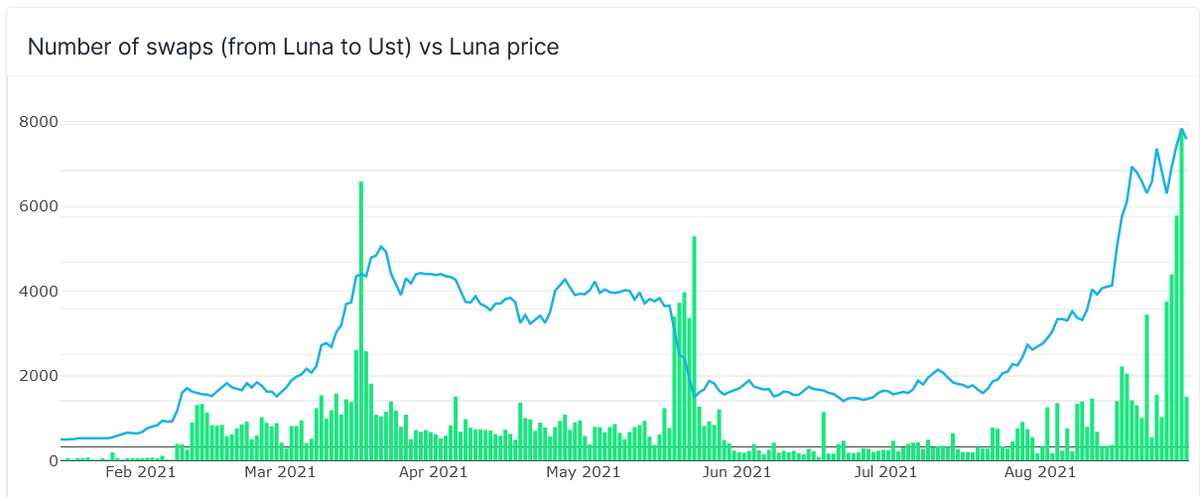

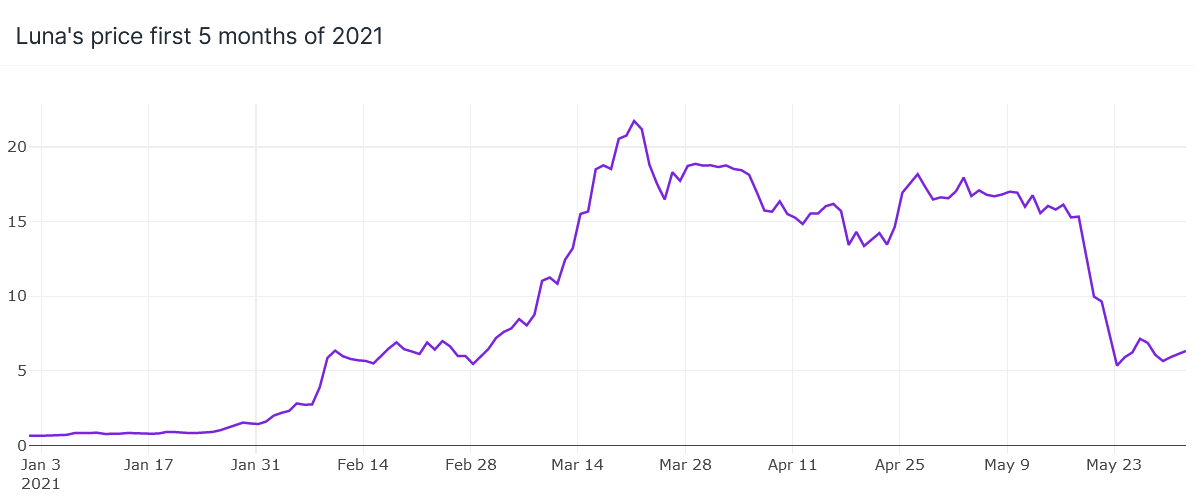

$Luna did a 12x from Feb to April this year. What are some trends we can learn during that bull run? A thread: 🧵

$Luna went on a parabolic run from $1.60 on Feb 1 to $18.60 on April 1 this year. I'll take this as the first bull run of Luna and explore insights within this 2 month period

1st learning:

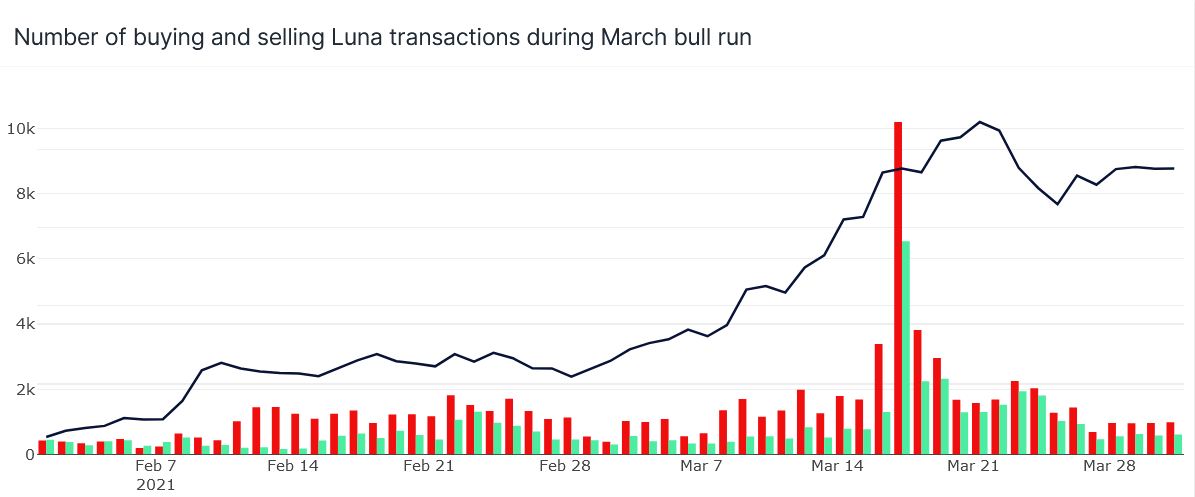

There were more transactions selling(red) Luna than buying (green)

As prices (in black) climbed, both selling and buying increased, but buying increased more - so much that on March 17, there are 10k sells compared to 6k buys

There were more transactions selling(red) Luna than buying (green)

As prices (in black) climbed, both selling and buying increased, but buying increased more - so much that on March 17, there are 10k sells compared to 6k buys

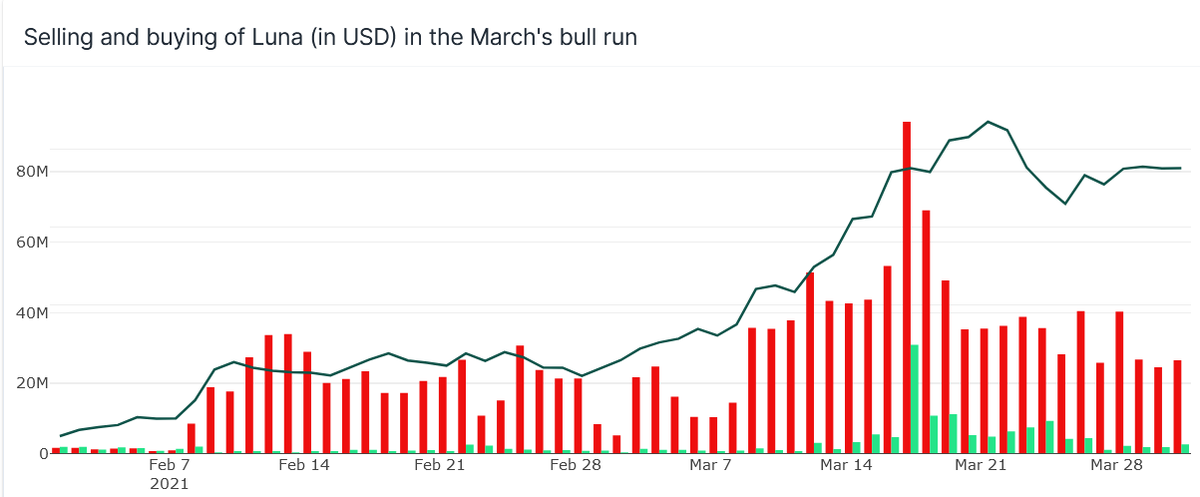

However, we should also look at the volume of luna buys and sells to get the full picture

The volume of Luna sold (in USD) daily during the bull run period heavily outweighs the volume of Luna bought!

This is of course with the caveat that the data only looks at Terraswap and Terrastation swaps. Volume of Luna buying might be higher in centralized exchanges

This is of course with the caveat that the data only looks at Terraswap and Terrastation swaps. Volume of Luna buying might be higher in centralized exchanges

This really shows the profit taking behavior for Luna holders. TBH this should be expected since people who bought Luna in Feb saw their holdings increased by 12x by April.

We also see some 'fomo' buying activity when Luna reached its peak around March 17 - 21 as buying volume is high during those dates

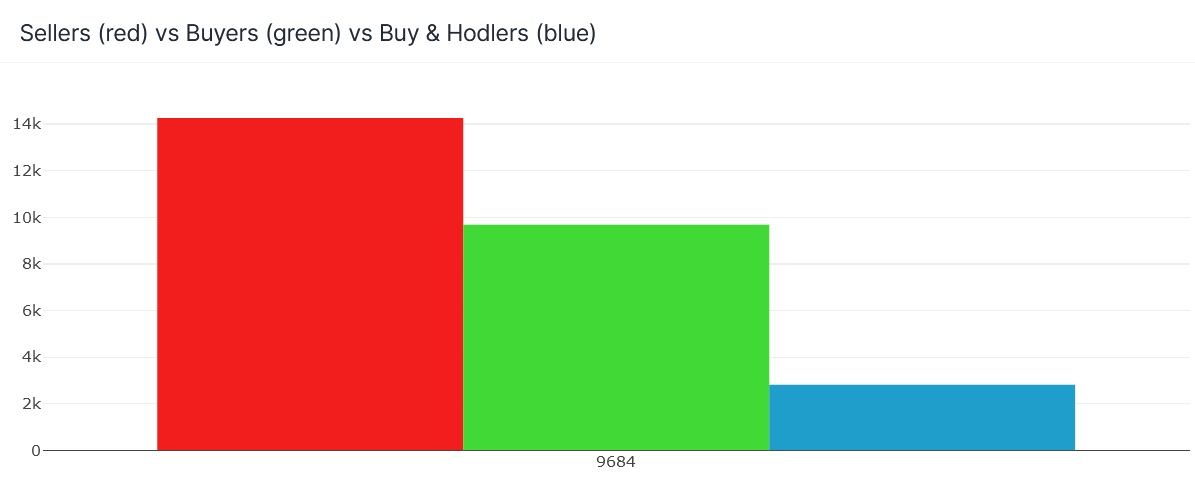

During this 2 month period, addresses that:

1. Have sold Luna (red): 14260

2. Have bought Luna (green): 9684

3. Have bought Luna and HODL-ed: 2820

This means 30% of people who bought Luna did not sell any of their Luna throughout this period

1. Have sold Luna (red): 14260

2. Have bought Luna (green): 9684

3. Have bought Luna and HODL-ed: 2820

This means 30% of people who bought Luna did not sell any of their Luna throughout this period

But also means 70% who bought Luna during those 2 months have sold some or all of their Luna in the same period.

So, what can we expect if there is another bull run coming?

So, what can we expect if there is another bull run coming?

One big lesson is that when prices go parabolic, profit taking is inevitable. The data shows that not everyone buys and never sells their Luna - in fact, a big majority do take profits.

Plan your profit taking strategies ahead of time so there is less fomo buying when prices skyrocket. You can be bullish $Luna long term even if you take profits. Stay safe CT fam

Wrote this article as part of Loop's content competition: loop.markets/1000-ust-bount…

Wrote the article here: loop.markets/what-we-can-le… . As usual, data obtained with the amazing @flipsidecrypto tools.

I'll be writing more about Terra analytics, you can find them here: sem1d5.substack.com . Thanks for reading ❣️

• • •

Missing some Tweet in this thread? You can try to

force a refresh