Received quite a large number of enquiries on the main option trading webinar and the live handholding group. Rather than answering individually, explaining the major points here .

First read this : quantgym.biz/workshop

First read this : quantgym.biz/workshop

This is a fully recorded workshop with 12+ hours of video. You also get access to all tools used in this workshop. System codes are on tradingview,

they are "invite only " indicators ( meaning you will be able to use the systems for lifetime, but the codes are locked )

they are "invite only " indicators ( meaning you will be able to use the systems for lifetime, but the codes are locked )

You can subscribe if interested and start learning at your own pace. You will need a few weeks to understand and assimilate the concepts as they

are quite exhaustive and vast.

are quite exhaustive and vast.

You will need to take subscription to two softwares :

1. TradingView PRO plan ( around 12k per year)

2. iCharts subscription ( 5k per year)

1. TradingView PRO plan ( around 12k per year)

2. iCharts subscription ( 5k per year)

We will start LIVE handholding of this batch from 26th Nov 2021 ( telegram group), will continue for a month. You will need at least a month before that to assimilate all concepts and be fluent in using the tools

READ THIS CAREFULLY :

There is no "easy way" to make money in the markets. I will teach you all I know, but it's not a guarantee that you will make money for sure.

Being successful depends upon the hard work you will put in and the risk management you will follow.

There is no "easy way" to make money in the markets. I will teach you all I know, but it's not a guarantee that you will make money for sure.

Being successful depends upon the hard work you will put in and the risk management you will follow.

The videos will be available for viewing for 3 months from your date of subscription. I will be available for lifetime to answer your questions :)

Last point : ELIGIBILITY

1. You must be trading F&O for atleast 2 years and know the basics of what options are

2. A minimum trading capital of 10 lacs

1. You must be trading F&O for atleast 2 years and know the basics of what options are

2. A minimum trading capital of 10 lacs

For the August 21 handholding batch, this was the performance of LIVE handholding ( daytrading) for 2 weeks

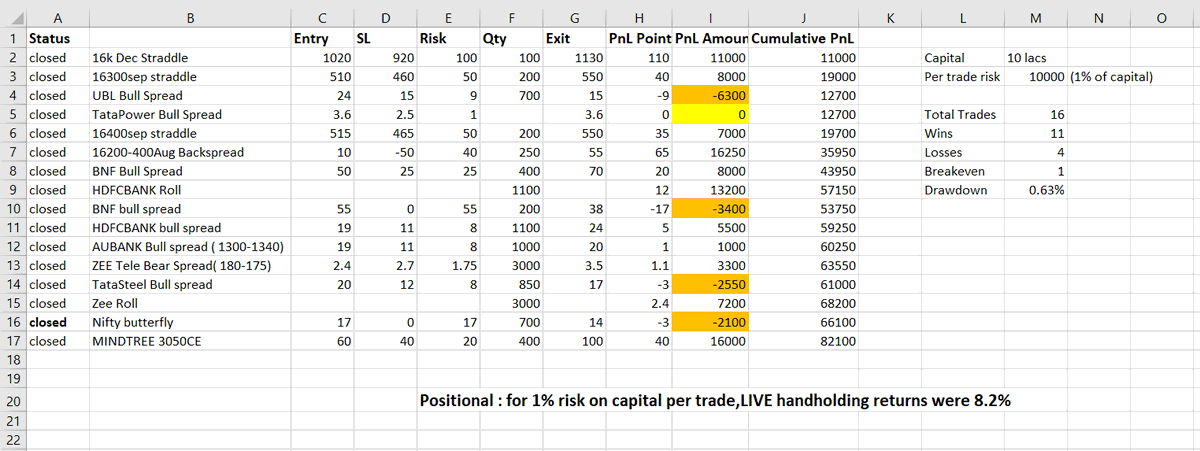

For the August 21 handholding batch, this was the performance of LIVE handholding( positional) for 1 month

Course material is 80% focussed on positional trading and 20%on options trading.

If interested, subscribe through this link :

quantgym.org/course/advance…

If interested, subscribe through this link :

quantgym.org/course/advance…

Feel free to DM me on twitter or email me if you need any clarifications. I strongly suggest clarifying any queries you have before you subscribe for this course.

Thank you.

Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh