to be seen but having said that they are the major contributors to profit coupled with other noncontrolling subsidiaries

This is definitely interesting!

Will the number for Sriram auto mall go up more now? That has to be seen but having said that they are the major contributors to profit coupled with other noncontrolling subsidiaries

This is definitely interesting!

15/

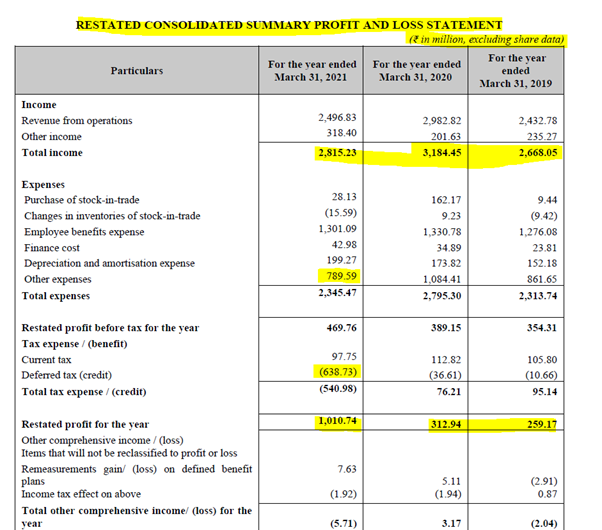

Financials -

B/S - Goodwill large part, fair enough they are a tech company who has done acquisitions

Cash Flows - CFO and FCF seem ok

Financials -

B/S - Goodwill large part, fair enough they are a tech company who has done acquisitions

Cash Flows - CFO and FCF seem ok

16/

P&L - Revenue hasn't grown, EBITDA also hasn't grown meaningfully. Net Profit 2-year CAGR has been 97%, but real net profit for FY21 is 37.2 Cr, which means a CAGR of 19%

The PAT jump this year is due to a tax credit!

P&L - Revenue hasn't grown, EBITDA also hasn't grown meaningfully. Net Profit 2-year CAGR has been 97%, but real net profit for FY21 is 37.2 Cr, which means a CAGR of 19%

The PAT jump this year is due to a tax credit!

17/

Peer Comparison

The only profitable player is CarTrade tech

But, Cars 24 took 5 years to reach the same revenue as the car trade who took 11 years!

Shows the hyper scale-up that can be done

Also, Car trade leads in google trends so why is the conversion not happening?

Peer Comparison

The only profitable player is CarTrade tech

But, Cars 24 took 5 years to reach the same revenue as the car trade who took 11 years!

Shows the hyper scale-up that can be done

Also, Car trade leads in google trends so why is the conversion not happening?

18/

International Peers Comparison

Many International peers are trading at crazy valuations!

Stock returns -

Vroom – 14% decline since listing

Carvana – 24x (yes, 24x!) in 4 years

Copart - 5x since in 4 years

Autotrader UK – 76% since Aug 2017

International Peers Comparison

Many International peers are trading at crazy valuations!

Stock returns -

Vroom – 14% decline since listing

Carvana – 24x (yes, 24x!) in 4 years

Copart - 5x since in 4 years

Autotrader UK – 76% since Aug 2017

19/

Valution & Conclusion

FY21 -

EPS - 19.2 Rs | BV - 393 | RoE - 5.43%

At the upper band, it is priced at 84x P/E, 41x P/BV, and 23.3x P/S!

These are indeed extreme valuations, astronomical valuations!

Valution & Conclusion

FY21 -

EPS - 19.2 Rs | BV - 393 | RoE - 5.43%

At the upper band, it is priced at 84x P/E, 41x P/BV, and 23.3x P/S!

These are indeed extreme valuations, astronomical valuations!

20/

Two arguments that I am hearing -

#1 - Peers are trading at 16-25x P/S

Fact - The International peers are clocking in 30-50x more revenue than Car Trade. And domestic competition also heating up like I said (Cars24 took 5 yrs to reach their levels)

Two arguments that I am hearing -

#1 - Peers are trading at 16-25x P/S

Fact - The International peers are clocking in 30-50x more revenue than Car Trade. And domestic competition also heating up like I said (Cars24 took 5 yrs to reach their levels)

21/

#2 - This is a niche company

Agreed, to some extent. But does that mean paying 84 times earnings and 23 times sales?

#2 - This is a niche company

Agreed, to some extent. But does that mean paying 84 times earnings and 23 times sales?

22/

Competitors

Benefits of Online Buying

Growth Drivers for Automotive Portals

Growth Drivers for Automotive Sector

Competitors

Benefits of Online Buying

Growth Drivers for Automotive Portals

Growth Drivers for Automotive Sector

23/

Covid Tailwinds

End of thread! Thanks for reading!

Stay tuned for more.

Got any questions? Post them below and we will try to solve them :)

Covid Tailwinds

End of thread! Thanks for reading!

Stay tuned for more.

Got any questions? Post them below and we will try to solve them :)

One minor correction from Tweet #19, P/BV is 4.1 and not 41.

• • •

Missing some Tweet in this thread? You can try to

force a refresh