@OlympusDAO's quest to begin branching to other layers begins with OIP-25, deploying Olympus to Arbitrum

forum.olympusdao.finance/d/102-oip-25-d…

🧵👇

forum.olympusdao.finance/d/102-oip-25-d…

🧵👇

Arbitrum has just been released, a layer 2 solution which offers the same security as ETH L1 with vastly lower fees.

With NFT minting on the rise, this is sorely needed in order to reduce friction in our ecosystem.

With NFT minting on the rise, this is sorely needed in order to reduce friction in our ecosystem.

In other to bootstrap liquidity, we'll be using the wETH obtained the wETH bonds, and mint OHM to create a 3.4 million OHM-wETH pool on arbitrum.

Since we'll be using all the wETH, we can now get more wETH from our existing wETH bonds (5% more wETH in our treasury? no-brainer)

Since we'll be using all the wETH, we can now get more wETH from our existing wETH bonds (5% more wETH in our treasury? no-brainer)

at launch, we'll have a OHM-wETH bond, which functions exactly the same way bonds work on L1. However, we'll implement a different dynamic staking rewards contract on arbitrum.

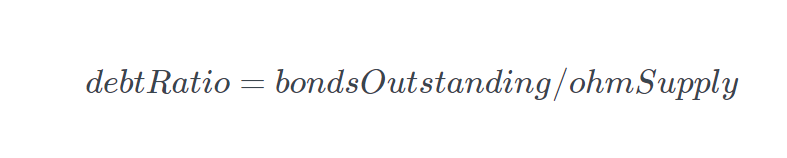

Essentially, the bond sales will drive the staking rewards. The staking rewards are derived by the number of OHMs minted for bonds and a scaling variable (dubbed staking multiplier)

Assuming the multiplier was 2, if we minted 10 OHMs for bonds, we'll mint 20 OHMs for the next epoch for staking rewards. This will align the goals of the stakers with the goals of the treasury. More value into the treasury -> more rewards to the L2 stakers.

As this is an experimental phase, we'll start only with 100k, and evaluate the success after it runs out. For reference, the ethereum chain will mint ~700k OHM in the same timeframe.

Striking the iron while it's hot, and getting the first mover advantage on a L2 solution will attract people to utilize the Olympus ecosystem, and will help in our goal in becoming the de facto trading pair in DeFi. Very excited to see where this goes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh