@OlympusDAO was the first protocol to ultilize a protocol controlled treasury via bonding. This mechanism can be used in many different ways—@KlimaDAO will use this mechanism to amass carbon tons, forcing quicker adoption of low carbon technology.

🧵👇:

🧵👇:

Climate change is one of the biggest issues of our generation. One way we incentivize eco-friendly decisions is through carbon credits. If your project reduces or destroys a tonne of carbon, you’re entitled to 1 carbon credit, which can be sold on the open market.

The problem with this is that the open market doesn’t value carbon at a fair price—it can wildly vary between 1-30$. Unpredictable demand, limited price data availability, scare financing are some of the factors that attribute to this.

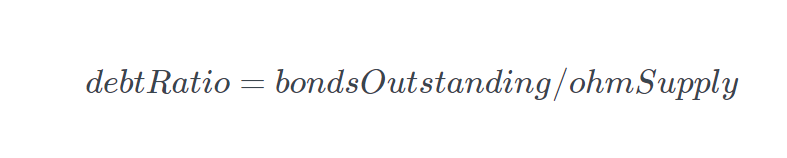

@KlimaDAO's bonding mechanism will let companies tokenize and bond their carbon credits to get KLIMA, their native rebasing token similar to OHM. Every KLIMA is backed by one BCT (Base Carbon Tonne).

the BCT token is a carbon index made of different carbon offsets. This will help stabilize the price of carbon as it will be a better indicator of the overall carbon market.

As KlimaDAO accrues more BCT in its treasury, it reduces the total supply of the carbon in the market. Coupled with the increased demand for carbon credits over the years (15x+ by 2030 and up to 100 by 2050), this should cause a supply shock within the carbon market.

This will accomplish two things:

with the sudden demand of carbon credits, projects that helped mitigate carbon but wasn’t economically feasible suddenly become profitable, and prices out big companies from making bad eco decisions.

with the sudden demand of carbon credits, projects that helped mitigate carbon but wasn’t economically feasible suddenly become profitable, and prices out big companies from making bad eco decisions.

It aligns the greed of the market with the benefits for humanity, a win-win scenario for everyone.

While the protocol hasn't been launched yet, early discord members were offered a pre-sale for 10 USD/KLIMA, up to 1000 USD (and a badass NFT)

its also not too late to invest–the pre-sale will be entirely used to fund the LBP (Liquidity bootstrap auction) from @_alchemistcoin

its also not too late to invest–the pre-sale will be entirely used to fund the LBP (Liquidity bootstrap auction) from @_alchemistcoin

This mechanism ensures the fairest launch, so that everyone gets a fair price once the sale is complete (you can learn more here: docs.alchemist.wtf/copper )

Very interested in where @ArchimedesCryp1 and the protocol goes from here, join the discord if you have any questions!

discord.gg/klimadao

discord.gg/klimadao

• • •

Missing some Tweet in this thread? You can try to

force a refresh