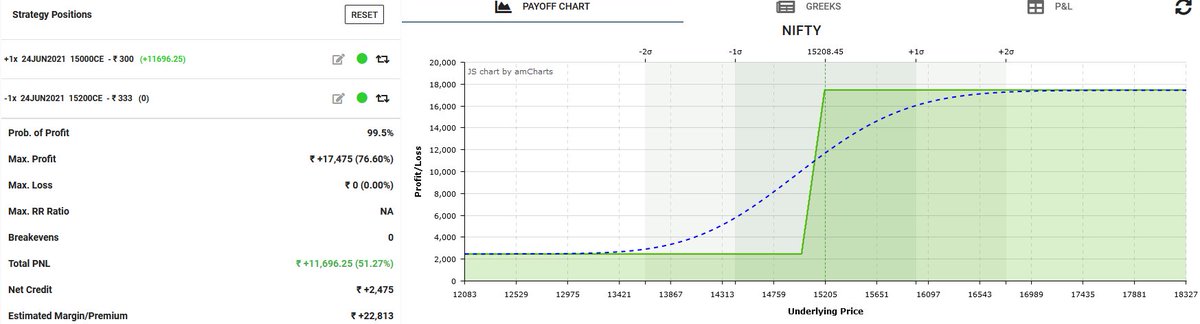

Case Study of Mine Mindtree Earning trade

1. Started with 1:3 Call ratio of 4k credit approx.

2. In dip volume missing so converted to 1:2 yesterday.

3. after morning gap when ORB trigger converted into butterfly.

4. Also took CSP sell OTM put. (optional)

Overall stop 3k holding.

1. Started with 1:3 Call ratio of 4k credit approx.

2. In dip volume missing so converted to 1:2 yesterday.

3. after morning gap when ORB trigger converted into butterfly.

4. Also took CSP sell OTM put. (optional)

Overall stop 3k holding.

Trade started with following things in mind, liquidity on put side poor unlike call side really good liquidity also looks good vol short trade but high beta stock and as per chart and data wise choose to sell R2.

As hv to trade only liquid and round strike choose such strike and one of my fav system ratio. Took 1:3 call ratio as IT looks weak from few days. But technical it's making low without good volume so as risk averse book one short leg and carried 1:2 almost flat credit.

Objective was will see further formation and earn from vol drop + skew. But underlying moved on tested side and got opportunity to convert trade with technical orb; so converted from ratio to butterfly.

Still very good position to hold and max loss after convertion only 5k, so anyone can hold with as per capital allocation and proper risk. For minimise loss someone can take additional short at untested side side.

This is whole thought process behind the trade.

If I m unable to manage on time then I will happy to carry trade with overall stop is best idea. Future can offset loss but no profit at all with block margin.

If I m unable to manage on time then I will happy to carry trade with overall stop is best idea. Future can offset loss but no profit at all with block margin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh