Summary 🧵

$UST $LUNA $ADA $DJED #Stablecoin #Cardano #Terra

Author: @GooseCapitalLLC

Original article: thecryptodrip.com/the-stablecoin…

$UST $LUNA $ADA $DJED #Stablecoin #Cardano #Terra

Author: @GooseCapitalLLC

Original article: thecryptodrip.com/the-stablecoin…

History:

- Austrian economist F.A Hayek postulates incentive markets are better than gov FIAT, 1976.

- Sees a world of free people, money, and capital movement.

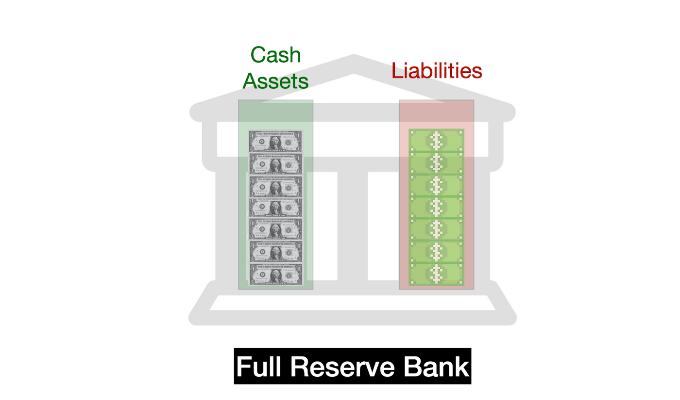

- Self-interested banks would a better job at value preservation.

- Is being built rn, Stablecoins.

- Austrian economist F.A Hayek postulates incentive markets are better than gov FIAT, 1976.

- Sees a world of free people, money, and capital movement.

- Self-interested banks would a better job at value preservation.

- Is being built rn, Stablecoins.

Stablecoins:

- Current iteration is a liq bridge, ref point Dollar.

- Very difficult for fiat and stables alike.

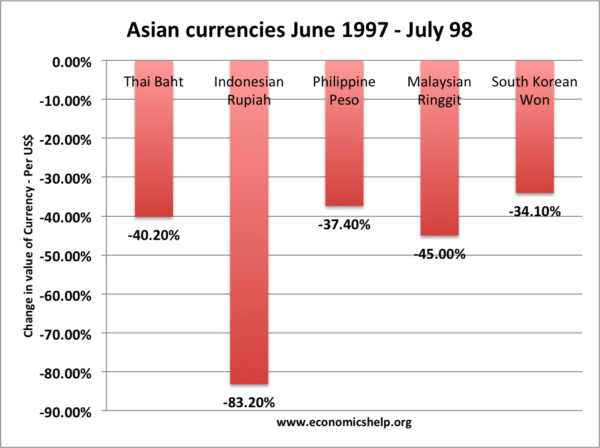

- Ex Thai baht removal US peg -> currency devaluation crisis.

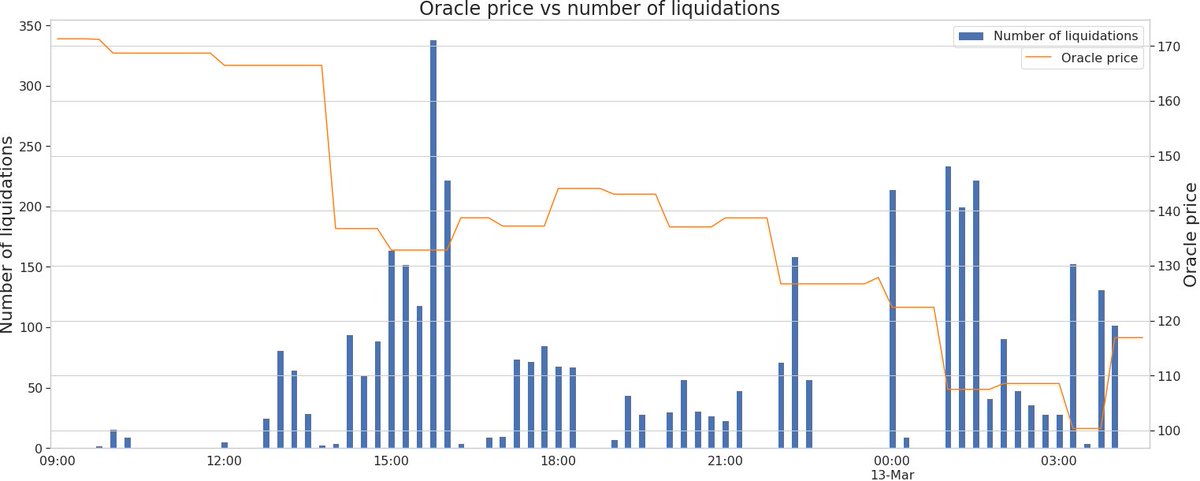

- EX MakerDao black Thursday, cascading liq.

- Need development and network effects.

- Enter Terra, Djed

- Current iteration is a liq bridge, ref point Dollar.

- Very difficult for fiat and stables alike.

- Ex Thai baht removal US peg -> currency devaluation crisis.

- EX MakerDao black Thursday, cascading liq.

- Need development and network effects.

- Enter Terra, Djed

Djed: (Minimal Djed)

- Hybrid, Algo crypto-backed pegged stablecoin

- Ancient Egyptian symbol for stability

- Targets over 1 reserve ratio with algo

- Stop reserve token buys/sells if reserve is too large or small

- Reserve token holders rewarded with reserve surplus

- Hybrid, Algo crypto-backed pegged stablecoin

- Ancient Egyptian symbol for stability

- Targets over 1 reserve ratio with algo

- Stop reserve token buys/sells if reserve is too large or small

- Reserve token holders rewarded with reserve surplus

EX Djed:

- Purchase reserve token when reserve token buy is enabled

- Absorb volatility of underlying, provide stability for djed purchases

- Purchase reserve token when reserve token buy is enabled

- Absorb volatility of underlying, provide stability for djed purchases

Flaws Djed:

- Bankruns can still happen, reserve holders race to sell before minimum reserve reach and buybacks are disabled.

- Whale exploit during Ergo blockchain deployment, slow oracle update gives price foresight. Fix with 60m -> 12m price update

- Extended Djed under dev

- Bankruns can still happen, reserve holders race to sell before minimum reserve reach and buybacks are disabled.

- Whale exploit during Ergo blockchain deployment, slow oracle update gives price foresight. Fix with 60m -> 12m price update

- Extended Djed under dev

Terra:

- UST stablecoin on the Terra blockchain

- Un-collateralized algorithmic pegged stable.

- Luna is not considered collateral from the traditional definition

- Arb opportunity similar

- UST stablecoin on the Terra blockchain

- Un-collateralized algorithmic pegged stable.

- Luna is not considered collateral from the traditional definition

- Arb opportunity similar

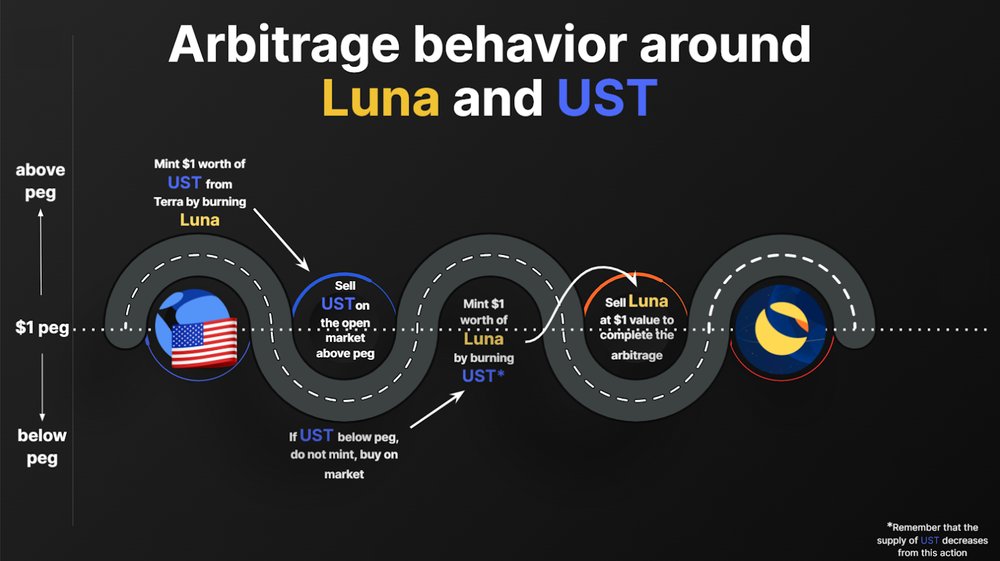

EX Terra stability:

When 1UST < $1. UST holder change 1 UST for $1 Luna

When 1UST > $1. Luna holder change $1 Luna for 1 UST

When 1UST < $1. UST holder change 1 UST for $1 Luna

When 1UST > $1. Luna holder change $1 Luna for 1 UST

Terra explained:

- If demand for UST rises users swap Luna on-chain, mechanism "burns" Luna.

- Price volatility of UST is transferred onto Luna fluctuating supply.

- Luna holders absorb short-term volatility.

- Incentived with seigniorage and transaction fees.

- If demand for UST rises users swap Luna on-chain, mechanism "burns" Luna.

- Price volatility of UST is transferred onto Luna fluctuating supply.

- Luna holders absorb short-term volatility.

- Incentived with seigniorage and transaction fees.

Terra is backed by the growth of the ecosystem.

- Harness growth to Luna holders.

- Growth converts to stability for the ecosystem.

- Luna always has util because arb mech

- Util paid for by fee, tax, and seignorage

- Harness growth to Luna holders.

- Growth converts to stability for the ecosystem.

- Luna always has util because arb mech

- Util paid for by fee, tax, and seignorage

Flaws also in Terra:

- No backing, trust the ecosystem.

- Luna holder lose faith could mean a potential death spiral(Iron/Titan)

- Somewhat happened May 2021. Lose peg 2 days, see anchor liqs.

- Dependency on off-chain liq > on-chain liq to prevent on-chain attacks.

- No backing, trust the ecosystem.

- Luna holder lose faith could mean a potential death spiral(Iron/Titan)

- Somewhat happened May 2021. Lose peg 2 days, see anchor liqs.

- Dependency on off-chain liq > on-chain liq to prevent on-chain attacks.

Flaws also in Terra(cont.):

- Lack of liq in off-chain may allow a bad actor to take advantage of oracle price.

- Price impact off-chain now makes an arb profitable

- Must have a large bag, protocol-level solution required.

- Proposals are underway

- Lack of liq in off-chain may allow a bad actor to take advantage of oracle price.

- Price impact off-chain now makes an arb profitable

- Must have a large bag, protocol-level solution required.

- Proposals are underway

Conclusion

- Terra ecosystem is robust and has many avenues for spurring growth.

- A lot of potential from eco-mechanisms.

- Col 5 connections may open for weak spots?

- Djed elegant solution, no exogenous reliance.

- May or may not be reliable or secure when met with demand.

- Terra ecosystem is robust and has many avenues for spurring growth.

- A lot of potential from eco-mechanisms.

- Col 5 connections may open for weak spots?

- Djed elegant solution, no exogenous reliance.

- May or may not be reliable or secure when met with demand.

Time will tell.

FIN

FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh