We’ve seen a high volume of $LUNA selling during the May crash which caused $UST to un-peg momentarily.

Given that massive sell offs are unavoidable, how can the ecosystem reduce the impact when it happens the next time? A thread🧵:

Given that massive sell offs are unavoidable, how can the ecosystem reduce the impact when it happens the next time? A thread🧵:

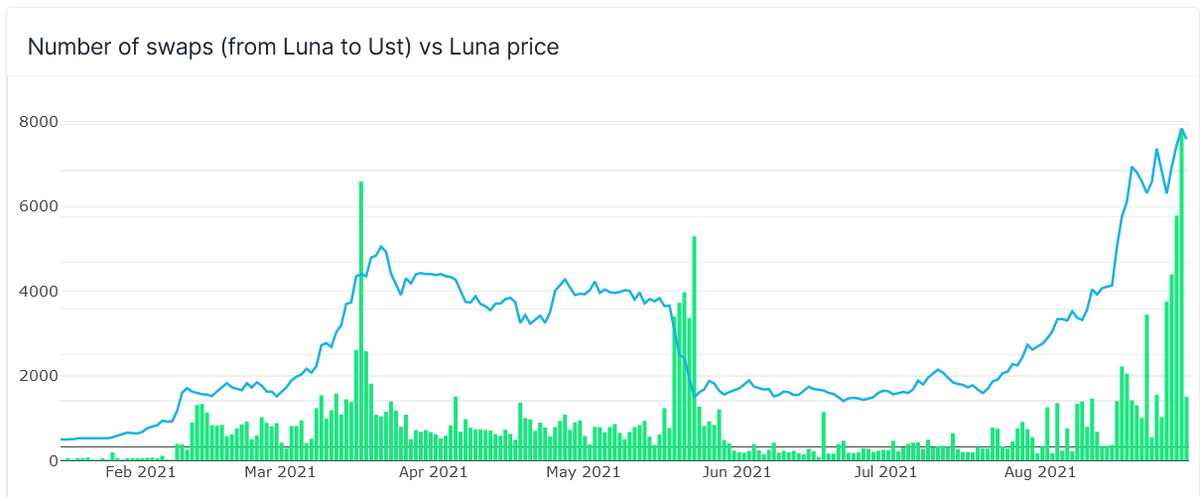

First, let’s understand in what scenarios we see a high number of swaps from Luna to UST.

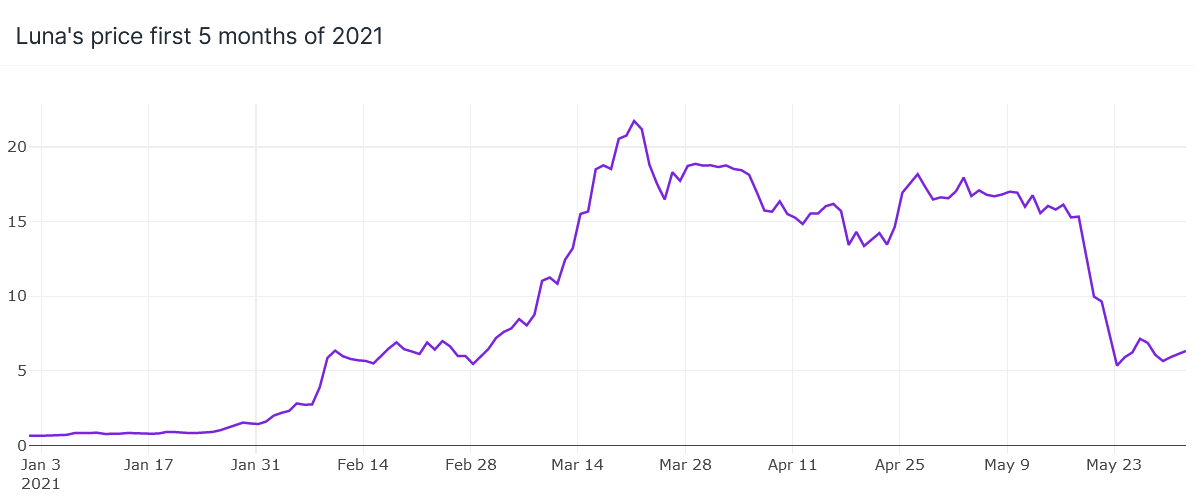

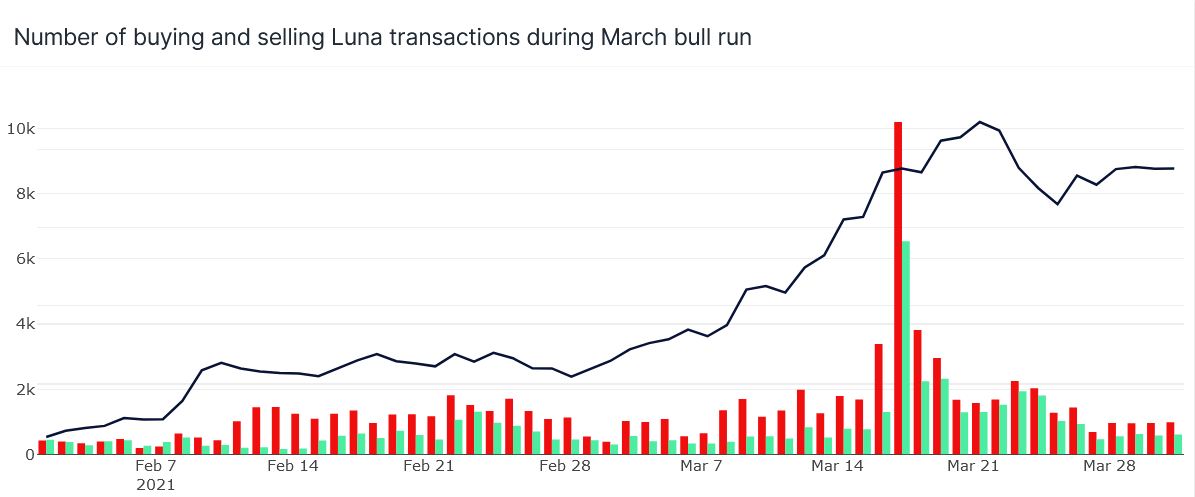

From the graph, whenever Luna prices (in blue) increase or decrease sharply, we see a high volume of Luna selling (green).

From the graph, whenever Luna prices (in blue) increase or decrease sharply, we see a high volume of Luna selling (green).

This is expected.

Selling when Luna prices are high = profit taking

selling when Luna prices dip = panic selling/cutting losses.

Selling when Luna prices are high = profit taking

selling when Luna prices dip = panic selling/cutting losses.

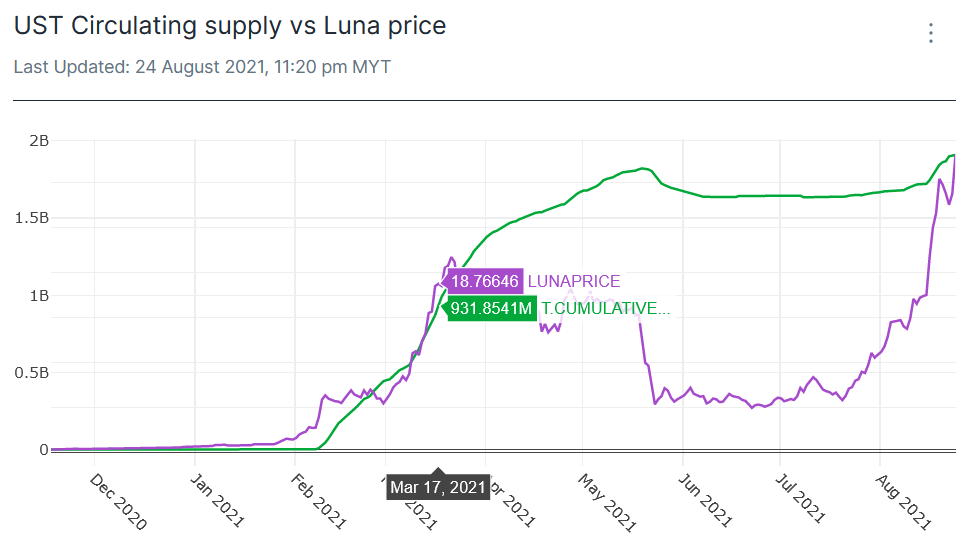

Although selling is healthy, a high volume of selling of Luna in a short amount of time causes inflated UST supply.

Which in turn causes the value of UST to drop below $1 with not enough demand to bring UST back to peg.

Which in turn causes the value of UST to drop below $1 with not enough demand to bring UST back to peg.

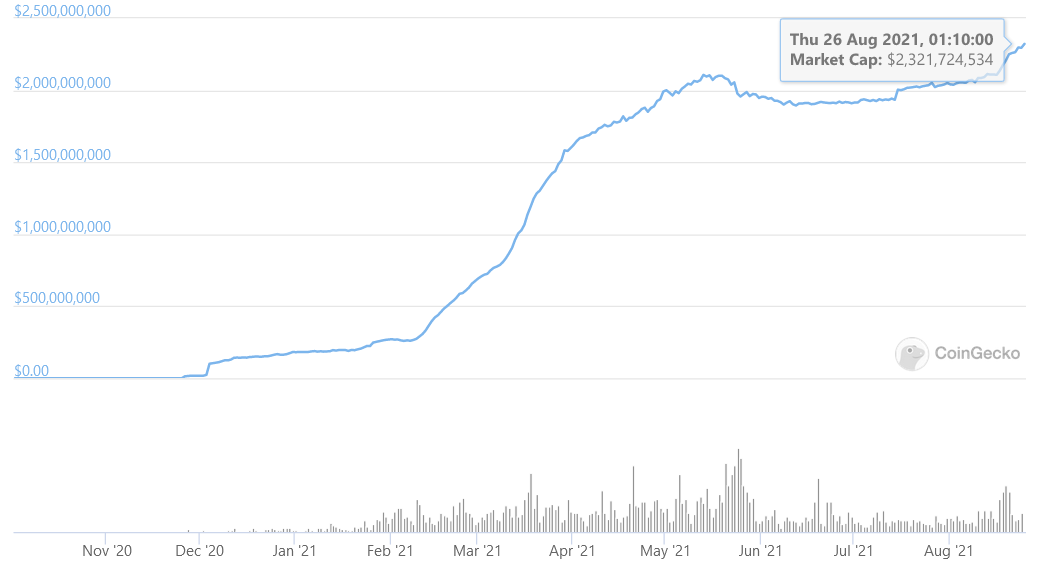

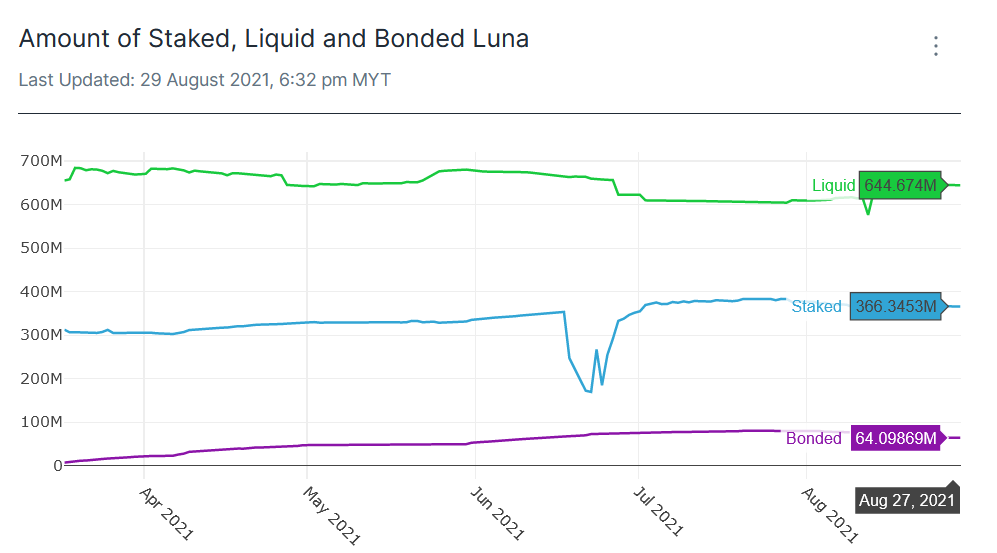

Luna on addresses that are liquid (not bonded or staked) makes up about 60% of the total Luna supply.

644M Luna sitting on addresses arguably doing..nothing.

Even though TFL’s address holds about 380M liquid Luna, the amount of liquid Luna just sitting on addresses is a lot.

644M Luna sitting on addresses arguably doing..nothing.

Even though TFL’s address holds about 380M liquid Luna, the amount of liquid Luna just sitting on addresses is a lot.

This still leaves us about 260M Luna that can potentially be sold whenever prices moon or take a hit. In the event where this happens (albeit low chance), it would be hard to recover UST’s peg.

Solution?

I think one way to approach this is by creating more use cases for Luna that are somewhat locked in the ecosystem, ie bLuna and staked Luna.

I think one way to approach this is by creating more use cases for Luna that are somewhat locked in the ecosystem, ie bLuna and staked Luna.

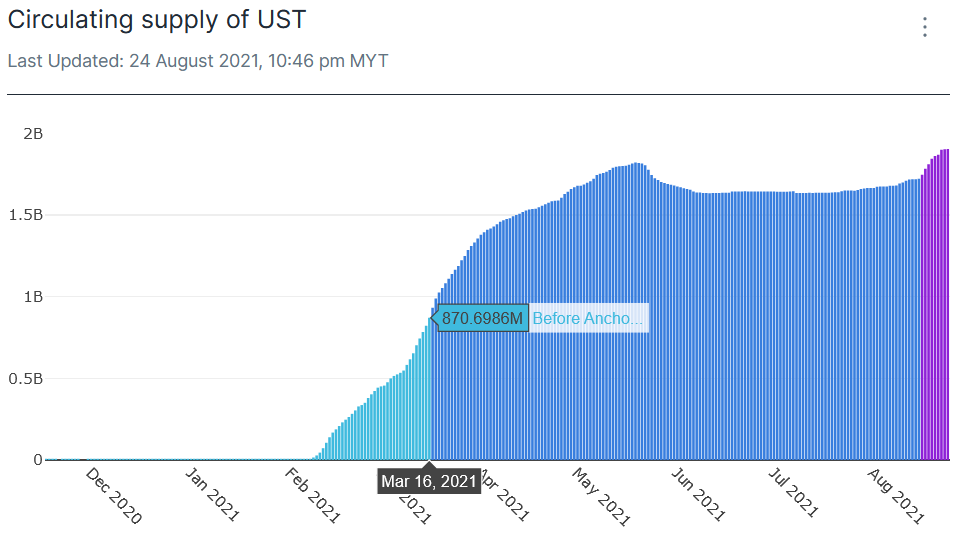

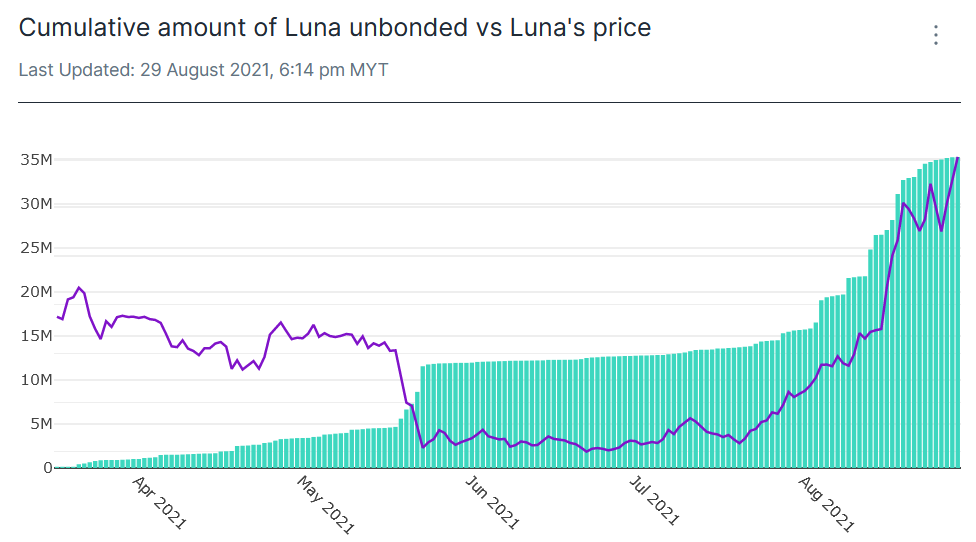

Currently, bLuna’s use case as collateral on Anchor does not seem to be a strong enough reason for people to hold bLuna long term.

Here, we see that people are willing to unbond their Luna for 21 days whenever Luna price drops and especially when Luna price spiked recently

Here, we see that people are willing to unbond their Luna for 21 days whenever Luna price drops and especially when Luna price spiked recently

Imagine people value waiting 21 days to unbond Luna to sell over than holding bLuna long term - that is not a good sign for the ecosystem.

In my opinion, new protocols on Terra should consider use cases for bLuna and staked Luna.

What if bLuna can be used to mint assets on Mirror? What if users are rewarded more for locking up bLuna for a longer period of time?

What if bLuna can be used to mint assets on Mirror? What if users are rewarded more for locking up bLuna for a longer period of time?

The possibilities are endless but are critical to reduce the impact of massive Luna sell offs. Thanks for reading! $LUNA $UST

Graphs created using @flipsidecrypto ❣️

Graphs created using @flipsidecrypto ❣️

• • •

Missing some Tweet in this thread? You can try to

force a refresh