“I could get my daughter married only because of you.”

“I could invite my friends at my home only because of you.”

“My social status has improved only because of you.”

“I could invite my friends at my home only because of you.”

“My social status has improved only because of you.”

In Tier-1 and Tier-2 cities, it may sound ok to live in a rented home. But, it’s still a dream of millions of Indians to have their own home.

In Tier-3, 4, 5/ rural areas, owning a home is socially uplifting. But, it's demotivating to see the home loans getting rejected.

In Tier-3, 4, 5/ rural areas, owning a home is socially uplifting. But, it's demotivating to see the home loans getting rejected.

Here comes Mr. Sushil Kumar Agarwal (CA – AIR 10, CS) with 19+ years of experience in retail financial services in AuSFB, ICICI Bank Limited, and Kotak Mahindra Primus Limited.

His father has a cloth shop in Jaipur where he sat for about 5 years while getting educated and decided to do something on his own one day. Mr. Sushil, coming from a middle-class background, saved INR 1 Cr. during his 10-year corporate career.

At 32, he went back to Jaipur (birthplace) from Mumbai (workplace) in 2010 and started planning for the business under the guidance of Mr. Sanjay Agarwal (now, MD & CEO of AU Small Finance Bank).

Prepared 10-year plan after studying 20 years balance sheets of key players

Prepared 10-year plan after studying 20 years balance sheets of key players

Value system which he inherited

~Do business but don’t go for making it big in a short time

~Understand the importance of compounding

~Appreciate others when they are trusting you

~Work ethics

~Customer is God

~Live daily rather than going for a 15-day vacation in a year

~Do business but don’t go for making it big in a short time

~Understand the importance of compounding

~Appreciate others when they are trusting you

~Work ethics

~Customer is God

~Live daily rather than going for a 15-day vacation in a year

He started Au Housing Finance Private Limited (now known as Aavas Financiers Ltd.) in February 2011 in Jaipur, Rajasthan with the sole objective of fulfilling the dreams of people living in Tier-3, 4, 5/ rural areas to have their own ‘CHHAT’/ home.

“SAPNE AAPKE, SAATH HAMAARA” (“Your Dreams, Our accompany”) – the tagline says it all

The business model is very effective

~100% in-sourcing: No middleman

~Effective usage of technology starting from loan application to approval to collection

The business model is very effective

~100% in-sourcing: No middleman

~Effective usage of technology starting from loan application to approval to collection

~85% of the customers are such who live in the home rather than investing in it

~Most of the locations catered having less than 10L population with ~5% loan penetration

~Target customers – Self-employed, lower-income group

~Robust pillars of People, Process and System

~Most of the locations catered having less than 10L population with ~5% loan penetration

~Target customers – Self-employed, lower-income group

~Robust pillars of People, Process and System

Employee care -

The company invests in medical checkups. After some medical checkups, the doctors asked some employees, “What have you been doing? Your reports are improving” The reply was, “we changed the company.”

Go back home at 1830 hours. Manage daily productivity.

The company invests in medical checkups. After some medical checkups, the doctors asked some employees, “What have you been doing? Your reports are improving” The reply was, “we changed the company.”

Go back home at 1830 hours. Manage daily productivity.

~Most of the loan approvers are CAs

~Received investment from Lake District, Kedaara AIF-1, Master Fund, and ESCL in 2016

~Received the ASSOCHAM Excellence Award for being the best housing finance company in affordable housing in 2016

~Received investment from Lake District, Kedaara AIF-1, Master Fund, and ESCL in 2016

~Received the ASSOCHAM Excellence Award for being the best housing finance company in affordable housing in 2016

Their product portfolio includes all types of housing finance like home purchase, construction-linked loan, loan for renovations and improvements, loan against property, and loan for MSME (Micro, Small, and Medium Enterprises)

Got listed in stock exchanges on 12th Oct 2018

Got listed in stock exchanges on 12th Oct 2018

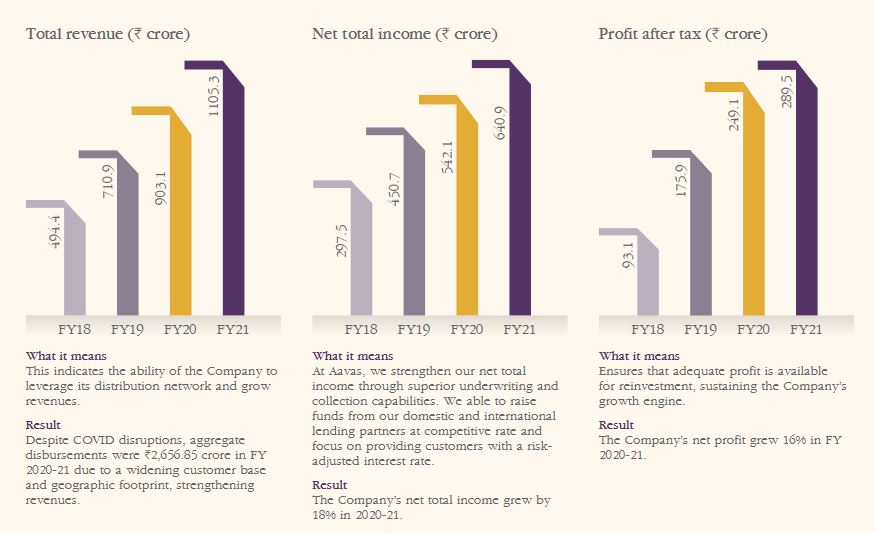

Mr. Sushil Kumar Agarwal (MD & CEO) says, “Despite the challenges in the sector during the last decade, the company was able to survive in a dynamic environment and now possesses a foundation to sustain its fast-paced growth journey across the foreseeable future.”

~Started with 1 state, now in 11 states with 6K+ employees, 265+ branches & market cap of INR ~20K Cr.

~Aiming for 500+ branches by 2028

~What a journey! Many more years to go for fulfilling the dreams of many Indians!

~Aiming for 500+ branches by 2028

~What a journey! Many more years to go for fulfilling the dreams of many Indians!

This is not a recommendation. Just an incredible story worth telling.

Retweet the 1st Tweet if you liked it.🙂🙏

For more threads like this, write your favourite business' name in the comments section.

You may have a look at 50+ names here: bit.ly/2VqfYKC

Thank You

Retweet the 1st Tweet if you liked it.🙂🙏

For more threads like this, write your favourite business' name in the comments section.

You may have a look at 50+ names here: bit.ly/2VqfYKC

Thank You

• • •

Missing some Tweet in this thread? You can try to

force a refresh