Imagine if all of these people worked for you:

Jack Dorsey

Caitlin Long

Jack Mallers

Ross Stevens

Cathie Wood

Michael Saylor

Ray Dalio

Jeff Booth

Well, if you own bitcoin, they already do.

That’s the power of aligned incentives.

Jack Dorsey

Caitlin Long

Jack Mallers

Ross Stevens

Cathie Wood

Michael Saylor

Ray Dalio

Jeff Booth

Well, if you own bitcoin, they already do.

That’s the power of aligned incentives.

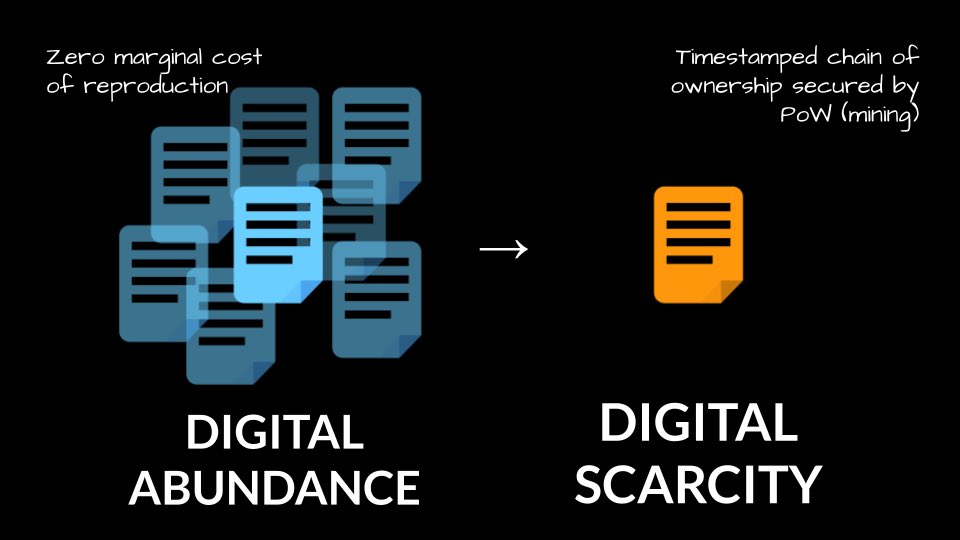

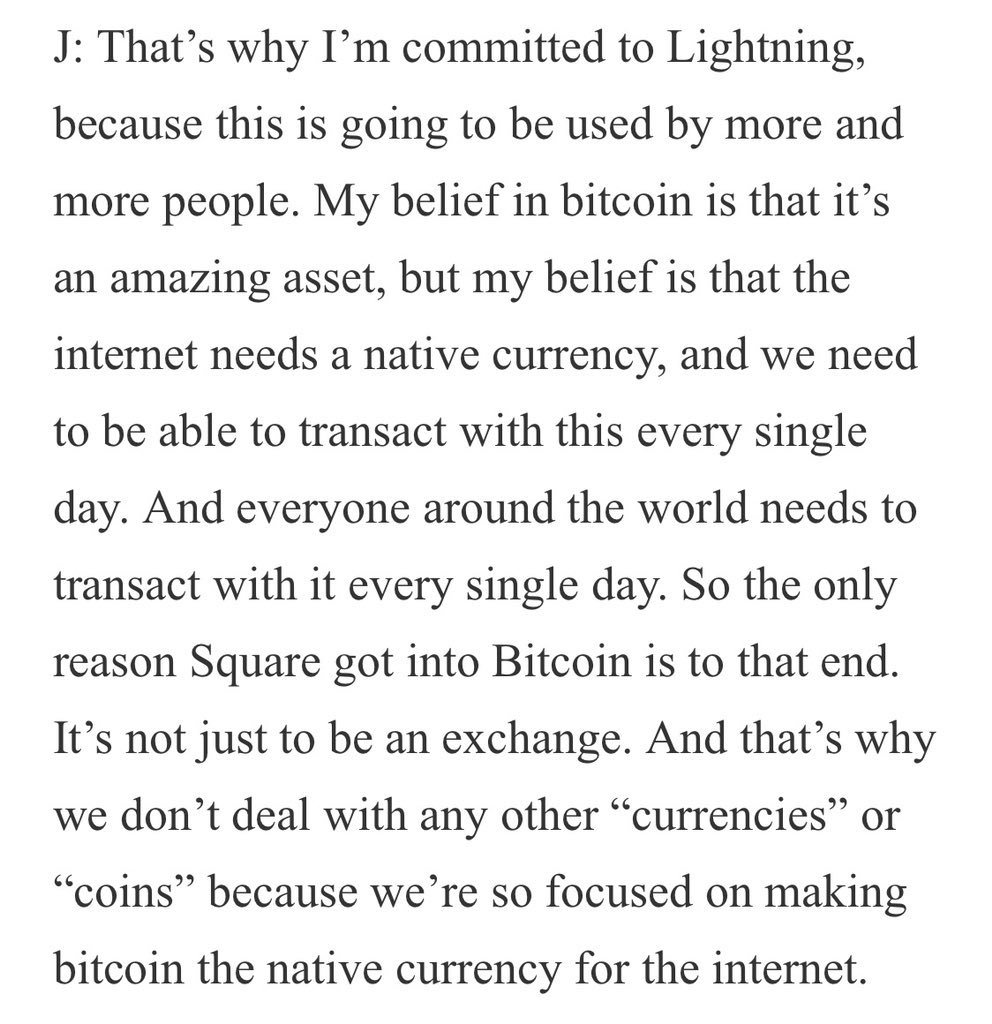

1/ Jack Dorsey & Square pushing to make bitcoin the native currency of the internet:

via: bitcoinmagazine.com/culture/the-ja…

via: bitcoinmagazine.com/culture/the-ja…

2/ Caitlin Long helping to craft new bank charter rules to enable banking services to be offered to bitcoin + digital asset businesses through Special Purpose Depository Institutions (SPDIs) via the state of Wyoming.

stephanlivera.com/episode/291/

stephanlivera.com/episode/291/

3/ Jack Mallers & Strike grinding to make Bitcoin THE global open monetary network.

https://twitter.com/anilsaidso/status/1368336347920961537

4/ Ross Stevens & NYDIG building out the infrastructure for institutional adoption, especially among insurers as a superior denominator to offset future declines in USD purchasing power.

5/ Cathie Wood & ARK appealing for changes to the accounting standards (FASB) for intangible assets, which have deterred companies holding bitcoin on their balance sheets.

6/ Michael Saylor & Microstrategy creating the playbook for adopting bitcoin as a treasury reserve asset to preserve long-term shareholder value in real terms.

microstrategy.com/en/bitcoin/doc…

microstrategy.com/en/bitcoin/doc…

7/ Ray Dalio, Stan Druckenmiller & Paul Tudor Jones removing the career-risk for capital allocators and validating the asset for pension funds & hedge funds as a partial replacement for neg/low-yielding bonds within a portfolio.

8/ Jeff Booth educating 1000’s about the higher-order effects + moral hazard caused by an inflationary monetary system and its stark incompatibility with the deflationary nature of technology.

• • •

Missing some Tweet in this thread? You can try to

force a refresh