These Five Hedge Fund Codes helped me survive 25 years in the industry…

...and here's how you can use them to invest your own money. 🧵👇

...and here's how you can use them to invest your own money. 🧵👇

When I first hit the trading floor of a New York investment bank in my early twenties, I arrived in a crummy suit and my only fake silk tie.

Naive, scared, and a little rough around the edges, I knew I'd have to mentally toughen up to survive.

Naive, scared, and a little rough around the edges, I knew I'd have to mentally toughen up to survive.

But I soon learned the codes that got me through the next 25 years, & I'll forever use them in my own investing. Here they are: 👇

1. NEVER BE THE SMARTEST ONE IN THE ROOM

Years ago, I was at a small hedge fund with a trader who was legit a child prodigy—college masters

1. NEVER BE THE SMARTEST ONE IN THE ROOM

Years ago, I was at a small hedge fund with a trader who was legit a child prodigy—college masters

at the age of 12 type of genius.

He devised a massively complicated options strategy to trade technology stock volatility.

This stuff was next level. I was trading arbitrage and had no idea what he was doing.

Problem was, neither did anyone else.

He devised a massively complicated options strategy to trade technology stock volatility.

This stuff was next level. I was trading arbitrage and had no idea what he was doing.

Problem was, neither did anyone else.

He never reached out to derivatives traders on the street for thoughts or opinions either. Operating in a vacuum, he just kept adding to positions.

Then a simple atypical market event caused every single one of his trades to blow apart, costing the fund millions and him his job.

Then a simple atypical market event caused every single one of his trades to blow apart, costing the fund millions and him his job.

Was it arrogance? Ego? Doesn’t matter.

When investing in any complicated or seemingly mispriced opportunities, I always ask a simple question:

Who knows more than me about this and can help me see what I’m missing?

Then I find that person, seek their input. Take them out for

When investing in any complicated or seemingly mispriced opportunities, I always ask a simple question:

Who knows more than me about this and can help me see what I’m missing?

Then I find that person, seek their input. Take them out for

drinks or dinner. Gain that deep knowledge to weigh the risk/reward accordingly or avoid a catastrophic failure altogether. Priceless.

2. YOU EAT WHAT YOU KILL

Early on, I believed Wall Street to be one of the purest arenas for meritocracy-based compensation and upward mobility

2. YOU EAT WHAT YOU KILL

Early on, I believed Wall Street to be one of the purest arenas for meritocracy-based compensation and upward mobility

Ha! Meritocracy implies you get paid for working hard. No, we got paid for taking risk. Period.

Think of yourself as an Alaskan grisly hunter, needing food for your family during winter. Would you step out into the open in the middle of a deep fog, unable to see your prey,

Think of yourself as an Alaskan grisly hunter, needing food for your family during winter. Would you step out into the open in the middle of a deep fog, unable to see your prey,

which also happens to be a predator?

No. You would wait until the fog clears before venturing into an area with any unknown pitfalls and blind spots, for a clear vision of opportunity. That's when you take your shot.

Let’s be clear: do not confuse excitement with conviction.

No. You would wait until the fog clears before venturing into an area with any unknown pitfalls and blind spots, for a clear vision of opportunity. That's when you take your shot.

Let’s be clear: do not confuse excitement with conviction.

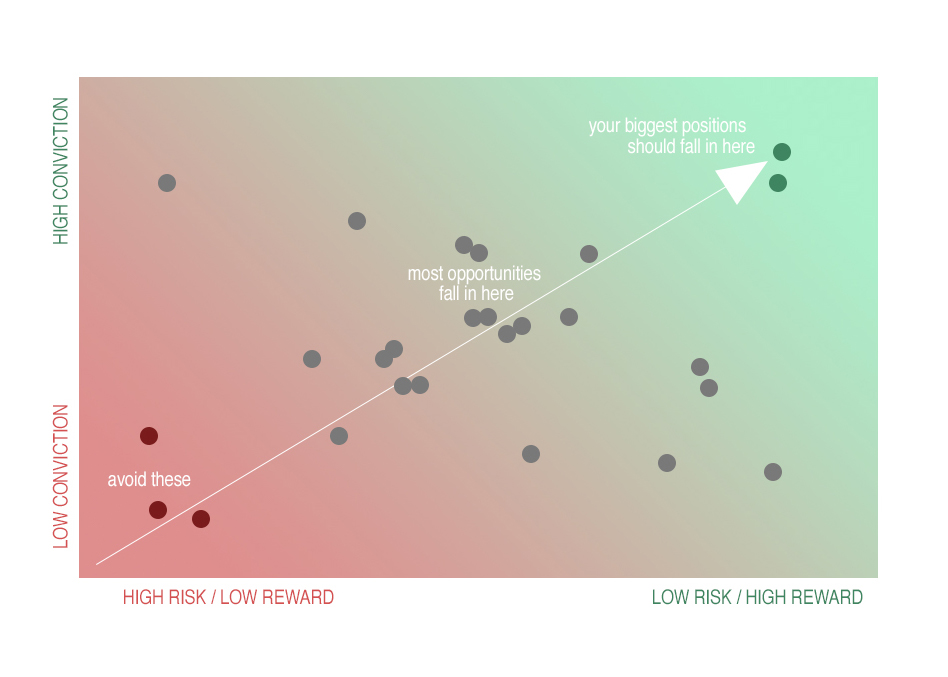

Conviction is a probability measure. And opportunity is a risk/reward measure.

The convergence of High Conviction & Low Risk/High Reward are where your largest positions should live.

Find one? Awesome. Size it properly in your portfolio and take advantage of your smart work!

The convergence of High Conviction & Low Risk/High Reward are where your largest positions should live.

Find one? Awesome. Size it properly in your portfolio and take advantage of your smart work!

On the arrogance front:

3. THE BANKS WORK FOR US

Growing up, I was intimidated by banks. Even in college they gave me the skeevs. I felt lucky they’d hold my $128, let me use their ATMs!

Then I was initiated into the Wall Street club, where banks fought for *our* business.

3. THE BANKS WORK FOR US

Growing up, I was intimidated by banks. Even in college they gave me the skeevs. I felt lucky they’d hold my $128, let me use their ATMs!

Then I was initiated into the Wall Street club, where banks fought for *our* business.

The JP Morgans of the world had all the money—vaults and bunkers full of cash—but needed us to borrow, so as far as hedge funds were concerned, they worked for us.

That’s how billionaire hedge funds get so big. Not inside information or 100 to 1 leverage (foolish shortcuts)

That’s how billionaire hedge funds get so big. Not inside information or 100 to 1 leverage (foolish shortcuts)

No, the best of the best take calculated risks and borrow/pile into the fantastic risk/reward situations we spoke of above.

*True conviction*

How can you adopt the same attitude in your own investments?

Here’s what I do:

•Set up availability at rock-bottom interest rates:

*True conviction*

How can you adopt the same attitude in your own investments?

Here’s what I do:

•Set up availability at rock-bottom interest rates:

i.e., home equity or low interest personal LOCs, never credit cards or teaser rate deals.

•Never borrow more than your assets and liquidity can handle in a shock period—financial, medical, etc. Work with your personal financial advisor to

•Never borrow more than your assets and liquidity can handle in a shock period—financial, medical, etc. Work with your personal financial advisor to

know your assets and liabilities inside and out!

•Never borrow money to buy big-ticket toys with no work function. Sports cars, boats, motorcycles. Borrowing to buy depreciating assets are truly not worth it.

•DO borrow money to make investments. If I can draw from a LOC for

•Never borrow money to buy big-ticket toys with no work function. Sports cars, boats, motorcycles. Borrowing to buy depreciating assets are truly not worth it.

•DO borrow money to make investments. If I can draw from a LOC for

3 to 4% and invest in a risk-adjusted 12%+ return opportunity—I’ll do this. All. Day. Long.

• & don’t stash cash in the bank. Only keep enough liquidity on hand to live on & service loans. Otherwise inflation eats your future purchasing power.

4. FORTUNES ARE MADE ON FEAR

• & don’t stash cash in the bank. Only keep enough liquidity on hand to live on & service loans. Otherwise inflation eats your future purchasing power.

4. FORTUNES ARE MADE ON FEAR

During market shocks, fortunes can be made in *true conviction* positions. While everyone is heading for the exits out of pure survival instinct, you can stand strong and hold off the inevitable urge to flee.

Why Hedge funds are damned good at this:

Why Hedge funds are damned good at this:

•They’re typically investing other people's money alongside their own, so a sizable number of people and assets are going along with their decision to hold strong and honor their convictions. Their capital isn’t alone.

•Many have extended time-horizons, affording them

•Many have extended time-horizons, affording them

flexibility to stomach short-term losses & achieve larger long-term gains.

•They have access to a ton of liquidity & in fearful, anxious, and inefficient markets, they can make good on this premise: Fortunes are made on fear.

•Finally, hedge funds know down to the *dollar*

•They have access to a ton of liquidity & in fearful, anxious, and inefficient markets, they can make good on this premise: Fortunes are made on fear.

•Finally, hedge funds know down to the *dollar*

how much dry powder they have available, every single morning before the market opens. They’re locked and loaded.

You should be, too.

Again, sit down with an advisor to make these determinations, well before it’s time to pounce.

& finally:

5. DON'T GET YOUR FACE RIPPED OFF

You should be, too.

Again, sit down with an advisor to make these determinations, well before it’s time to pounce.

& finally:

5. DON'T GET YOUR FACE RIPPED OFF

Aimed at trades with infinite downside, like shorting naked equities or writing uncovered derivatives, these can turn against you fast & furious. Snuff out all emotional attachment and shut down the ego.

Don't open yourself up to being gutted.

I’ll never forget a fellow trader

Don't open yourself up to being gutted.

I’ll never forget a fellow trader

shorting a hyped online bookseller in the summer of 1998. He said, "People will never buy over the internet. It'll be a zero by year-end."

Yup. @amazon.

He shorted at ~$60 per share and made a lick when the price fell to ~$45 per share. 25% profit in a mere few days was sweet

Yup. @amazon.

He shorted at ~$60 per share and made a lick when the price fell to ~$45 per share. 25% profit in a mere few days was sweet

...but he wanted a killing.

September. AMZN traded to $100. He shorted more.

*He was right. They were wrong. He would show them. They would pay*

November, $150.

$216.

December, $223. More shorting.

$250.

$280.

On December 21st, 1998, it traded up to $324.

September. AMZN traded to $100. He shorted more.

*He was right. They were wrong. He would show them. They would pay*

November, $150.

$216.

December, $223. More shorting.

$250.

$280.

On December 21st, 1998, it traded up to $324.

A full-on melt-up of nuclear proportions.

He finally covered the short for a ~500%, and yes, millions of dollars epic loss.

He finally covered the short for a ~500%, and yes, millions of dollars epic loss.

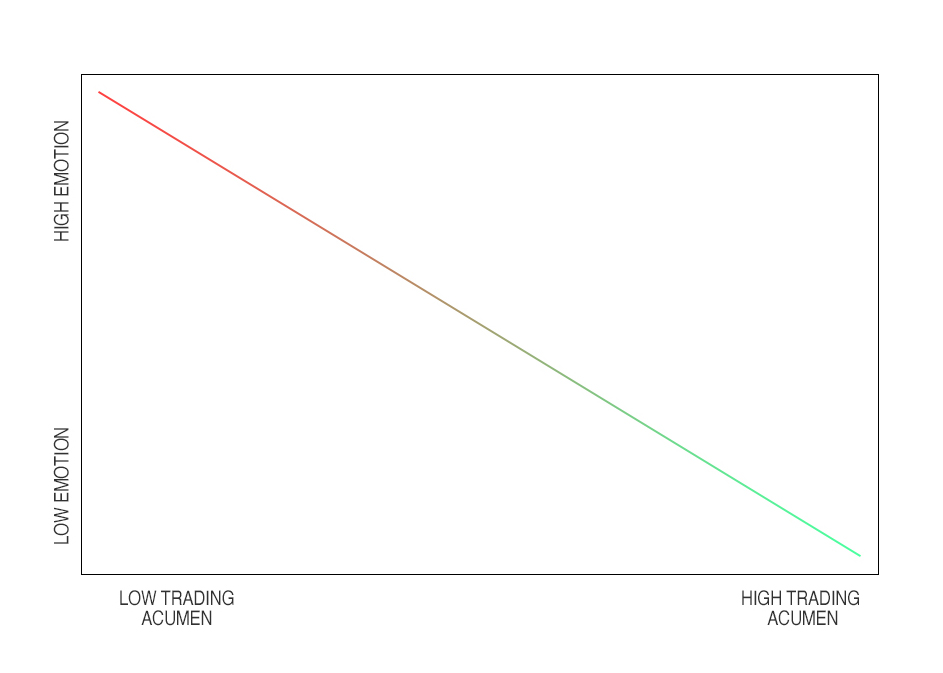

The simplest & most powerful equation on the trading floor:

Emotions + Investing = Bad

Keep the codes near. Combined with specific advice from your personal financial advisor, limit downside & maximize upside with: true conviction, precise goals & research-backed risk.

Emotions + Investing = Bad

Keep the codes near. Combined with specific advice from your personal financial advisor, limit downside & maximize upside with: true conviction, precise goals & research-backed risk.

• • •

Missing some Tweet in this thread? You can try to

force a refresh