In DeFi today, liquidity is one of the hardest things to bootstrap for a new protocol. To incentivize users to provide liquidity, protocols will reward you with their native token by staking the LP (Often known as pool2's).

🧵👇:

🧵👇:

While liquidity mining was a novel idea that sparked DeFi, one question left unanswered is "what happens when rewards run out?". Some say that the fees generated will be enough for the users, but in my opinion, they'll quickly move onto their liquidity onto the next pool2.

These protocols are so dependent on these liquidity pool providers that they offer massive incentives in order to keep the LP providers satisfied.

for reference, @AlchemixFi , @feiprotocol , and @TokenReactor provides 100%, 85%, and 566% APR for LP.

for reference, @AlchemixFi , @feiprotocol , and @TokenReactor provides 100%, 85%, and 566% APR for LP.

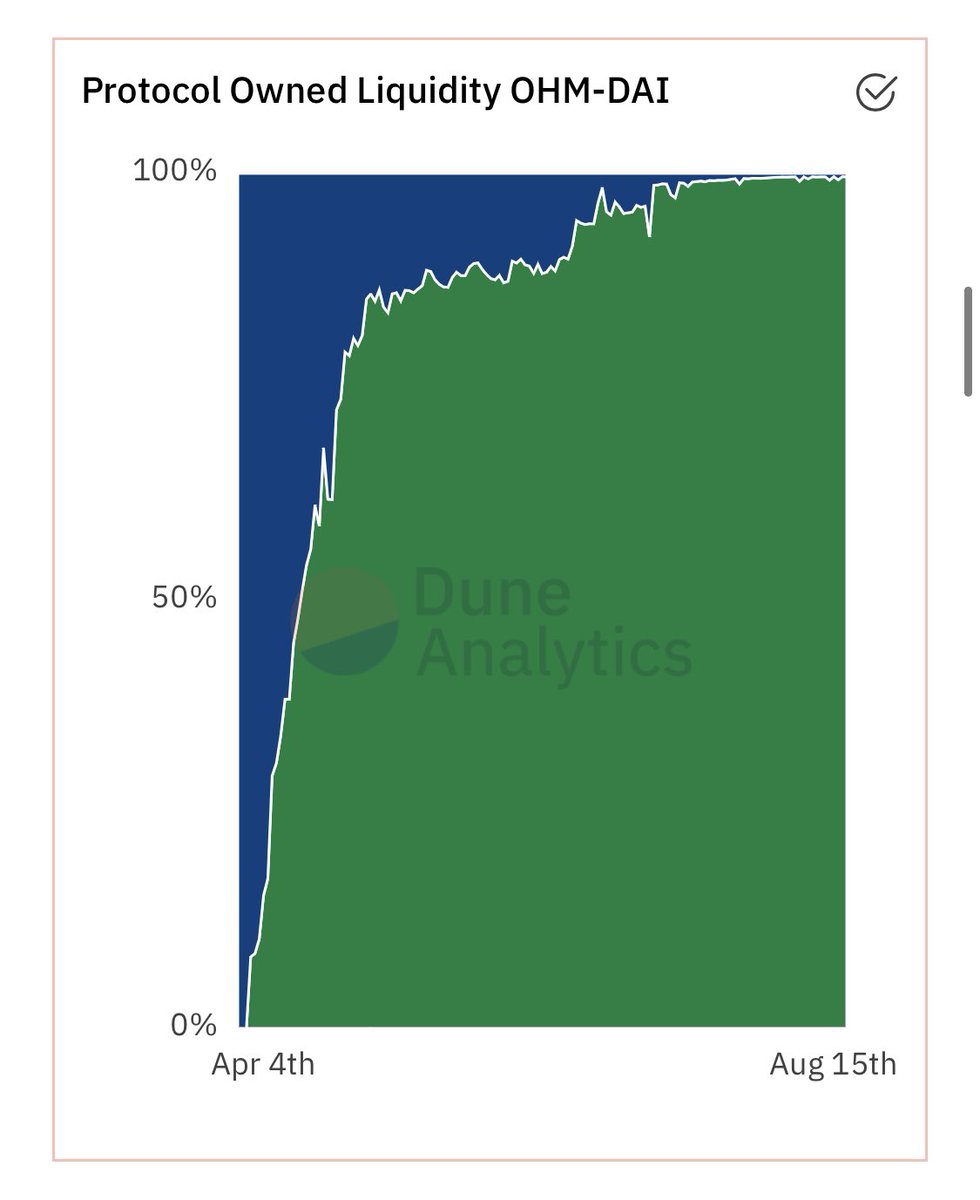

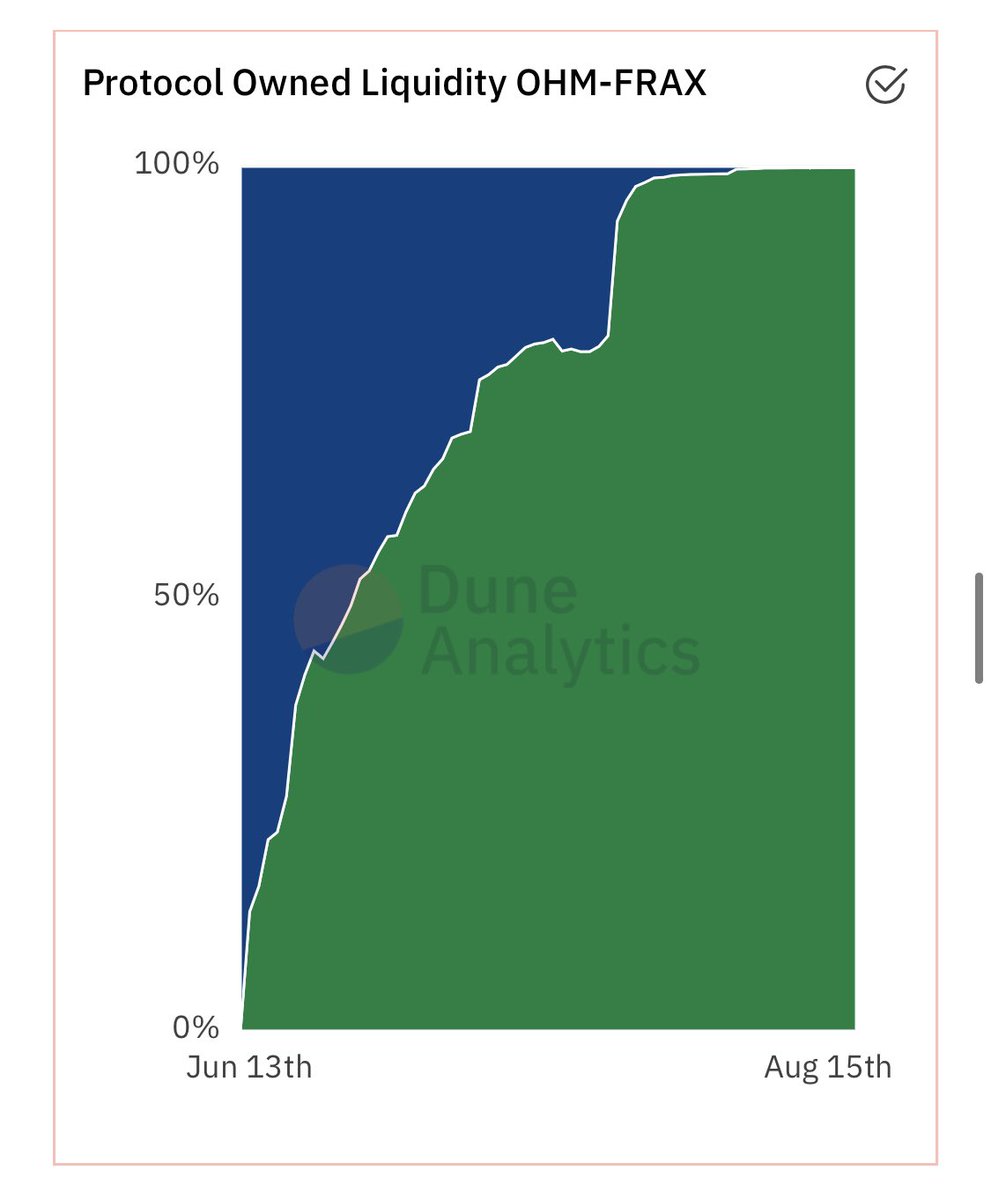

@OlympusDAO removes this dependence of liquidity by outright paying for the liquidity (via bonds), rather than rewarding those who LP. Initially Olympus did have a Pool2, but phased it out after they obtained a significant percentage of liquidity.

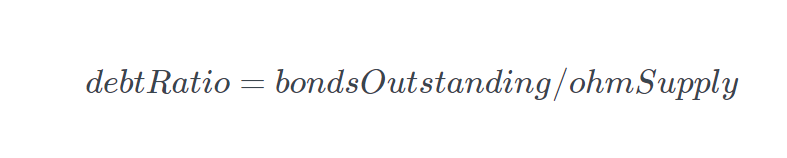

The results speak for themselves: Olymous owns the super majority of the OHM-DAI and the OHM-FRAX pool, with the OHM-DAI being one of the most liquid pairs on @SushiSwap.

This is liquidity that not only the protocol can depend on, but as the user as well! Users are now confident that liquidity providers won't pull out when the market goes on a downturn. It also provides a constant revenue source for the protocol (1m+ in fees to date).

This is akin to buying a home, instead of renting a home. The initial cost of doing this may be significant, but in the long run, should pay for itself over the long run.

As the space evolves, I can see @OlympusDAO influencing and empowering every DeFi protocol today.

Instead of paying 100% APR to current LP, protocols could pay 80% APR for Olympus to bootstrap, maintain, and hold their LP in their Treasury, guaranteeing stability indefinitely.

Instead of paying 100% APR to current LP, protocols could pay 80% APR for Olympus to bootstrap, maintain, and hold their LP in their Treasury, guaranteeing stability indefinitely.

The protocol can guarantee liquidity for their users, and Olympus gets to diversify their Treasury, as well as increase the use cases for the OHM token. Truly a win-win scenario.

This thread was inspired by @ohmzeus tweet a couple of weeks ago. See the potential of @OlympusDAO and join the Ohmies!

https://twitter.com/ohmzeus/status/1420831688582705153

• • •

Missing some Tweet in this thread? You can try to

force a refresh