Thinking about clean teaching alternative to IS-LM. Ditch LM for monetary policy rule: i = a(Y - Yfe) + b

Yfe is fixed (later removed), level model and of course fixed prices.

Prior to working the model, one can spend a week talking monetary policy, role of liquidity preference.

Yfe is fixed (later removed), level model and of course fixed prices.

Prior to working the model, one can spend a week talking monetary policy, role of liquidity preference.

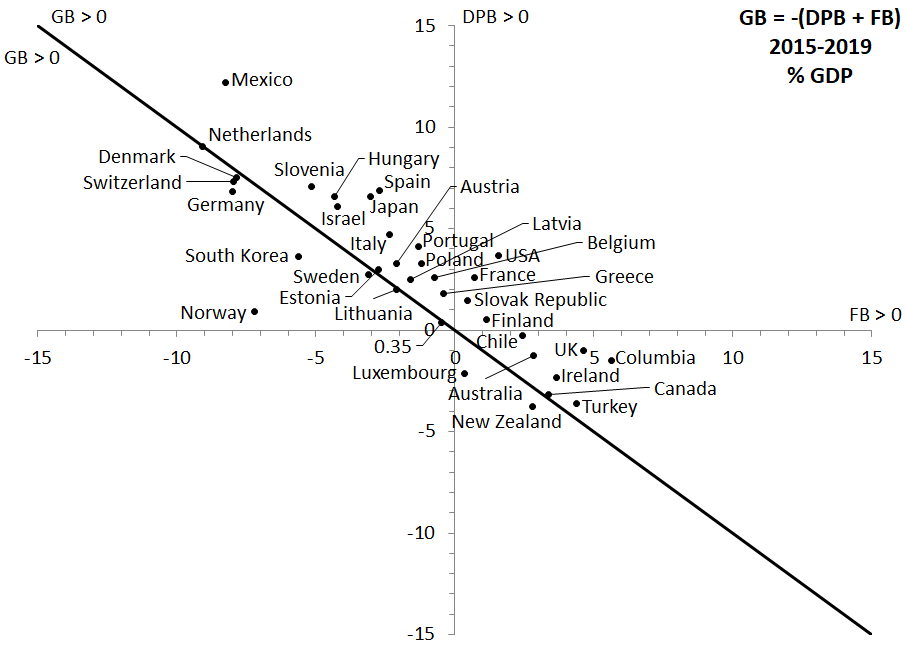

Then talk about policy effectiveness and coordination of policies too. Thoughts from anyone?

also talk a bit about banking and endogenous money before introducing the model.

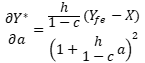

Report of progress. The first-order partial derivative of the equilibrium income level relative to the reactivity of the central bank is positive if the economy is underemployed (h sensitivity of I to i, c MPC, b is the reactivity of central bankers to output gap)

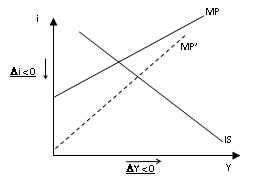

Basically, the interest rate falls faster if the economy is underemployed and so equilibrium income is higher. Graphically

Images did not paste correctly, there are a few dividers missing in the derivative (oddly one showed up), but it is easy to see where they are missing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh