Top 23 takeaways from The Latest One Percent Show.

Prof @Sanjay__Bakshi talking to Vishal ( @safalniveshak ) on Health, Wealth and Wisdom.

And yes, also on Investing!

Grab a popcorn and here we go.

Prof @Sanjay__Bakshi talking to Vishal ( @safalniveshak ) on Health, Wealth and Wisdom.

And yes, also on Investing!

Grab a popcorn and here we go.

1.Never grow up. It's a trap.

2. Losing curiosity is one of the biggest traps as we grow old. We end up accepting life without questioning.

3. Experience is a double-edged sword. A child on the other hand always has an edge because she has a clean slate of mind.

4. Everything has an opportunity cost. But you can't look at life that way. Focus on a few things that are important to you.

5. If you lend money to somebody, you can make that money yourself. But if you lend time to somebody, you are never going to get it back.

6. All wisdom is ancient. And most of them is spiritual.

~Mental Models Vs Spirituality

~Loss aversion Vs Equanimity

~Commitment Bias Vs Detachment

~Mental Models Vs Spirituality

~Loss aversion Vs Equanimity

~Commitment Bias Vs Detachment

7. Burning Bridges Vs Preserve Optionalities

Often burning bridges turn out to be more important than preserving optionalities.

Often burning bridges turn out to be more important than preserving optionalities.

8. Teaching is a form of giving but also a form of receiving. Teach to Learn. No amount of money can match the payback from teaching.

9. Look at business models from an architect's view.

~Fragile

~Robust

~Antifragile

~Fragile

~Robust

~Antifragile

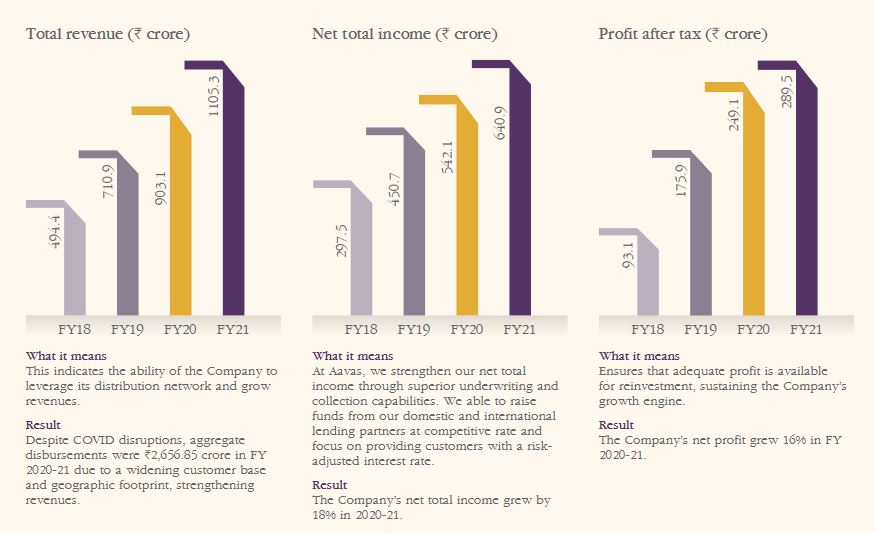

10. Four types of lending business ~Extremely risky (accidents waiting to happen)

~Less risky (Prudent Management)

~Safe (well collateralized & you can auction it easily)

~Bulletproof (You can't have NPA)

~Less risky (Prudent Management)

~Safe (well collateralized & you can auction it easily)

~Bulletproof (You can't have NPA)

11. Dividend & Earnings Growth are predictable. Valuation Multiples are not predictable. Better to focus on things that are predictable.

12. When everyone starts behaving as if the world is going to die, it makes sense to just believe it won't happen that way.

13. Be willing to look foolish but not behave in a foolish way. The world will judge you on your short term performance.

Focus more on survival & longevity than exceptional growth.

Survive to Thrive

Focus more on survival & longevity than exceptional growth.

Survive to Thrive

14. Compound interest on investment is appreciated. Compounded interest inside a business is not appreciated well enough.

15. Herd Mindset & Social Proof is a common tendency in the world of business and investing. Try to rewire your brain. Observe the survivors and those who thrive.

16. You don't need to have views on everything. Grab the popcorn and watch the show.

#CryptocurrencyMarket

#CryptocurrencyMarket

17. If you keep taking high risks, you have more odds of blowing up than generating more returns.

18. As the investing world becomes more and more indexed, it appears like a virtuous circle in a long bull market. It may change into a vicious circle if there is a long bear market.

19. To see life as it is, one path is to become financially independent. The other path is a spiritual path- to not be materialistic.

20. Lower expectations, be a satisfier (knowing what's good enough) than an optimizer. Keep it simple and adapt.

Ex: Ben Graham's idea of buying equities that have an earning yield = 2x of bond yield.

Ex: Ben Graham's idea of buying equities that have an earning yield = 2x of bond yield.

21. Learning on your own is very important. Schools, colleges and universities are not going to help beyond a point.

22. Vantage point: Take one idea and look it from a different point of view. Detach yourself from any of your own conclusions you draw from one view.

23. Breathing correctly, fasting, being quiet and contemplating are age-old techniques of improving physical and Mental Health. They also help you to focus.

Reco:

~Mandukia Upanishad

~The Art of Living by Epictetus & Sharon Lebell

~@TheAncientSage

Hope we have influenced you to watch the whole video.

Go for it. One of the best ways to spend the weekend.🙂

~Mandukia Upanishad

~The Art of Living by Epictetus & Sharon Lebell

~@TheAncientSage

Hope we have influenced you to watch the whole video.

Go for it. One of the best ways to spend the weekend.🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh