Personal income rose by 1.1% in July, a larger increase than market expectations, as compensation grew at a strong pace and government support increased due to the first monthly installment of the Child Tax Credit. 1/

Aggregate compensation (reflecting both number of employees and wages/benefits paid) grew at 0.9 percent month-over-month, a strong pace. For comparison, there were only 9 months from January 2008 to January 2020 where compensation grew at a faster pace. 2/

Government support increased over the month as Child Tax Credit payments went out, even as spending on unemployment insurance and economic impact payments decreased. 3/

This is the first month that government support for incomes has increased over the month since March, when the first economic impact payments from the ARP went out. 4/

Overall, consumer spending increased as nominal spending on services rose, but spending on goods fell. This change has been anticipated and likely reflects consumers feeling more comfortable purchasing services outside the home. 5/

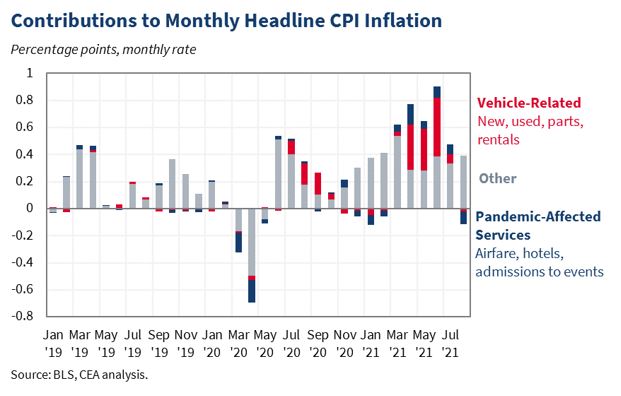

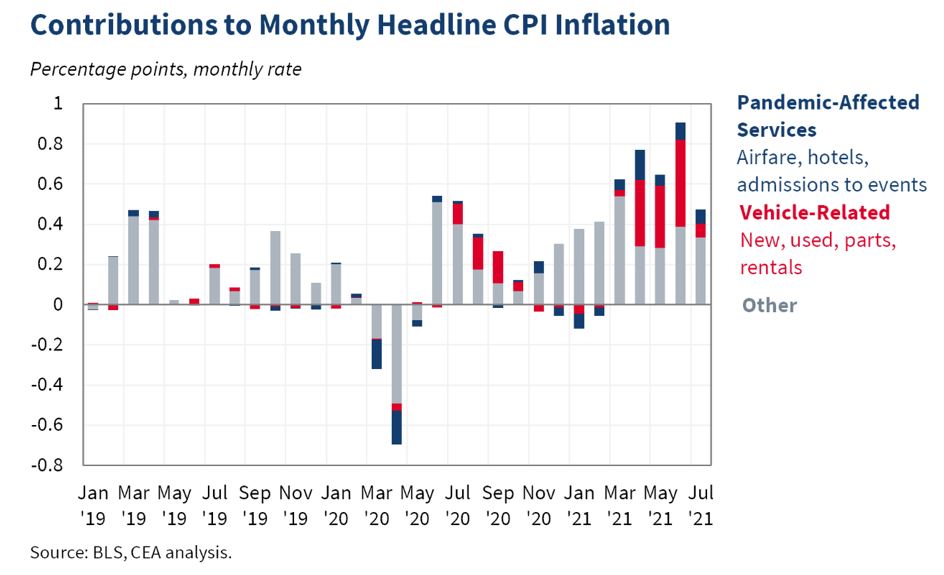

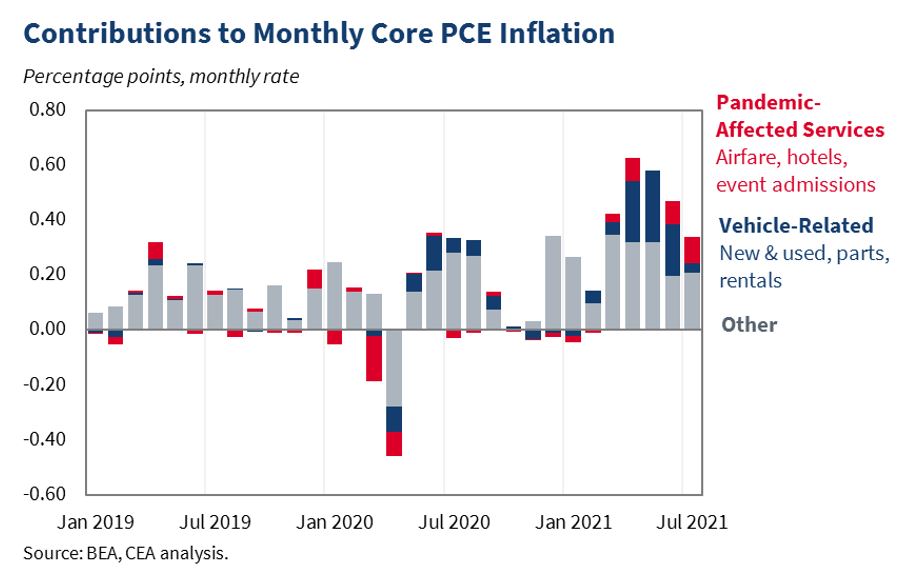

The headline PCE price index increased by 0.4 percent in July, ticking down from its June rate. The core PCE price index, which removes volatile food and energy, increased by 0.3 percent, decelerating from June. 6/

Monthly price growth in durable goods slowed from 1.0 to 0.3 percent, as prices in nondurable goods grew faster than durable goods for the first time since March. 7/

About 0.1 percentage point of the 0.3 percent month-over-month increase in the monthly core inflation measure was due to pandemic-affected services and increases in cars. 8/

While month-to-month data can be volatile, overall, this report is consistent with a strengthening labor market supporting consumer spending as the post-pandemic expansion continues apace. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh