Paytmmmmm Karooooooo! Most of us have heard this jingle right?

After the much-celebrated #IPO of Zomato, all eyes are now on #PayTM!

So let's not wait and let's understand everything about PayTM in the below thread 👇

After the much-celebrated #IPO of Zomato, all eyes are now on #PayTM!

So let's not wait and let's understand everything about PayTM in the below thread 👇

1/

- The DRHP mentions a Rs 16,600 Cr Fundraise

- Split - 50% Fresh, 50% OFS

- Valuation of $25-30 billion targeted from this IPO

Let’s put all of these numbers into perspective here –

- The DRHP mentions a Rs 16,600 Cr Fundraise

- Split - 50% Fresh, 50% OFS

- Valuation of $25-30 billion targeted from this IPO

Let’s put all of these numbers into perspective here –

https://twitter.com/aditya_kondawar/status/1412617118873362433

https://twitter.com/aditya_kondawar/status/1412274574578704387

2/

Some big numbers, right? Ok back to PayTM now –

What does it do?

Well, it does a lot of things but at the core of it let's term it a fintech company.

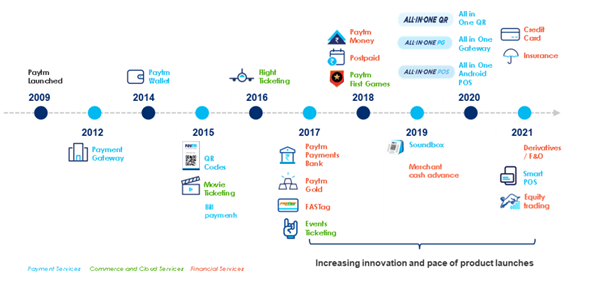

- It started as a digital wallet-based platform focused on mobile SIM top-ups and utility payments in 2010

Some big numbers, right? Ok back to PayTM now –

What does it do?

Well, it does a lot of things but at the core of it let's term it a fintech company.

- It started as a digital wallet-based platform focused on mobile SIM top-ups and utility payments in 2010

3/

- They pivoted to marketing, mobile phone top-ups, payments, e-comm, then a full-scale fintech services company – The avatar that we see today

- The Paytm ecosystem has payments (wallet / UPI), merchant acquiring, credit, savings, broking, wealth management, and insurance.

- They pivoted to marketing, mobile phone top-ups, payments, e-comm, then a full-scale fintech services company – The avatar that we see today

- The Paytm ecosystem has payments (wallet / UPI), merchant acquiring, credit, savings, broking, wealth management, and insurance.

4/

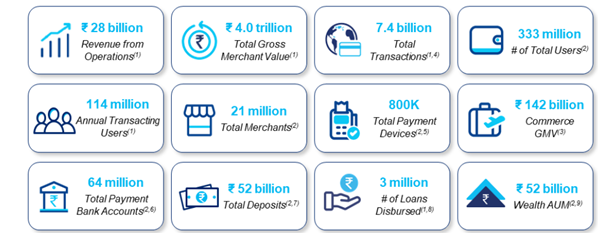

Total users - 333 mn

Monthly active users - 50 mn

Merchants - 21.1 mn

RedSeer - Paytm has a payments transaction volume market share of ~40% and wallet payments transaction mkt share of 65-70% in India for FY21

Total users - 333 mn

Monthly active users - 50 mn

Merchants - 21.1 mn

RedSeer - Paytm has a payments transaction volume market share of ~40% and wallet payments transaction mkt share of 65-70% in India for FY21

5/

Some notable investors in PayTM are Ant Group, Softbank, Warren Buffett, and even Mr. Ratan Tata (extremely small investment holding but).

Also time for a fun fact :)

Some notable investors in PayTM are Ant Group, Softbank, Warren Buffett, and even Mr. Ratan Tata (extremely small investment holding but).

Also time for a fun fact :)

https://mobile.twitter.com/aditya_kondawar/status/1197394108832051200

7/

Paytm Payments Bank

Paytm owns 49%, Vijay Shekhar Sharma(VSS) holding the rest 51%. Why 49%? That’s because of FDI rules. The policy restricts foreign investment in the banking sector (through the automatic route) to 49%

Note - PayTM has an option to buy out VSS stake

Paytm Payments Bank

Paytm owns 49%, Vijay Shekhar Sharma(VSS) holding the rest 51%. Why 49%? That’s because of FDI rules. The policy restricts foreign investment in the banking sector (through the automatic route) to 49%

Note - PayTM has an option to buy out VSS stake

8/

About PPB -

- Paytm Payments Bank is the only profitable arm of Paytm

- Offering of a Savings account, 2.5% per annum, the max balance of ₹200,000 as per RBI Rules. Also has a partnership with Paytm Money, the wealth management business.

About PPB -

- Paytm Payments Bank is the only profitable arm of Paytm

- Offering of a Savings account, 2.5% per annum, the max balance of ₹200,000 as per RBI Rules. Also has a partnership with Paytm Money, the wealth management business.

9/

Offerings of PPB -

Wallet – Secure digital wallet, allows customers to make payments at 87,000 online merchants, 21.1 mn in-store merchants, FY21 - 333 mn Paytm Wallets

Post-paid – BNPL (buy no pay later) to customers across their merchant base

Offerings of PPB -

Wallet – Secure digital wallet, allows customers to make payments at 87,000 online merchants, 21.1 mn in-store merchants, FY21 - 333 mn Paytm Wallets

Post-paid – BNPL (buy no pay later) to customers across their merchant base

10/

FASTags –Largest issuer, as of FY21 issued a cumulative of ~ 9 million FASTags, with a market share of 28%.

UPI - 155 mn+ UPI IDs. Doesn’t reveal the no. of UPI transactions which is the better metric to know about the hold of payments it has.

FASTags –Largest issuer, as of FY21 issued a cumulative of ~ 9 million FASTags, with a market share of 28%.

UPI - 155 mn+ UPI IDs. Doesn’t reveal the no. of UPI transactions which is the better metric to know about the hold of payments it has.

11/

Data from NPCI - Paytm 13.6% market share in the volume of UPI transactions in June 2021, up from the 10.3% it had in June 2020.

FDs - Via partnership with Indian commercial banks. FY21 - FDs ₹1750 Cr

Data from NPCI - Paytm 13.6% market share in the volume of UPI transactions in June 2021, up from the 10.3% it had in June 2020.

FDs - Via partnership with Indian commercial banks. FY21 - FDs ₹1750 Cr

12/

Total deposits - 5200 Cr+ including savings accounts, current accounts, fixed deposits with partner banks, and balance in wallets

Debit Card and Paytm Credit Card - Offer co-branded credit cards

FY21 - Paytm Payments Bank had 6.4 Cr bank accounts

Total deposits - 5200 Cr+ including savings accounts, current accounts, fixed deposits with partner banks, and balance in wallets

Debit Card and Paytm Credit Card - Offer co-branded credit cards

FY21 - Paytm Payments Bank had 6.4 Cr bank accounts

13/

Gross Merchandise Value (GMV) and Merchants

- Majority of revenue is from transaction fees collected from merchants for payment services

- Revenue from payment + financial services accounted for 52.5%, 58.1%, and 75.3% of total revenue in FY19, FY20, and FY21 respectively

Gross Merchandise Value (GMV) and Merchants

- Majority of revenue is from transaction fees collected from merchants for payment services

- Revenue from payment + financial services accounted for 52.5%, 58.1%, and 75.3% of total revenue in FY19, FY20, and FY21 respectively

14/

Some Key Indicators (payment, Financial services on the rise while commerce/cloud on the decline)

Financials –

Balance Sheet – 2876 Cr cash, 2375 cr in other financial assets, IPO only to give exit to PEs and raise a war chest for cash burn/acquisitions, etc

Some Key Indicators (payment, Financial services on the rise while commerce/cloud on the decline)

Financials –

Balance Sheet – 2876 Cr cash, 2375 cr in other financial assets, IPO only to give exit to PEs and raise a war chest for cash burn/acquisitions, etc

15/

P&L - Loss narrowed down (optical or long term? no one can say) due to lesser marketing expenses further aided by lower payment processing charges (img)

It has to be seen if the payment processing charges as % of GMV falls down further from here (currently at 0.5%).

P&L - Loss narrowed down (optical or long term? no one can say) due to lesser marketing expenses further aided by lower payment processing charges (img)

It has to be seen if the payment processing charges as % of GMV falls down further from here (currently at 0.5%).

16/

Cash Flows - bad Cash flows.

Super App Play

FY21 - 480 mini-apps+ on the platform ranging from content to transaction apps and across a broad range of industries, including food delivery, gaming, e-commerce, and with a visitor base of 5.7mn MAU

Cash Flows - bad Cash flows.

Super App Play

FY21 - 480 mini-apps+ on the platform ranging from content to transaction apps and across a broad range of industries, including food delivery, gaming, e-commerce, and with a visitor base of 5.7mn MAU

17/

Valuations & Conclusion

PayTM didn’t report an operating profit or a net profit in FY21.

They clocked sales of Rs 3186 Cr in FY21 and we also know that they are said to be targeting 25-30bn$ as per various news sources.

Valuations & Conclusion

PayTM didn’t report an operating profit or a net profit in FY21.

They clocked sales of Rs 3186 Cr in FY21 and we also know that they are said to be targeting 25-30bn$ as per various news sources.

18/

At 25 bn $, the P/S (price to sales) will be 58x and at 30 bn $, the P/S will be 71x!

They don’t even own full of PayTM payments bank which is the only profitable entity, not that it makes a large difference as the FY21 Sales for PPB was Rs 1987 Cr and net profit Rs 18 Cr

At 25 bn $, the P/S (price to sales) will be 58x and at 30 bn $, the P/S will be 71x!

They don’t even own full of PayTM payments bank which is the only profitable entity, not that it makes a large difference as the FY21 Sales for PPB was Rs 1987 Cr and net profit Rs 18 Cr

19/

Outlook -

The growth in Digital will come from –

Development of the Ecosystem – Digital payment adoption by Small businesses/merchants, PoS machines, QR Codes, UPI, Payment Gateways, etc

Outlook -

The growth in Digital will come from –

Development of the Ecosystem – Digital payment adoption by Small businesses/merchants, PoS machines, QR Codes, UPI, Payment Gateways, etc

20/

Mobile Wallets and UPI – Set to increase with the number of increasing mobile phone users and mobile digital payment users

Increasing penetration of digital banking products

Mobile Wallets and UPI – Set to increase with the number of increasing mobile phone users and mobile digital payment users

Increasing penetration of digital banking products

21/

According to RedSeer, in FY21 there were 30-35 mn unique merchants using QR codes for digital payments in India and expected to increase to 55-60 mn by FY 2026. Out of all the players driving QR adoption, Paytm has the highest QR code coverage amongst merchants.

According to RedSeer, in FY21 there were 30-35 mn unique merchants using QR codes for digital payments in India and expected to increase to 55-60 mn by FY 2026. Out of all the players driving QR adoption, Paytm has the highest QR code coverage amongst merchants.

22/

Point of Sale (PoS) machines - TPV (Total Payment Value) of PoS is expected to reach USD 275 bn in FY26 from US$ 94 bn in FY21

Payment Gateways and Payment Aggregators – TPV of payment aggregator is expected to reach US$ 550 bn in FY26 from USD 170 bn in FY21

Point of Sale (PoS) machines - TPV (Total Payment Value) of PoS is expected to reach USD 275 bn in FY26 from US$ 94 bn in FY21

Payment Gateways and Payment Aggregators – TPV of payment aggregator is expected to reach US$ 550 bn in FY26 from USD 170 bn in FY21

23/

End of thread! Thanks for reading!

Stay tuned for more :)

End of thread! Thanks for reading!

Stay tuned for more :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh