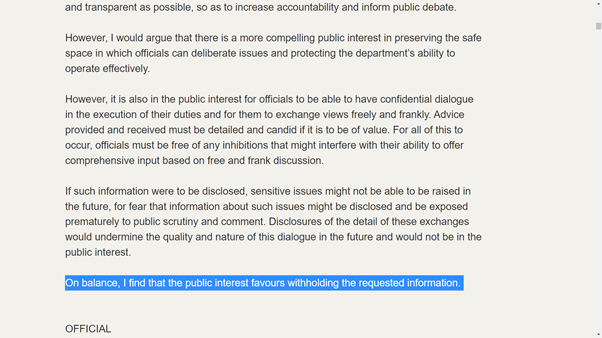

The recent FOIA disclosures led to some further requests by me. I have now had the results of those requests.

1/33

1/33

HMRC have not actually disclosed the suspicious e-mail. But I can live without it. What the disclosures did reveal however is that HMRC send a monthly bulletin to MPs.

I wonder whether this communication exercise explains the reticence experienced with some MPs.

2/33

I wonder whether this communication exercise explains the reticence experienced with some MPs.

2/33

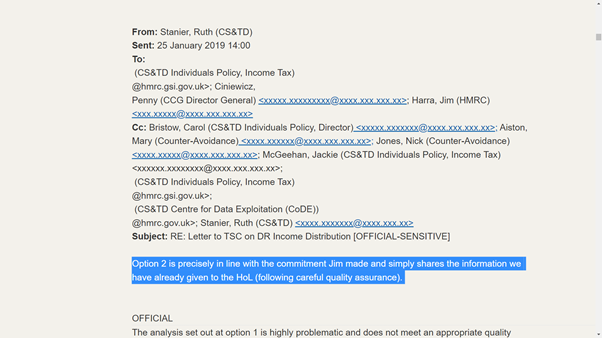

The draft anti-avoidance paper also makes interesting reading.

This, for example, shows the extent (as at January 2019) of HMRC’s action against promoters – relatively little action taken against promoters of loan arrangements.

3/33

This, for example, shows the extent (as at January 2019) of HMRC’s action against promoters – relatively little action taken against promoters of loan arrangements.

3/33

The preceding screenshot also confirms how the APN legislation in 2014 led to a significant decrease in the number of disclosures under DOTAS.

That is wholly unsurprising and a regrettable consequence of the overburdening of the DOTAS rules.

4/33

That is wholly unsurprising and a regrettable consequence of the overburdening of the DOTAS rules.

4/33

I am somewhat surprised that 18m after Rangers, HMRC still express the view that the loans are taxable as income.

That view has NEVER been accepted by any court or tribunal.

HMRC won Rangers only because they abandoned that argument.

6/33

That view has NEVER been accepted by any court or tribunal.

HMRC won Rangers only because they abandoned that argument.

6/33

In para 4, HMRC recognise a need to treat vulnerable people sensitively, but this compassion must be balanced with the need to ensure everyone pays the right amount of tax.

7/33

7/33

The highlighting in para 5 is HMRC’s.

It notes that HMRC got an easy ride when enacting the loan charge, but that the political landscape has since changed.

8/33

It notes that HMRC got an easy ride when enacting the loan charge, but that the political landscape has since changed.

8/33

HMRC’s own figures suggest that 75% of those affected by the loan charge are contractors, who are effectively employees.

9/33

9/33

This confirms that the “avoidance market” changed radically in 2005/06 and HMRC’s response 7-8 years later.

10/33

10/33

HMRC here acknowledge that there were “some who genuinely didn’t realise that the arrangements were avoidance or feel they were forced into using the scheme”.

11/33

11/33

There is a lot on this screenshot. Mainly, HMRC’s acknowledgement that they could have done more and sooner.

12/33

12/33

But an earlier sentence is also worth considering.

HMRC recognise that their spotlights are NOT seen by most taxpayers & only by the professional community.

HMRC defend themselves by stating they opened enquiries in earlier years and therefore taxpayers should have known.

13/33

HMRC recognise that their spotlights are NOT seen by most taxpayers & only by the professional community.

HMRC defend themselves by stating they opened enquiries in earlier years and therefore taxpayers should have known.

13/33

But what HMRC omit is that those enquiry letters told taxpayers that HMRC would tell them if they found anything wrong – yet HMRC said nothing.

And, as these screenshots show, the enquiries were not conducted quickly.

14/33

And, as these screenshots show, the enquiries were not conducted quickly.

14/33

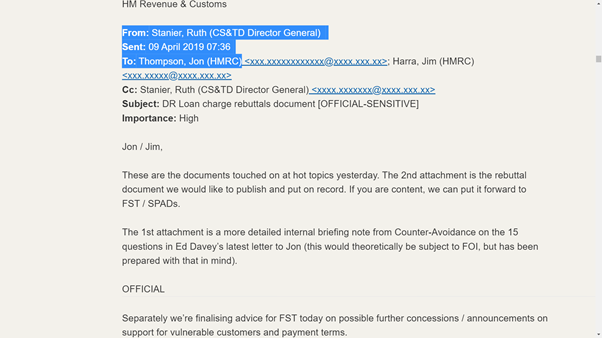

HMRC have frequently spun the line that the loan charge will be principally borne by employers.

This shows that this spin is completely false in relation to contractors.

15/33

This shows that this spin is completely false in relation to contractors.

15/33

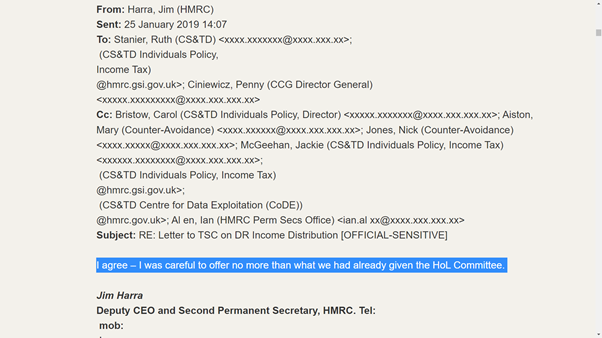

The highlighting in para 22 is HMRC’s.

HMRC warned ministers about the significant impact of the legislation. It was the ministers who said press on.

We also see how the 2017 (not 2016) election allowed the parliamentary process to be fastracked.

16/33

HMRC warned ministers about the significant impact of the legislation. It was the ministers who said press on.

We also see how the 2017 (not 2016) election allowed the parliamentary process to be fastracked.

16/33

Here’s an acknowledgement by HMRC that the loan charge effectively ensures that HMRC’s views about a historical tax charge are now enshrined as a future and unchallengeable tax liability.

19/33

19/33

This looks like a case of chicken and egg, regarding “unprotected” years.

Settlement terms require “voluntary” restitution because the loan charge would have caught unprotected years anyway.

And it makes HMRC’s life easier.

21/33

Settlement terms require “voluntary” restitution because the loan charge would have caught unprotected years anyway.

And it makes HMRC’s life easier.

21/33

Another admission that contractors (and not employers) will pick up the tab for the loan charge.

23/33

23/33

• • •

Missing some Tweet in this thread? You can try to

force a refresh