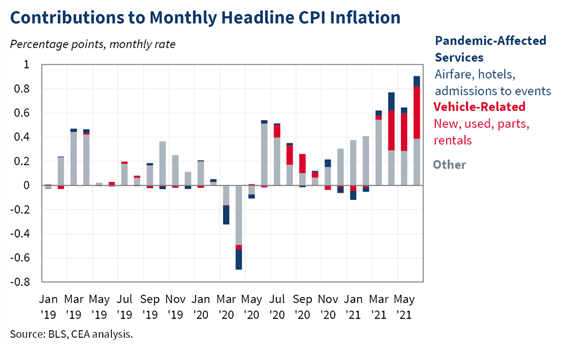

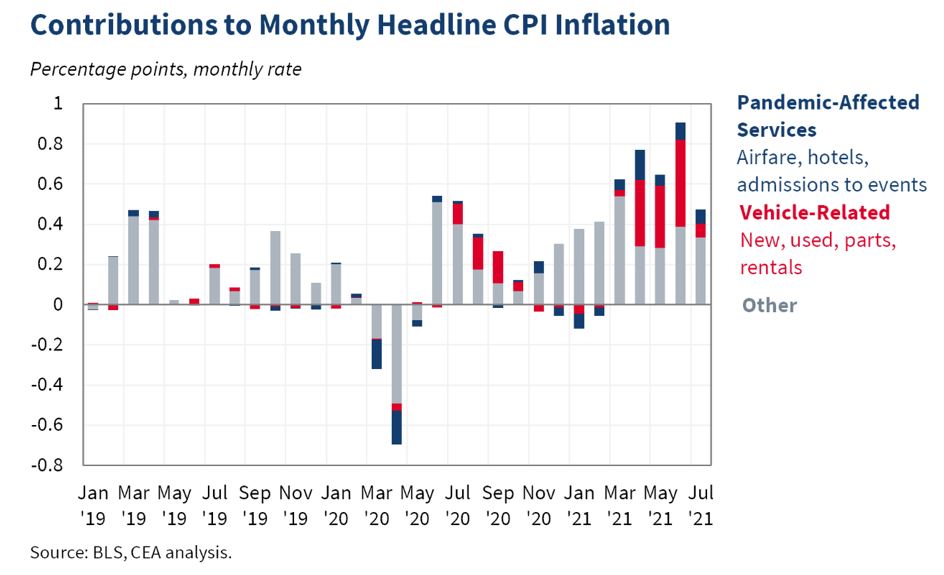

Inflation as measured by CPI increased 0.5% month-over-month in July—at expectations and below June’s rate of 0.9%. The deceleration largely reflected a lessening of price pressures from the motor vehicle sector. 1/

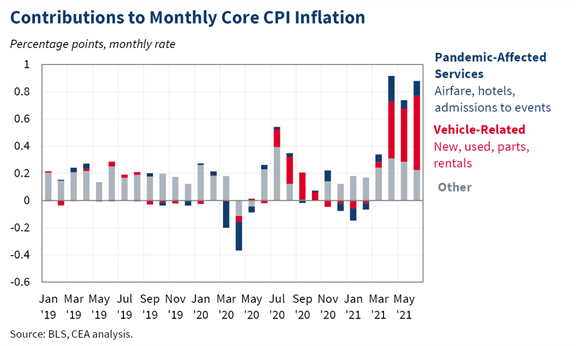

Core inflation—without food/energy—rose 0.3% month-over-month—below expectations and well below June’s rate of 0.9%. 2/

Year-over-year, headline inflation rose by 5.4% while core inflation rose by 4.3%. While both measures had been accelerating in recent months, year-over-year growth did not accelerate for either measure this month. 3/

Used cars, new cars, auto parts, and car rentals together made up about 27 percent of core month-over-month inflation, down from about 54 percent on average in April, May, and June. 4/

Prices of pandemic-affected services rose again this month and contributed 9 basis points to the core inflation increase in July, relative to 11 basis points in June. The index of pandemic-affected services is now above its pre-pandemic level. 5/

Month-over-month growth in shelter costs ticked down in July, reflecting slower growth in lodging away from home (e.g. hotels). Price growth in rent of primary residence and owners’ equivalent rent held steady at the rate they’ve been in recent months. 6/

One month does not make a trend (monthly inflation slowed in May before rebounding in June), and we know supply constraints persist in various sectors. However, July’s deceleration is encouraging. 7/

We know that the recovery from the pandemic will not be linear. The Council of Economic Advisers will continue to monitor the data as they come in. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh