AR20-21 Notes

Praj Industries

India’s Leader in Bio-Fuel Technology

Put on your helmets & Enjoy the ride 🙂

Retweet for wider reach 🙏

Praj Industries

India’s Leader in Bio-Fuel Technology

Put on your helmets & Enjoy the ride 🙂

Retweet for wider reach 🙏

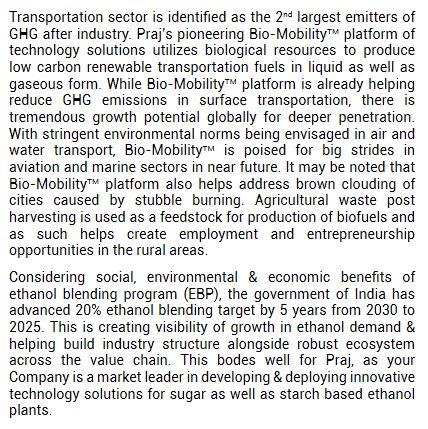

2/ Chairman’s Message

~Ethanol Demand to rise from Govt push for 20% ethanol blending by 2025

~Launched BioPrism tech portfolio for producing bio-based Renewable Materials

~Identified growth areas like Bioplastics, Lignin products, specialty

chemicals, & others

~Ethanol Demand to rise from Govt push for 20% ethanol blending by 2025

~Launched BioPrism tech portfolio for producing bio-based Renewable Materials

~Identified growth areas like Bioplastics, Lignin products, specialty

chemicals, & others

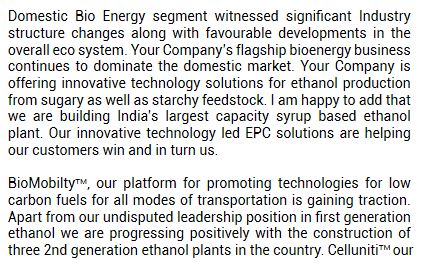

3/ CEO & MD’s Note

~Praj continues to dominate the bioenergy sector in India

~Engg Business saw good unique opportunities

~Delivered Solutions as part of critical vaccine supply chain

~Praj continues to dominate the bioenergy sector in India

~Engg Business saw good unique opportunities

~Delivered Solutions as part of critical vaccine supply chain

4/ Technologies introduced under Biomobility Platform in FY21 provided

~Reduced water requirement

~Enhanced plant capacity

~Increased ethanol yield

~Reduction in emissions

~Pharma Grade Ethanol

~Production of Compressed Biogas from agri-residues and pressmud

~Reduced water requirement

~Enhanced plant capacity

~Increased ethanol yield

~Reduction in emissions

~Pharma Grade Ethanol

~Production of Compressed Biogas from agri-residues and pressmud

6/ R&D & Award Highlights

~Gained 5 Indian & 6 Foreign Patents in FY21

~Bagged awards for innovation and waste management

~Gained 5 Indian & 6 Foreign Patents in FY21

~Bagged awards for innovation and waste management

7/ Business Highlights

1st Gen Ethanol Domestic:

~Govt push to create opportunity for new 10 bn liters PA capacity

~Good traction for B-heavy molasses and sugar syrup based ethanol plants

1st Gen Ethanol International

~Traction for Pharma grade Ethanol

~Demand up for biofuels

1st Gen Ethanol Domestic:

~Govt push to create opportunity for new 10 bn liters PA capacity

~Good traction for B-heavy molasses and sugar syrup based ethanol plants

1st Gen Ethanol International

~Traction for Pharma grade Ethanol

~Demand up for biofuels

8/ Business Highlights Contd

2nd Gen Ethanol

~Has 3 orders for advanced biofuel refineries in India

~Expect demand from North Europe

Compressed BioGas

~Expecting setup of 5000 CBG plants in next 5 years

Others

~Developed process for making Isobutanol

~Scaling up SAF in India

2nd Gen Ethanol

~Has 3 orders for advanced biofuel refineries in India

~Expect demand from North Europe

Compressed BioGas

~Expecting setup of 5000 CBG plants in next 5 years

Others

~Developed process for making Isobutanol

~Scaling up SAF in India

9/ Business Highlights Contd

~CPES got orders from a US-based Industrial Gases Company

~Slowdown in domestic Brewery Segment

~Got repeat orders for Zero Liquid Discharge Solutions

~HiPurity to see demand rise from pharma & personal care segments

~CPES got orders from a US-based Industrial Gases Company

~Slowdown in domestic Brewery Segment

~Got repeat orders for Zero Liquid Discharge Solutions

~HiPurity to see demand rise from pharma & personal care segments

10/ R&D Developments

~Joined with Institute Of Chemical Technology, Mumbai (ICT) for process development and reactor design research

~Produced breakthrough in making “Bio-bitumen” based on Lignin

~Filed for over 300 patents to date

~Joined with Institute Of Chemical Technology, Mumbai (ICT) for process development and reactor design research

~Produced breakthrough in making “Bio-bitumen” based on Lignin

~Filed for over 300 patents to date

11/ Outlook for the Future

~Ethanol demand to rise for blending

~CBG opportunity to rise

~Bioenergy to become mainstream due to focus on sustainability

~Ethanol demand to rise for blending

~CBG opportunity to rise

~Bioenergy to become mainstream due to focus on sustainability

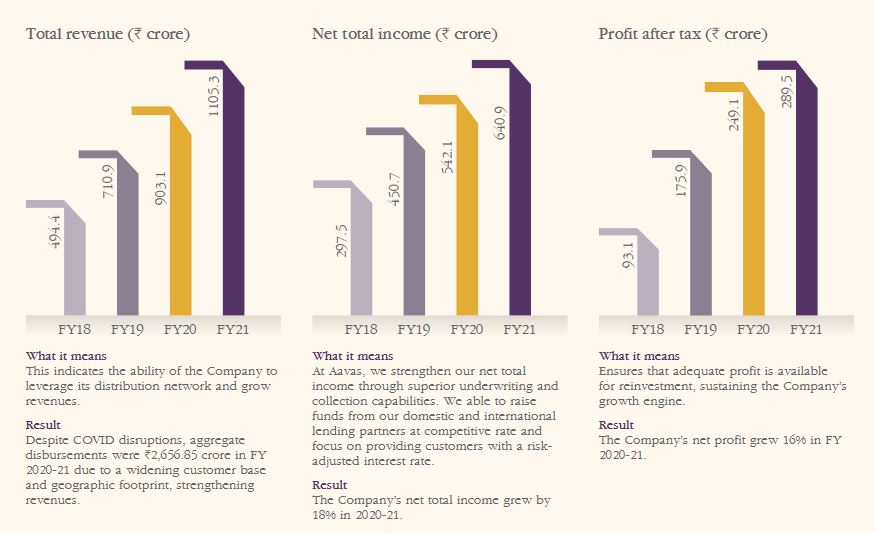

12/ Financials

~Consolidated Balance Sheet

~Consolidated P&L Statement

~Consolidated Cash Flow Statement

~Consolidated Balance Sheet

~Consolidated P&L Statement

~Consolidated Cash Flow Statement

13/ End 🙂🙏

Plz L&R the 1st tweet here if you liked this

Plz L&R the 1st tweet here if you liked this

• • •

Missing some Tweet in this thread? You can try to

force a refresh