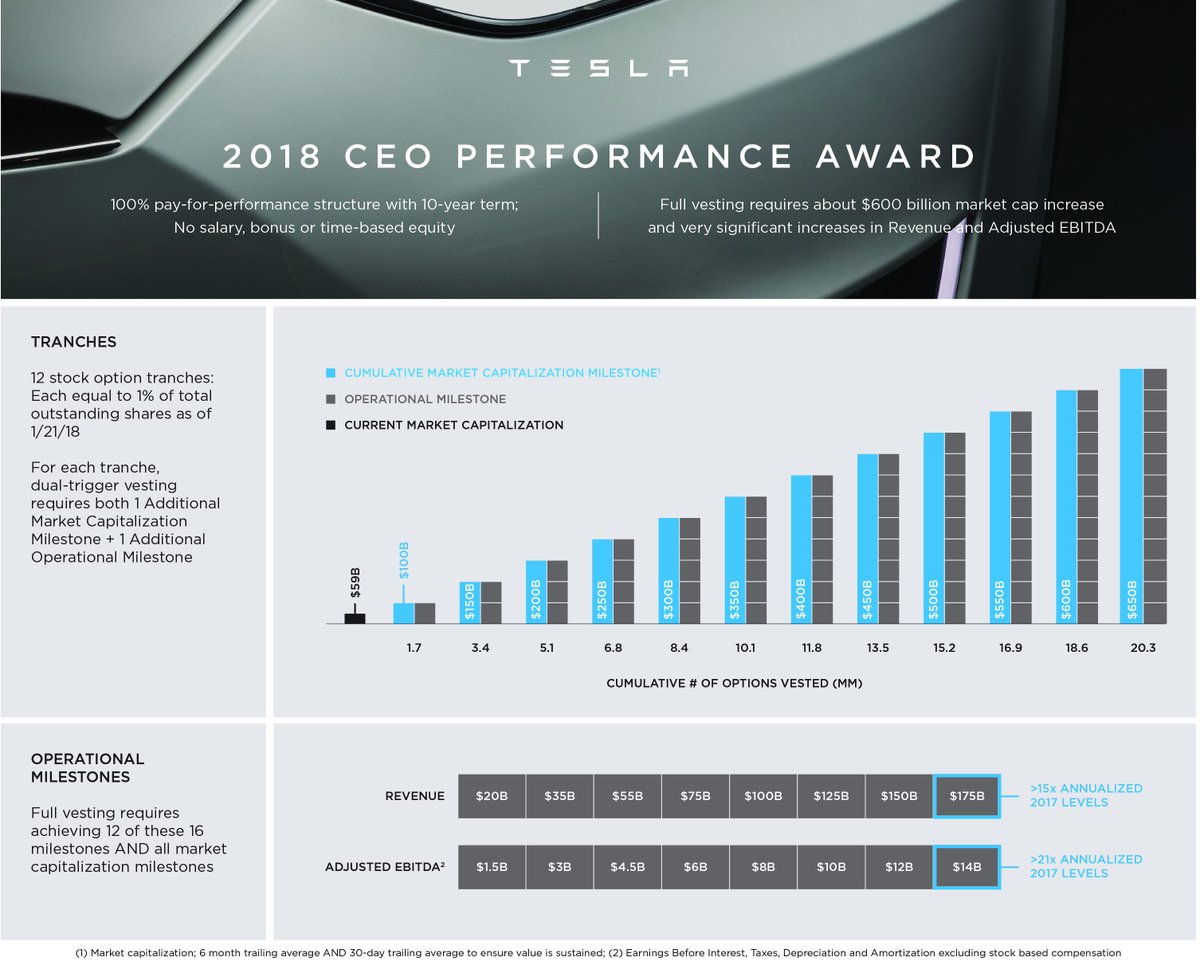

Next time @elonmusk agrees to a 100% pay for performance incentive plan where he needs to 10x market cap of company, folks ought to pay attention. Just saying.

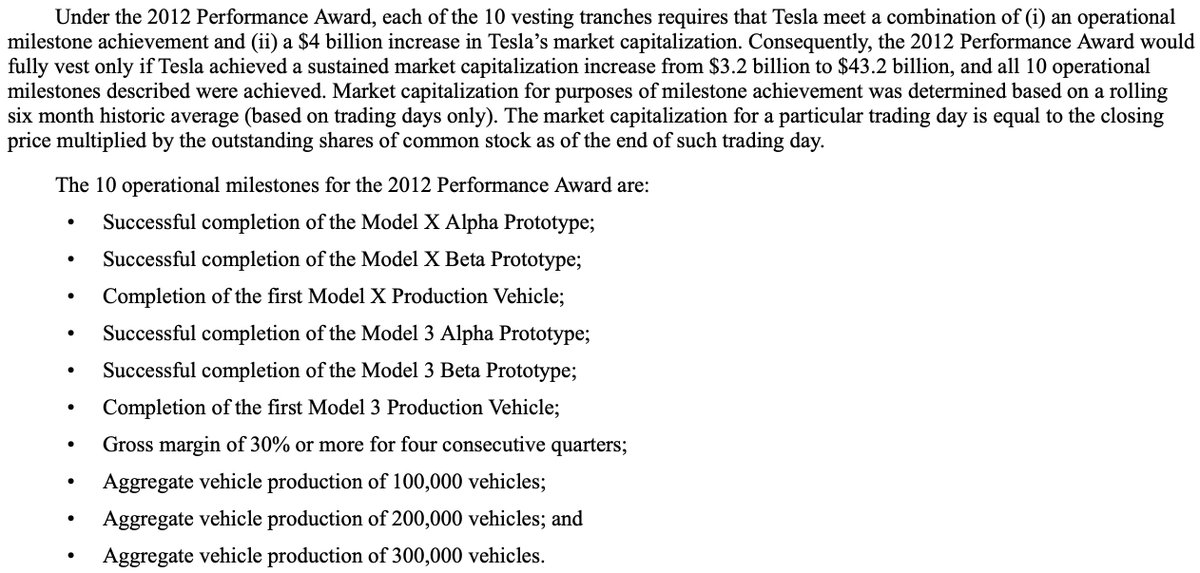

@elonmusk Prior to the 2018 CEO compensation plan, Elon agreed to a 2012 CEO compensation that would reward him in tranches for taking TSLA from $3.2B in market cap to $43.2B in market cap. Another 10x.

The 2012 and 2018 CEO compensation plans laid out a clear 100x in market cap appreciation for $TSLA. Problem was not many people believed that these compensation plans were achievable. But it's clear @elonmusk thought they were acheivable or else he wouldn't have agreed to them.

The big question is after the final tranches of the 2018 CEO compensation plan are reached, will @elonmusk agree to a new stock compensation plan and will it include a new 10x market cap goal?

https://twitter.com/Confidential25/status/1426647221014089734?s=20

The 2012 and 2018 CEO compensations plans were a big part of my investment thesis for $TSLA. Knowing the CEO was working toward 10x'ing the value of the company within 5-10 years and with clear milestones and compensation was and has been priceless. Wish more would do this.

Let's say you had $100k in 2012. Stark difference between believing and scorning @elonmusk and his CEO compensation plans.

Believer puts $100k in TSLA in 2012 = $10m now

Scorner puts $100k into shorting TSLA in 2012 = now left with ~$10k, if that.

Want $10k or $10m? 🤣

Believer puts $100k in TSLA in 2012 = $10m now

Scorner puts $100k into shorting TSLA in 2012 = now left with ~$10k, if that.

Want $10k or $10m? 🤣

• • •

Missing some Tweet in this thread? You can try to

force a refresh