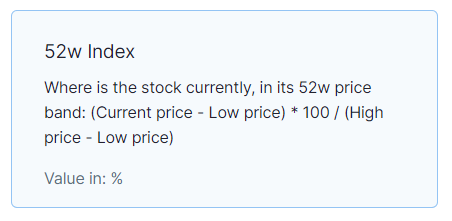

List of stocks where you can find good short-term and medium-term trading opportunities 📊

Please Retweet if you find this helpful, so that more people can benefit from this.

Disclaimer: Stocks shared here are not buy or sell recommendation.

#StocksInFocus #watchlist #nifty50

Please Retweet if you find this helpful, so that more people can benefit from this.

Disclaimer: Stocks shared here are not buy or sell recommendation.

#StocksInFocus #watchlist #nifty50

• • •

Missing some Tweet in this thread? You can try to

force a refresh