Wat today happen with nifty 16450 ce and yesterday bnf option, it can happen to anyone. Either you trade any time with sl-m. Even in stocks further worst.

Every type of system hv some limit. Suppose someone hv 100cr aum for one trade then impossible to exit at price sll or slm.

Every type of system hv some limit. Suppose someone hv 100cr aum for one trade then impossible to exit at price sll or slm.

Even in urgency you can think wat will happen. Also nowadays one kind of quick money scheme like intraday option selling very famous along all ppl and everyone hv little various like 20-50% series stoploss. When they start hitting; huge demand of buyers n no sellers to fill.

Definitely smart ppl already taking advantage. Now question is how we can survive with slm? Answer is straight No. Few execution system can precise but can't ignore this problem.

For algos very difficult to find good fill which happened fraction of sec, sll is one good option but if miss the range of trigger to price, every few sec need to chase the price. But biggest problem for normal players who hv simple slm order and can't chase price such frequently

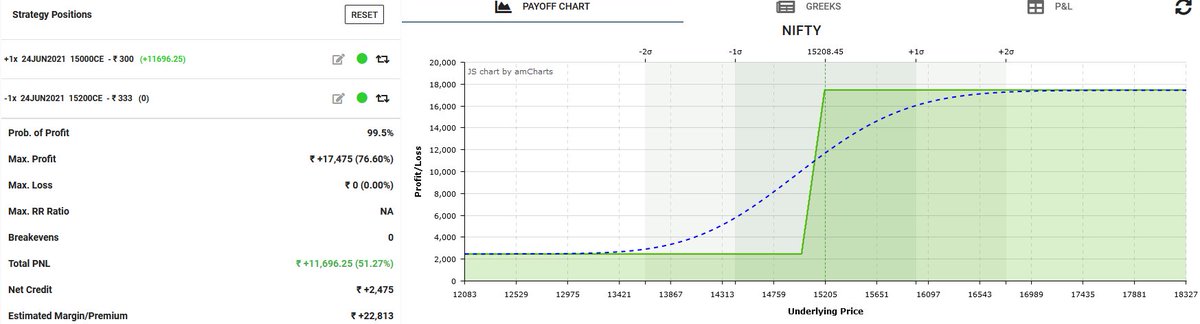

I personally use little wider hedge, one or two strike wider than standard. I never use stop in system as I know my max limit. So I never take call in urgency first, once my sll hit then only another process I take through simple algo or even manual someone can do.

These weekly hedges definitely makes no sense bcoz it will not protect from spike (gamma/vega/slippage), but yes I know my position sizing n maxloss; which allow me to stay calm in various flash crashes in last many yrs.

Choice is individual and see ur plan is fullproof to deal with most of the situations. In high iv I don't use hedges as premium enough to manage. But understand the situation. Even statics and backtesting check howz ur system perform in low iv.

Enough to write ✍️. TC traders.

Enough to write ✍️. TC traders.

• • •

Missing some Tweet in this thread? You can try to

force a refresh