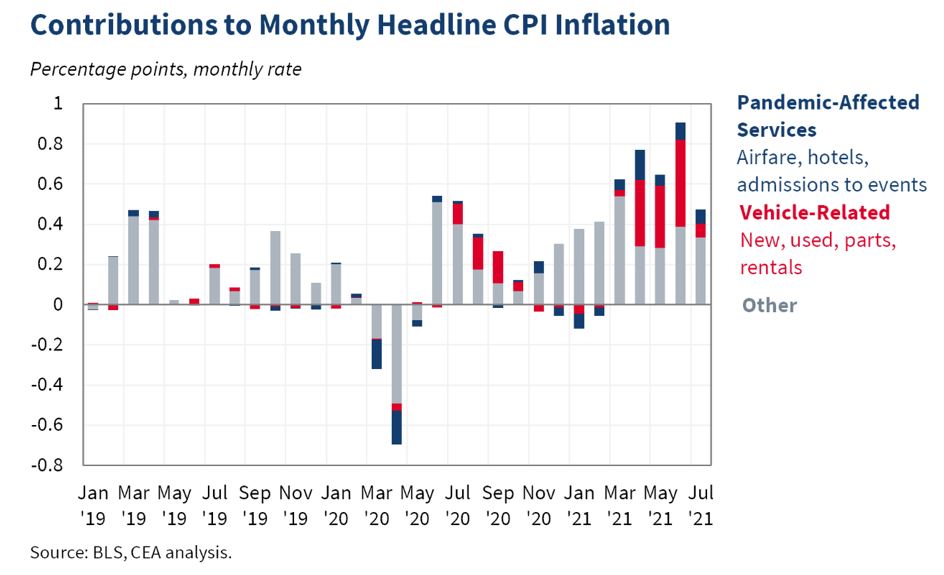

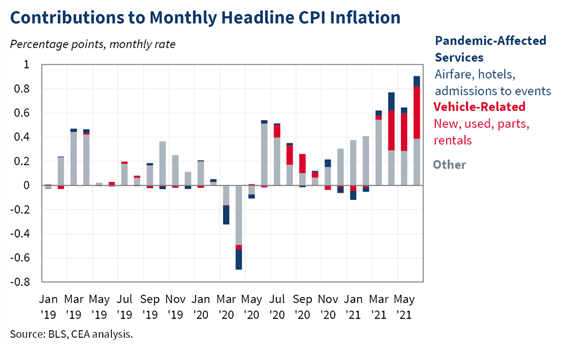

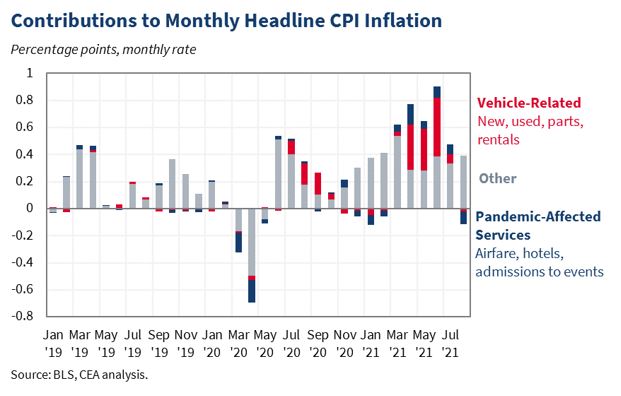

Inflation as measured by CPI increased 0.3% month-over-month in August—slightly below expectations and below July’s rate of 0.5%. The deceleration largely reflected a fall in car prices and also in pandemic-affected services. 1/

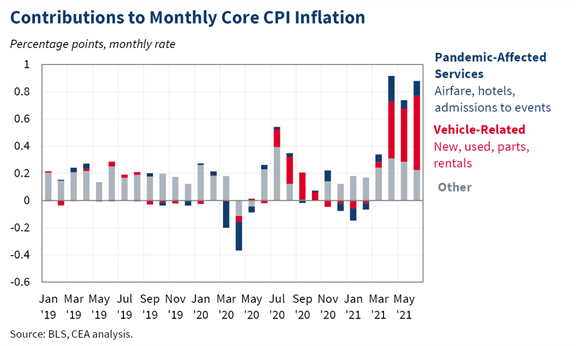

Core inflation—without food/energy—rose 0.1% month-over-month, below expectations and below July’s rate of 0.3%. 2/

Year-over-year, headline inflation rose by 5.3% while core inflation rose by 4.0%. The deceleration in the year-over-year core measure was more marked than the deceleration in the headline measure, reflecting the relatively faster price growth in food and energy. 3/

Used cars, new cars, auto parts, and car rentals together subtracted 2 basis points (functionally nil) from core month-over-month inflation, down from adding about 34 basis points on average in May, June, and July. 4/

Prices of pandemic-affected services fell this month and subtracted 12 basis points to the core inflation increase in August, relative to 9 basis points in July. The decline in this index likely reflects a change in consumer behavior due to the Delta variant. 5/

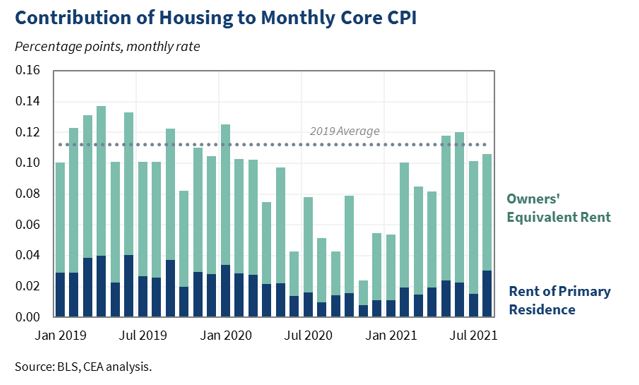

Month-over-month growth in shelter costs decelerated to a 0.2% increase in August, reflecting a price decline for lodging away from home (e.g. hotels). 6/

Price growth in owners’ equivalent rent held steady at the rate it has been in recent months, while rent for primary residence ticked up by 10 basis points. 7/

The deceleration in August is encouraging from an inflationary perspective, but continued economic disruptions from the pandemic may continue to impact inflation in months to come in either direction. 8/

In addition, even if core inflation continued at August’s rate moving forward, the year-over-year measure would remain elevated into 2022 given the higher monthly inflation seen this summer. 9/

We know that the recovery from the pandemic will not be linear. The Council of Economic Advisers will continue to monitor the data as they come in. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh