I worked for 4y in an online financial advice company. This is what I learned on how to put your finances in order. 🧵

Three types of investors, each with their own mistakes: self-directed, with financial advisor, and those who leave their $ in the bank.

Three types of investors, each with their own mistakes: self-directed, with financial advisor, and those who leave their $ in the bank.

Issue #1: Ppl leave their $ in the bank

This is what our $ does in the bank vs. invested

After 60y, invested $ is 10x more than bank account $.

Put in another way: 1 day of work putting your finances in order is 10x more important for $ than your entire professional career.

This is what our $ does in the bank vs. invested

After 60y, invested $ is 10x more than bank account $.

Put in another way: 1 day of work putting your finances in order is 10x more important for $ than your entire professional career.

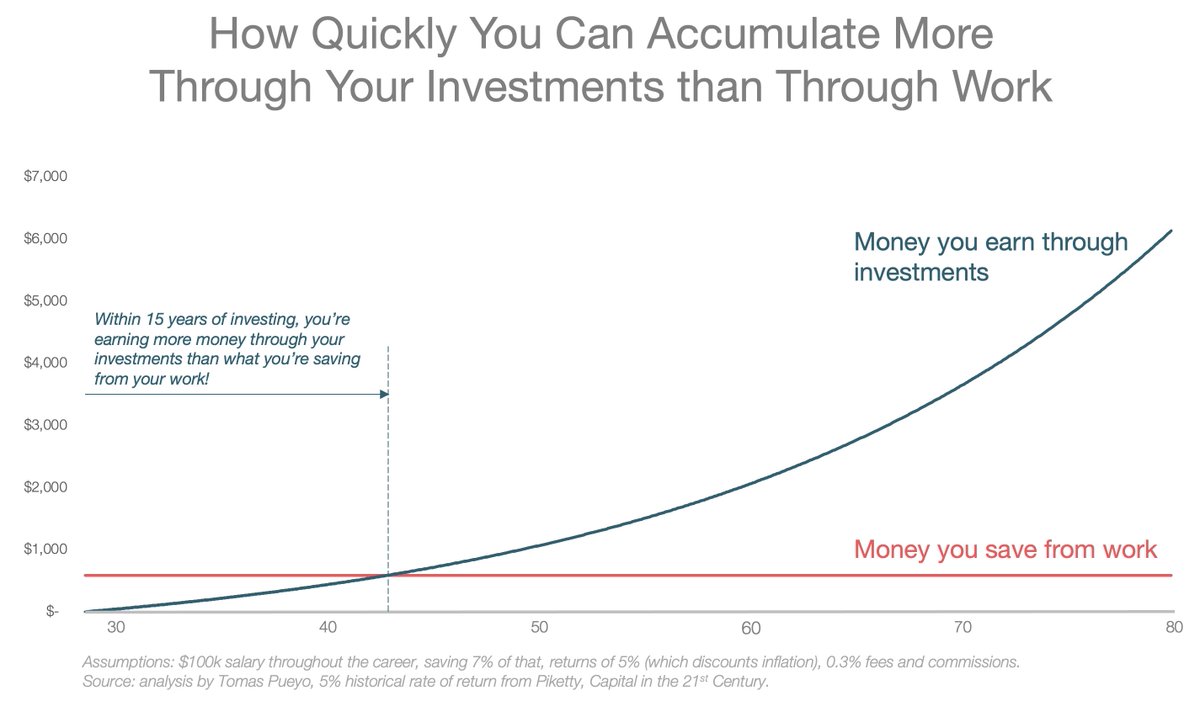

Another fun stat: within 15 years of working, you accumulate more $ from your investments than from your work savings

Another fun stat: if you retire at 60 after investing, to get to the same level of $ through only work + putting your $ in your bank account, you'd need to work for an additional.... 44 years!

So investing is the difference between retiring early and not retiring at all

Invest!

So investing is the difference between retiring early and not retiring at all

Invest!

In what should you invest though?

Issue #2: Don't diversify enough

Ppl pick a few stocks they believe in and that's it. Or put all their savings in one investment. Terrible.

You should instead invest as diversified as possible.

Issue #2: Don't diversify enough

Ppl pick a few stocks they believe in and that's it. Or put all their savings in one investment. Terrible.

You should instead invest as diversified as possible.

Vanguard does a good job at this. They invented index funds/ETFs in the 1970s, and it has taken time for ppl to catch up, but now they are managing... $7 trillion!

For orders of magnitude, global equity markets have $70T in investments...

For orders of magnitude, global equity markets have $70T in investments...

Roboadvisors also do a very good job at this. I worked at sigfig.com so I'm very biased. Do your own research, this is informational/entertainment only and not financial advice.

But I was a roboadvice customer before joining, and still am.

But I was a roboadvice customer before joining, and still am.

Other great roboadvisors: Wealthfront, Betterment, Ellevest in the US...

Plenty in Europe

robo-advisors.eu

Plenty in Europe

robo-advisors.eu

Issue #3: Trying to beat the market

This is the nightmare scenario of a self-directed investor, a person who picks the stocks to invest in.

S/he traded too much trying to beat the market, and lost $300k s/he doesn't have

This is the nightmare scenario of a self-directed investor, a person who picks the stocks to invest in.

S/he traded too much trying to beat the market, and lost $300k s/he doesn't have

Another example: this guy invested $15k in credit card debt and two $30k home equity loans, He has $7k left

Same thing: tried to beat the market.

Same thing: tried to beat the market.

As Mark Hanna would say:

“Name of the game: Move the money from your clients’ pocket into your pocket.... Number 1 rule of Wall Street: Nobody [...] knows if the stock is going to go up, down, sideways or in f* circles, least of all stockbrokers.”

“Name of the game: Move the money from your clients’ pocket into your pocket.... Number 1 rule of Wall Street: Nobody [...] knows if the stock is going to go up, down, sideways or in f* circles, least of all stockbrokers.”

Warren Buffet says it less flamboyantly:

“Lethargy, bordering on sloth, should remain the cornerstone of an investment style. Why? Because constantly buying and selling in an attempt to beat the market is a fool’s errand. It simply won’t work.”

“Lethargy, bordering on sloth, should remain the cornerstone of an investment style. Why? Because constantly buying and selling in an attempt to beat the market is a fool’s errand. It simply won’t work.”

To prove the point, in 2005 he bet $1M that just buying and holding the stock of the top 500 US companies would be a better investment than whatever any professional investor would could come up with. One hedge fund guy took the bet, and lost.

fool.com/retirement/201…

fool.com/retirement/201…

Unsurprising. Over 15 years, 92% of funds perform worse than the market.

That happens because they're bad at beating the market, and because of taxes and fees. Which leads us to...

That happens because they're bad at beating the market, and because of taxes and fees. Which leads us to...

Issue #4: Fees and Commissions

Another relevant quote from Mr Hanna:

“[A customer who's invested following your advice] thinks he’s getting rich … but you and me, the brokers, we’re taking home cold hard cash via commissions m**********r!”

Another relevant quote from Mr Hanna:

“[A customer who's invested following your advice] thinks he’s getting rich … but you and me, the brokers, we’re taking home cold hard cash via commissions m**********r!”

Here's the difference between investing with low vs. high fees: low fees gives you more than 2x the $!

Yet another reason to simply buy index funds yourself, or go through a roboadvisor.

Good index funds/ETFs charge <0.15%. It's called the expense ratio.

Bad funds, such as many mutual funds, charge much more. Look at this!!

Good index funds/ETFs charge <0.15%. It's called the expense ratio.

Bad funds, such as many mutual funds, charge much more. Look at this!!

There's no world in which you should pay weird upfront or sale fees. In fact, the only fee you should pay for a fund is the expense ratio, and it should nearly always be <0.50%. The best cost ~0.02%

So those are the fees you pay for buying the investments.

So those are the fees you pay for buying the investments.

But there's also the Financial Advisor fees. And this is the main mistake of ppl who have financial advisors. They're giving them their retirement.

In the US, the average advisory fee for a $50k account is 1.18% in the US. It’s usually more elsewhere. And that’s just an average!

In the US, the average advisory fee for a $50k account is 1.18% in the US. It’s usually more elsewhere. And that’s just an average!

Remember the massive difference btw 0.3% fees & commissions and 2.5%? Yeah, on average half of that is eaten away by the financial advisors.

smartasset.com/financial-advi…

smartasset.com/financial-advi…

If they did some type of voodoo magic, that would be great. But on average they're BAD. From a Canadian paper:

Or put in another way: Financial Advisors aren't bad for you because they cheat you. Mainly it's because they're just bad.

onlinelibrary.wiley.com/doi/abs/10.111…

Or put in another way: Financial Advisors aren't bad for you because they cheat you. Mainly it's because they're just bad.

onlinelibrary.wiley.com/doi/abs/10.111…

Issue #5: fairy tale retirement

All the retirement plans assume that you'll retire when you're 65, and you'll do that with 80% of your income.

Here's what happens if you do that.

Bank saver? Out of money before you're 70!

Even the investor is broke in her mid-90s

All the retirement plans assume that you'll retire when you're 65, and you'll do that with 80% of your income.

Here's what happens if you do that.

Bank saver? Out of money before you're 70!

Even the investor is broke in her mid-90s

But retire at 70 and... magic!

So aim for that.

You can also aim for spending less than 80% of your pre-retirement income. Super healthy. Ideally both.

So aim for that.

You can also aim for spending less than 80% of your pre-retirement income. Super healthy. Ideally both.

Also, be tax-efficient. It can have a dramatic impact in your assets. 401ks, IRAs, HSAs, FSAs... Look into them all!

Much more, with actionable advice, in the full article:

unchartedterritories.tomaspueyo.com/p/key-investme…

I'm publishing the follow-up this Thursday. Some of the topics:

The FIRE Movement

Negotiation

F**k Y** Money

When should you concentrate your bets?

Dollar-cost averaging

(cont.)

unchartedterritories.tomaspueyo.com/p/key-investme…

I'm publishing the follow-up this Thursday. Some of the topics:

The FIRE Movement

Negotiation

F**k Y** Money

When should you concentrate your bets?

Dollar-cost averaging

(cont.)

Cryptocurrencies, Fiat Currencies, MMT

Markovitz’ Efficient Frontier

Details of diversification

Mental biases of investing

Specifics of tax optimization

The accelerating impact of returns

And +

(That art. will be premium)

Want more? Follow me & sign up!

unchartedterritories.tomaspueyo.com

Markovitz’ Efficient Frontier

Details of diversification

Mental biases of investing

Specifics of tax optimization

The accelerating impact of returns

And +

(That art. will be premium)

Want more? Follow me & sign up!

unchartedterritories.tomaspueyo.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh