Noticing a lot of traditional crypto traders/investors getting into NFTs.

There’s many similarities between NFT marketplaces and Crypto exchange/economies.

Floors, tops, walls, volume, liquidity,

1/ Thread 👇

There’s many similarities between NFT marketplaces and Crypto exchange/economies.

Floors, tops, walls, volume, liquidity,

1/ Thread 👇

2/ Crypto investors are familiar with these terms over the last several years.

Indicating when to enter/exit positions.

Now, I’m not a big TA guy, but I do use some.

PS This Tweet is NOT Art related - that’s a diff beast.

Indicating when to enter/exit positions.

Now, I’m not a big TA guy, but I do use some.

PS This Tweet is NOT Art related - that’s a diff beast.

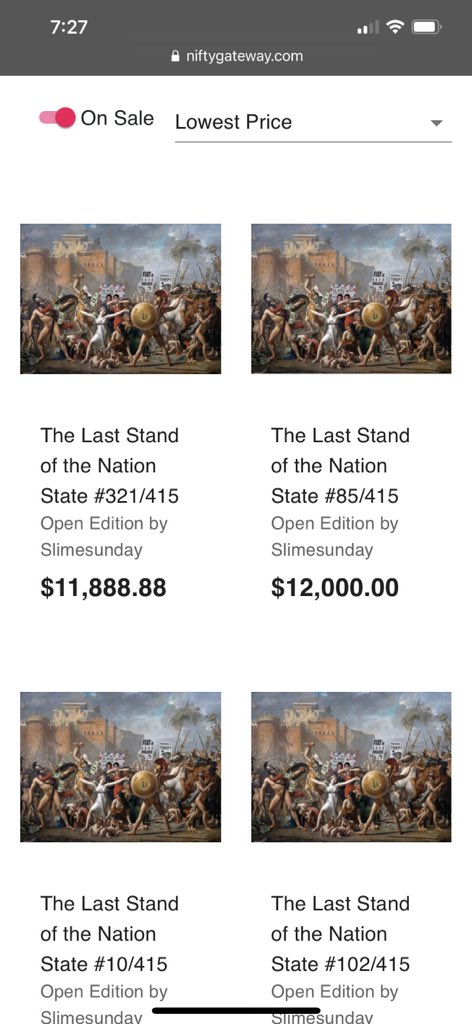

3/ Thin floors: Below is one of the first ever NFT releases on @niftygateway from Cris Cyborg.

If the cheapest 8 are bought, the floor price goes up over 600%.

This is how we see CRAZY NFT prices.

Low supply, thin floor, demand comes in -> People make $.

If the cheapest 8 are bought, the floor price goes up over 600%.

This is how we see CRAZY NFT prices.

Low supply, thin floor, demand comes in -> People make $.

4/ Number of Holders/wallets:

This doesn’t get talked about much but imo is VERY important.

Especially for 10k avatar projects.

More holders = better distribution = less concentrated whales that can potentially cause sell pressure.

This doesn’t get talked about much but imo is VERY important.

Especially for 10k avatar projects.

More holders = better distribution = less concentrated whales that can potentially cause sell pressure.

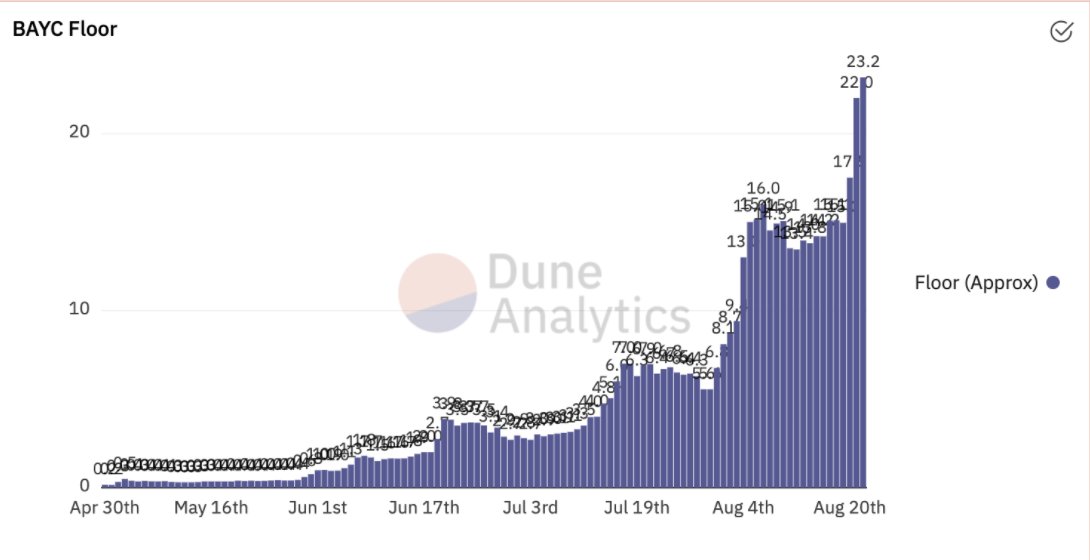

5/ Floor Tracking:

There’s definitely a correlation between ETH/USD prices and floor prices of NFT projects.

As @LASCisthePLAY used to time his entry into Punks.

ETH/USD chart is technically the “floor” price for ETH, (lowest someone is willing to sell for).

There’s definitely a correlation between ETH/USD prices and floor prices of NFT projects.

As @LASCisthePLAY used to time his entry into Punks.

ETH/USD chart is technically the “floor” price for ETH, (lowest someone is willing to sell for).

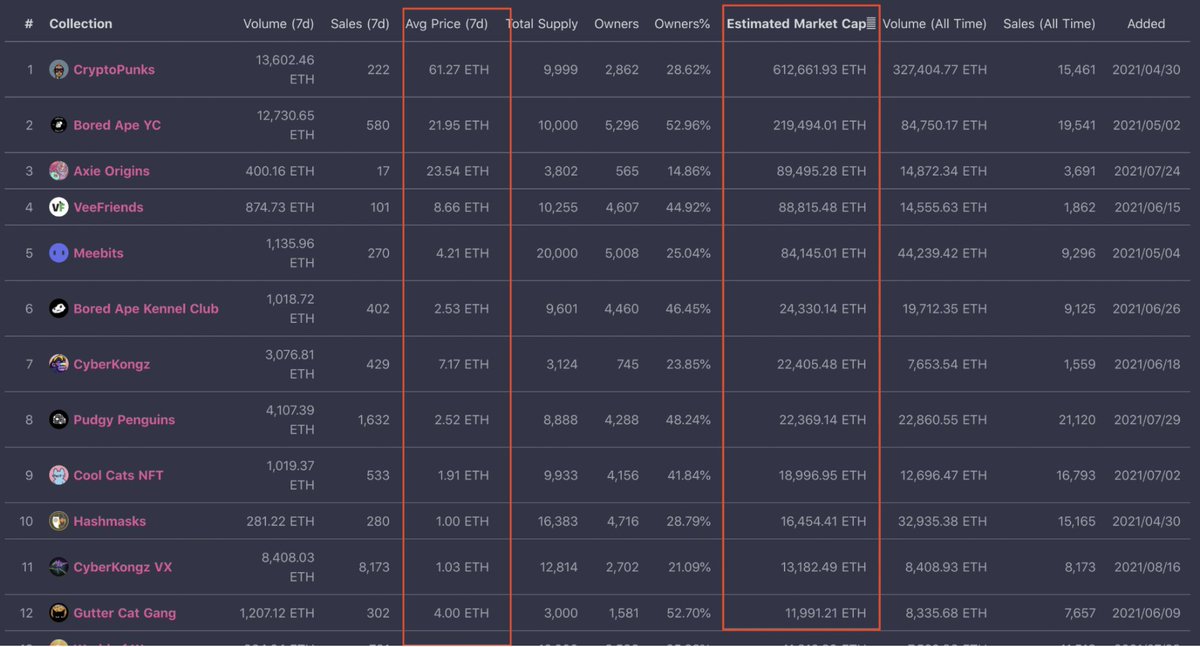

6/ Market caps:

Large, Mid, Small Caps. Sound familiar?

Market caps give a general indication on how much $ is required to move floor prices

Eg, It requires MUCH more capital to 2x on a floor punk than a Hasmask. There is no floor price column but avg price gives an indication

Large, Mid, Small Caps. Sound familiar?

Market caps give a general indication on how much $ is required to move floor prices

Eg, It requires MUCH more capital to 2x on a floor punk than a Hasmask. There is no floor price column but avg price gives an indication

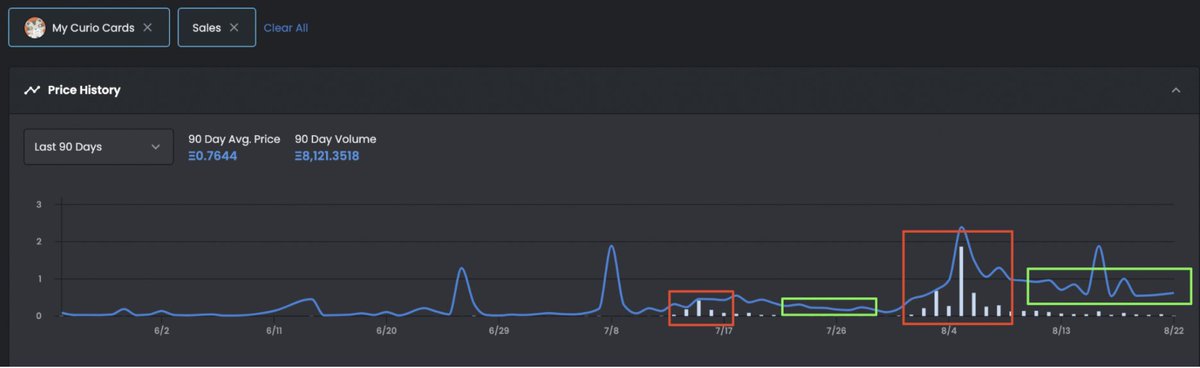

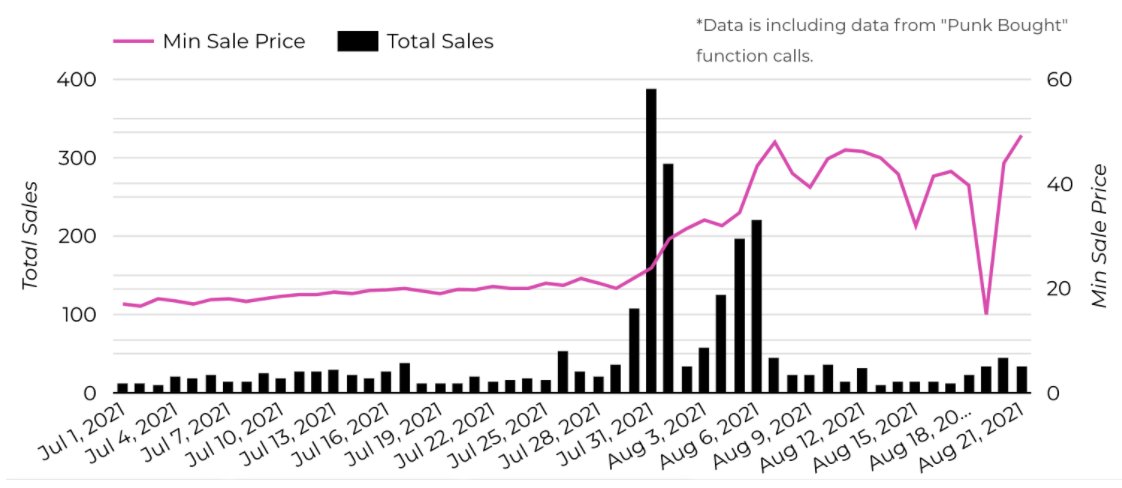

7/ Volume:

Volume dictates liquidity/price action.

Either the project grows organically, or an influencer pumps it on Twitter.

The latter is usually temporary.

You can see how volume, (red), pushes prices up every time giving the project a strong floor resistance, (green).

Volume dictates liquidity/price action.

Either the project grows organically, or an influencer pumps it on Twitter.

The latter is usually temporary.

You can see how volume, (red), pushes prices up every time giving the project a strong floor resistance, (green).

8/ Liquidity:

Liquidity and volume are obviously connected.

But just like how cryptocurrencies can become relatively illiquid due to their being less volume, (high slippage), so can NFTs. In fact, moreso.

Extremely important when choosing your position size.

Liquidity and volume are obviously connected.

But just like how cryptocurrencies can become relatively illiquid due to their being less volume, (high slippage), so can NFTs. In fact, moreso.

Extremely important when choosing your position size.

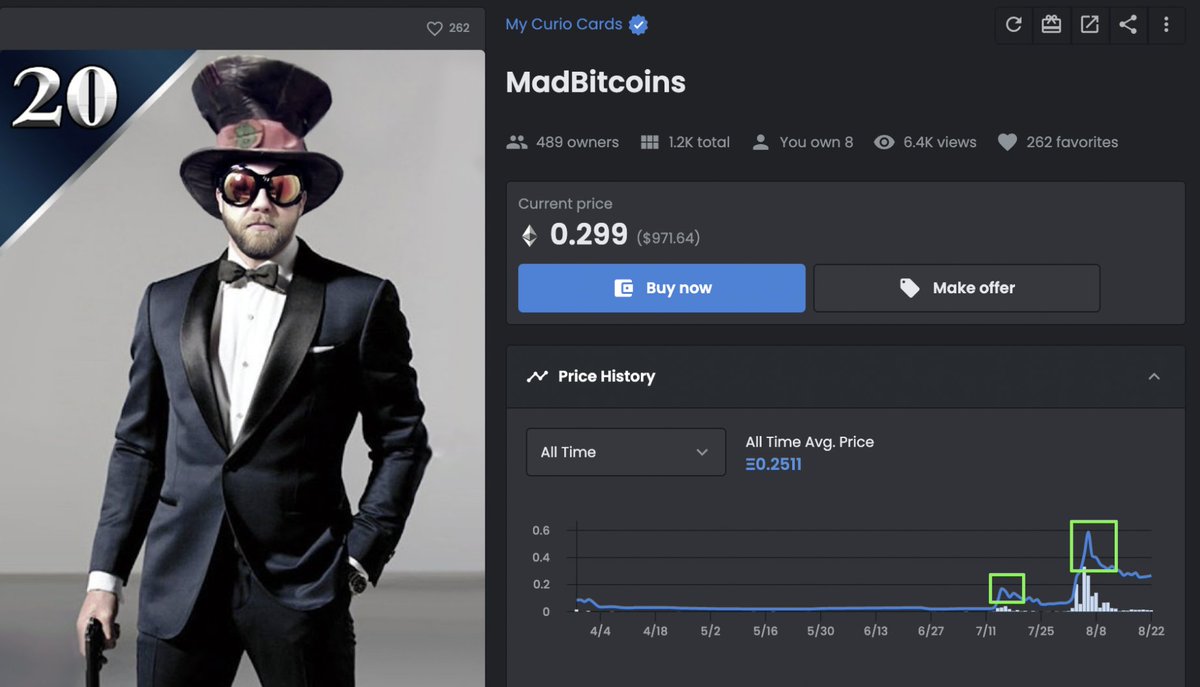

9/ Tops:

Taking a Curio Card as an example once again,

There can be times where you buy “the top”. But many NFTs can become more valuable in time. Especially collectibles.

So price usually continues upwards as utility/history/community brings in demand.

Taking a Curio Card as an example once again,

There can be times where you buy “the top”. But many NFTs can become more valuable in time. Especially collectibles.

So price usually continues upwards as utility/history/community brings in demand.

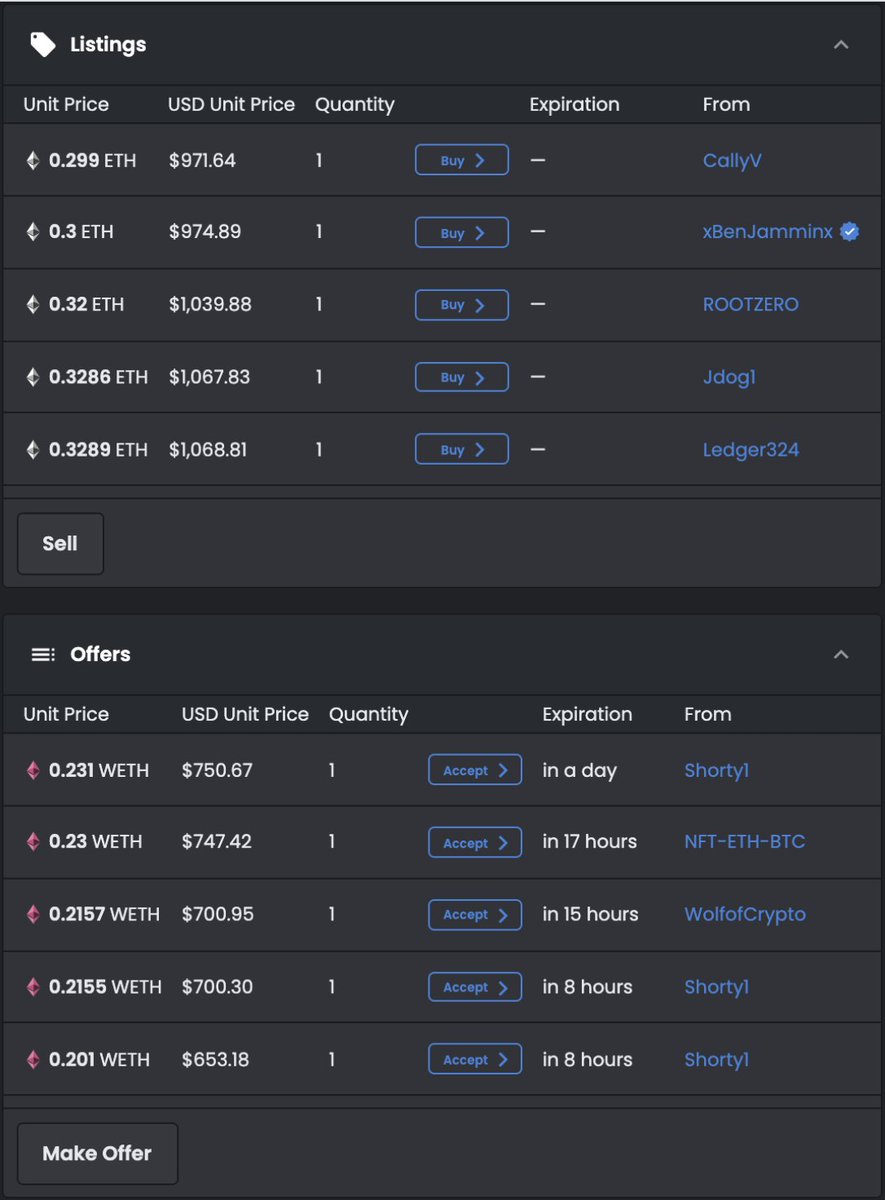

9/ Sell Walls:

Basically a price point that acts as a barrier to the price moving up due to many listed for sale.

Eg with Pudgy Penguins it takes 38 ETH to push the price up 20%. (2 -> 2.5 ETH)

BUT you get stuck at a 2.5 ETH sell wall

Which needs 112.5 ETH, ($350k), to cross

Basically a price point that acts as a barrier to the price moving up due to many listed for sale.

Eg with Pudgy Penguins it takes 38 ETH to push the price up 20%. (2 -> 2.5 ETH)

BUT you get stuck at a 2.5 ETH sell wall

Which needs 112.5 ETH, ($350k), to cross

10/ Order Books:

There isn’t much of an order book in the NFT industry.

Most just don’t work that way.

But some do. Like Twitter, Curio Cards, Enjin due to being ERC1155, (Semi Fungible).

There isn’t much of an order book in the NFT industry.

Most just don’t work that way.

But some do. Like Twitter, Curio Cards, Enjin due to being ERC1155, (Semi Fungible).

11/ Charts:

There isn’t much graphs that chart NFTs. But there is def more stat websites exploring with them.

Floor graphs, volume and average sales price, pie charts to give trait/color/variance weighting.

There isn’t much graphs that chart NFTs. But there is def more stat websites exploring with them.

Floor graphs, volume and average sales price, pie charts to give trait/color/variance weighting.

12/ Whale manipulation/holdings:

NFT projects absolutely can be manipulated.

Someone comes in, injects $1-$3M and floor price goes nuts. They can create walls, remove walls, dump positions etc. Just like crypto.

That’s why checking whale holders is important imo.

NFT projects absolutely can be manipulated.

Someone comes in, injects $1-$3M and floor price goes nuts. They can create walls, remove walls, dump positions etc. Just like crypto.

That’s why checking whale holders is important imo.

13/ Now there ARE differences.

Diff: Like more transparency:

You can actually see who owns how many of what.

Pretty interesting and adds a diff dynamic to crypto, (where most $ is held in exchanges).

Diff: Like more transparency:

You can actually see who owns how many of what.

Pretty interesting and adds a diff dynamic to crypto, (where most $ is held in exchanges).

14/ Diff: Emotionally more connection:

There obviously is the “collector” element that adds emotion to this.

Harder to sell something that you are attached to due to being involved in the game/community.

Crypto tokens? Hmm, somewhat of an emotional connection but not so much.

There obviously is the “collector” element that adds emotion to this.

Harder to sell something that you are attached to due to being involved in the game/community.

Crypto tokens? Hmm, somewhat of an emotional connection but not so much.

15/ Diff: Utility:

Utility can obviously add demand.

If you own NFT x, you have a stat boost of 2%,

Or you own NFT y, you have a stat boost of 10%.

Guess which will be more sought after/expensive granted supply is the same?

Utility can obviously add demand.

If you own NFT x, you have a stat boost of 2%,

Or you own NFT y, you have a stat boost of 10%.

Guess which will be more sought after/expensive granted supply is the same?

16/ Diff: Lower overall market cap:

Most NFT projects are $1-$3M market cap.

These 10k avatar projects often raise $2.5M

Which makes them pretty easy to push prices up organically or inorganically, (influencers/whales).

Most NFT projects are $1-$3M market cap.

These 10k avatar projects often raise $2.5M

Which makes them pretty easy to push prices up organically or inorganically, (influencers/whales).

17/ Diff: Different prices due to non fungibility:

Different NFTs within the same NFT project can be of different values.

eg, different land co-ordinates, scarcer traits, better perks, art,

This is the beauty of Non-Fungibility which doesn’t exist with Fungible tokens/crypto.

Different NFTs within the same NFT project can be of different values.

eg, different land co-ordinates, scarcer traits, better perks, art,

This is the beauty of Non-Fungibility which doesn’t exist with Fungible tokens/crypto.

18/ Diff: Mint date matters.

With cryptocurrencies, this prob matters way less but I'd say value is more in the utility.

But NFTs are different,

Early Axies are ~30ETH, 2017 Rocks are 100+ ETH, Mooncats, punks, etheria all appreciate coz history matters.

With cryptocurrencies, this prob matters way less but I'd say value is more in the utility.

But NFTs are different,

Early Axies are ~30ETH, 2017 Rocks are 100+ ETH, Mooncats, punks, etheria all appreciate coz history matters.

19/ I can prob add more to this but I’ll stop.

This is why 1-2 years experience in either crypto or NFT markets will do you a LOT of good.

Don’t just fomo buy, data will show you the way.

This is why 1-2 years experience in either crypto or NFT markets will do you a LOT of good.

Don’t just fomo buy, data will show you the way.

20/ Things don’t always work like this. These are just some general similarities I’ve noticed.

A lot of the above is how I used to think but the NFT industry got me to look deeper which is how, instead of just watching floors, you can hunt for gems

My next thread topic :)

A lot of the above is how I used to think but the NFT industry got me to look deeper which is how, instead of just watching floors, you can hunt for gems

My next thread topic :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh