A short thread on how to win at NFT investing.

👇

👇

1/ Be open minded.

Try new things, it’s fun and expands the mind.

You also stumble upon way more opportunities and ways to get involved.

Try new things, it’s fun and expands the mind.

You also stumble upon way more opportunities and ways to get involved.

2/ Spend money.

Getting free stuff is cool, but you make real money when you spend real money.

Maybe it’s just my experience.

But utilise wealth to build more wealth. It’s more scalable.

Getting free stuff is cool, but you make real money when you spend real money.

Maybe it’s just my experience.

But utilise wealth to build more wealth. It’s more scalable.

3/ Take that extra 5-10 mins to jump into discord’s.

You get a better feel for the project.

- Is the announcement channel active?

- Are new ppl regularly entering?

- Is it just a bunch of moon boys/girls?

You get a better feel for the project.

- Is the announcement channel active?

- Are new ppl regularly entering?

- Is it just a bunch of moon boys/girls?

4/ Time efficiency

Don’t waste time on daily clutter.

Debates, drama, discussion with no purpose.

That extra 1-2 hours can do you plenty experimenting, learning and getting involved.

Don’t waste time on daily clutter.

Debates, drama, discussion with no purpose.

That extra 1-2 hours can do you plenty experimenting, learning and getting involved.

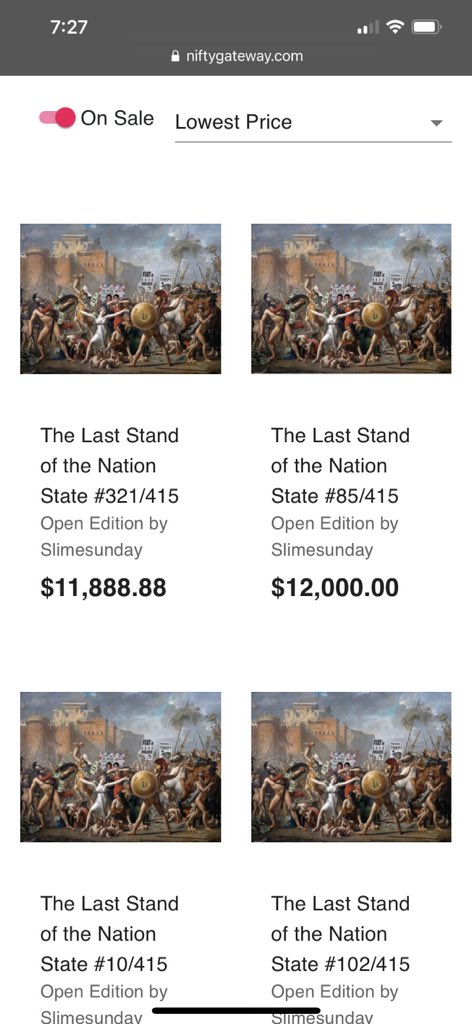

5/ Data

3-4 years later we have plenty of data to look at and help guide our decisions.

- Are you buying at peak?

- Does the project get consistent buyers?

- Which platforms are new to experiment on?

3-4 years later we have plenty of data to look at and help guide our decisions.

- Are you buying at peak?

- Does the project get consistent buyers?

- Which platforms are new to experiment on?

6/ Get a broad range of info.

Don’t just follow one influencer like gospel.

They are just a dot in this massive industry. Get multiple takes, multiple sources, multiple niches.

Don’t just follow one influencer like gospel.

They are just a dot in this massive industry. Get multiple takes, multiple sources, multiple niches.

7/ Experience.

Just keep going. As long as you implement and move forward you learn.

Which eventually leads to better decisions, more frequent pay days.

Just keep going. As long as you implement and move forward you learn.

Which eventually leads to better decisions, more frequent pay days.

8/ Double down on what works.

Do you flip? Long term invest? Found a killer project?

If you find a strategy that works, perfect it, you can do extremely well with just one strat.

Do you flip? Long term invest? Found a killer project?

If you find a strategy that works, perfect it, you can do extremely well with just one strat.

9/ Investing isn’t like employment.

Some months you make nothing, others you make bankkk

If your first month brings you no results, relax you’re doing fine.

When it clicks, you’ll find fruitful investments.

Some months you make nothing, others you make bankkk

If your first month brings you no results, relax you’re doing fine.

When it clicks, you’ll find fruitful investments.

10/ Have fun.

Life’s too short.

If you find yourself in a space where you’re having fun, chances are others are too.

Signs of longevity.

Life’s too short.

If you find yourself in a space where you’re having fun, chances are others are too.

Signs of longevity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh