UST’s supply has passed 2b recently. What actually has been driving this increase from the beginning? Did the increase in Anchor’s deposits contribute to an increase in UST's supply? A thread:

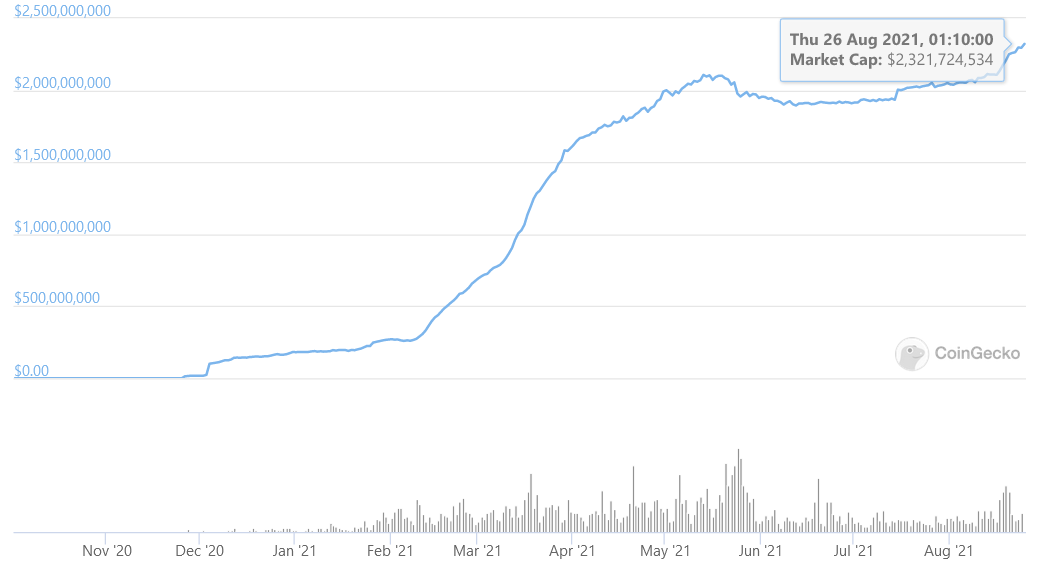

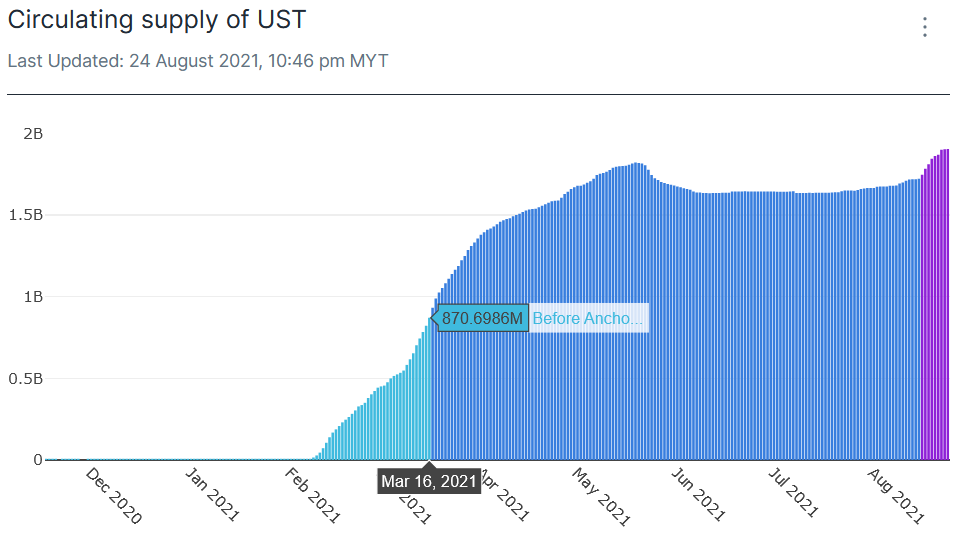

This is the overall circulating supply of UST. From Feb 7 to March 16, UST went from 2M in market cap (MC) to 870M MC! Note that Anchor only launched on March 17. One driver could be the anticipation of Anchor’s launch.

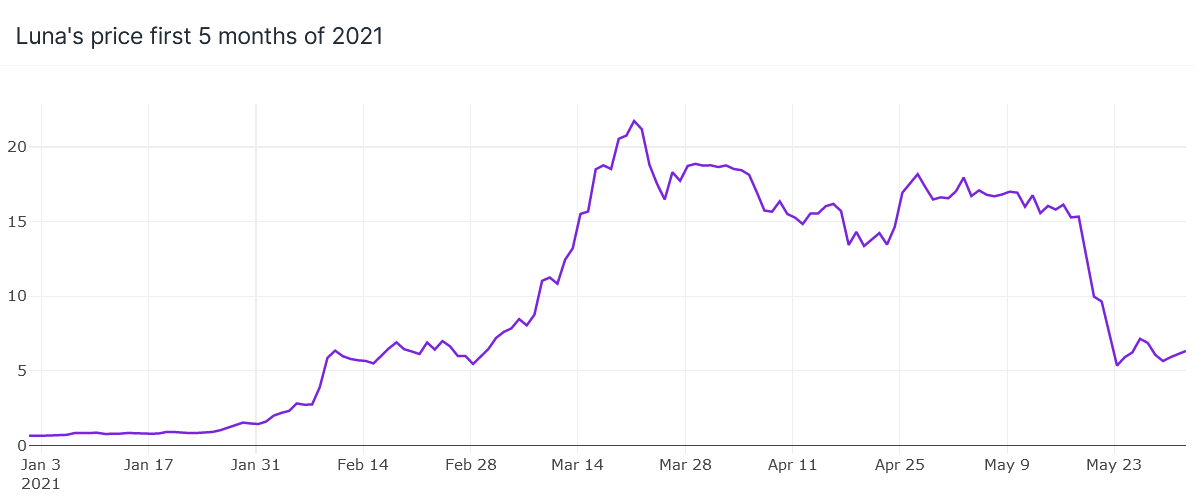

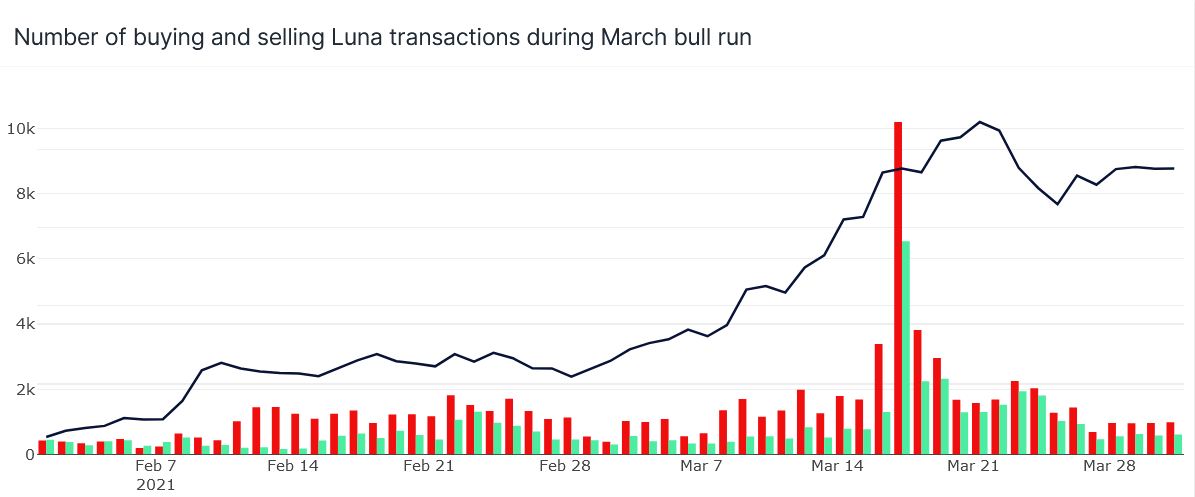

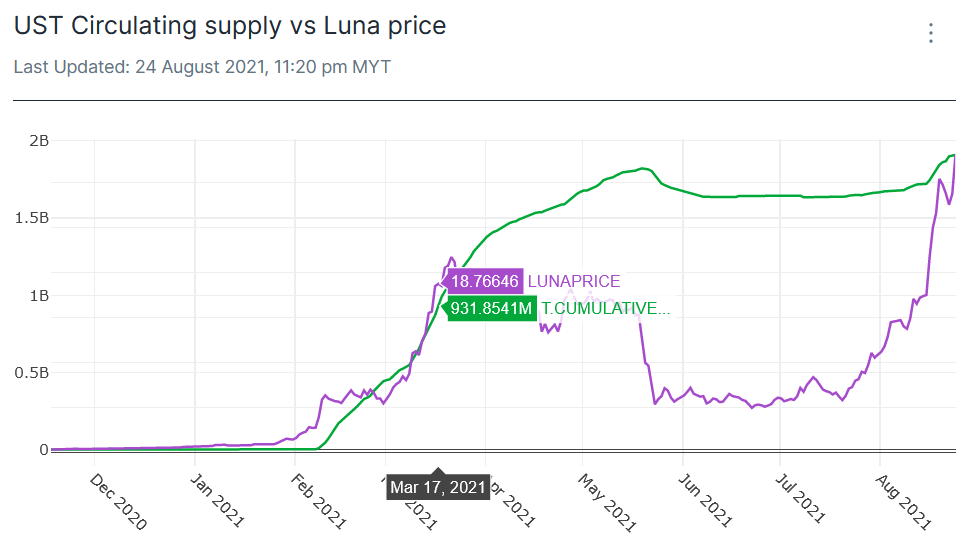

But I think the bigger reason is Luna’s price run-up during that time range. Luna’s prices on Feb 7 was 2.7, but saw a massive run up to 18.7 on March 17. This huge spike prompted some selling of Luna to UST in the market.

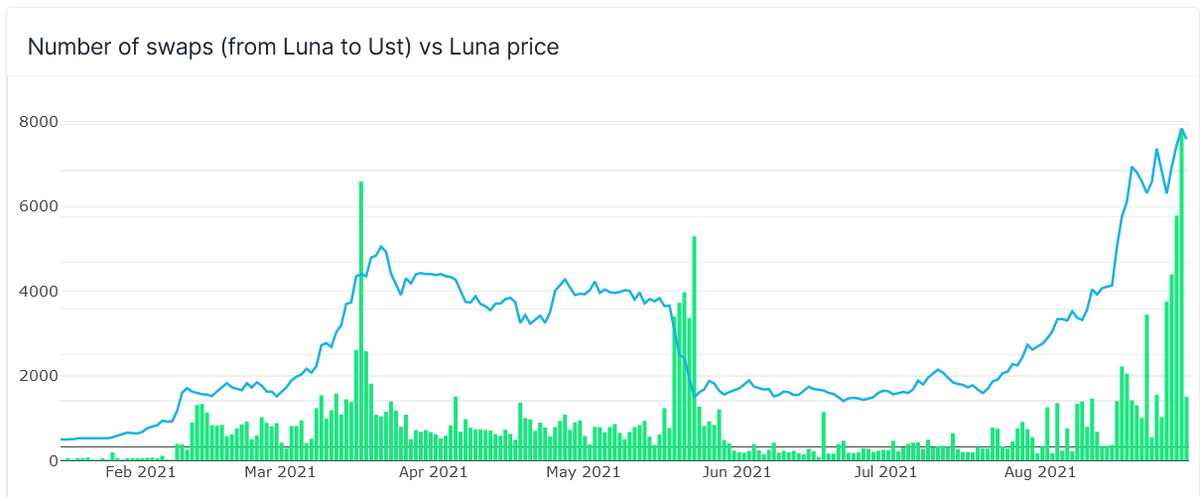

We know that native swaps of Luna to UST burns Luna and mints UST, increasing UST’s circulating supply. As Luna is increasing steeply, more and more people are taking profit and this caused a huge increase in UST’s supply.

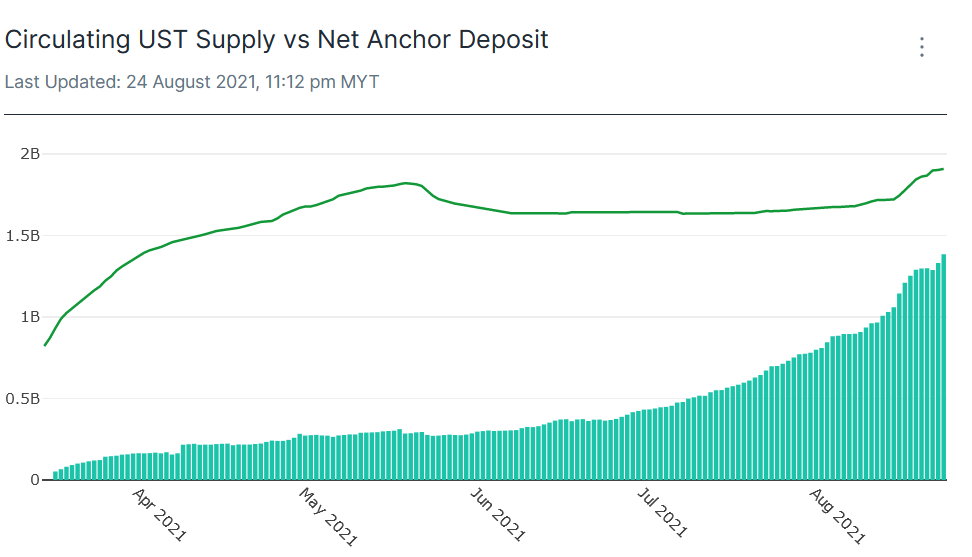

What about the usage of Anchor? Does it drive UST’s growth? The bar graphs at the bottom represent cumulative net deposits into Anchor. We see that although UST supply is increasing until May, net deposits in Anchor are not growing as fast.

Then, after the May crypto crash, we actually see a steeper increase in UST deposited into Anchor which shows that people are favoring the ‘risk-off’ strategy of saving on Anchor.

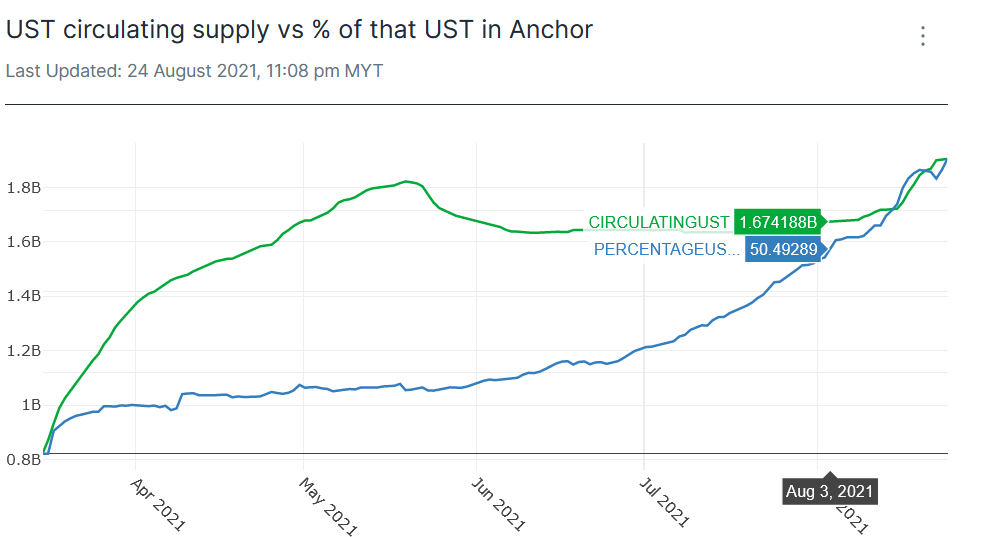

The net deposits kept on increasing so much that on Aug 3, 50% of ALL UST is now deposited on Anchor. However, it did not stop there. Based on Aug 24’s data, 73% of All UST is now deposited on Anchor!

Even though we see the net deposits increased, we do not see the same explosive growth for UST’s supply cap. Well, I'd argue that this is because there isn’t a strong demand for increased usage of UST right now.

This will of course change with more projects launching and with UST being used in other L1. But at the moment, UST’s supply cap isn’t moving that much because it seems that the safe play for now is taking existing UST and depositing it onto Anchor.

Let me know if you found this analysis useful! Also, graphs in this thread are made using data from @flipsidecrypto ❣️$LUNA $UST

@Josephliow @danku_r Curious to get your thoughts on Anchor's effect on UST market cap. I'd argue it did not have that big of an impact contrary to popular belief

• • •

Missing some Tweet in this thread? You can try to

force a refresh