How Sprott Physical Uranium Trust (SPUT) is dominating the #Uranium space: A thread👇

1) They are buying physical uranium with the sole intention of storing it and taking pounds off the table.

1) They are buying physical uranium with the sole intention of storing it and taking pounds off the table.

2) The supply side of the market is pretty rigid as it’s not profitable to start a new mine to produce additional #uranium below 50-60 dollars per pound currently.

No new mines = rigid supply

No new mines = rigid supply

3) As Sprott buys pounds and increases demand, the spot price of #uranium inches up

This increases Sprott’s “Net asset value”

(NAV) = lbs stored x spot price per lb

This increases Sprott’s “Net asset value”

(NAV) = lbs stored x spot price per lb

4) When the share price of SPUT trades at a premium to NAV per share, Sprott has the ability to sell additional shares at the market (ATM)

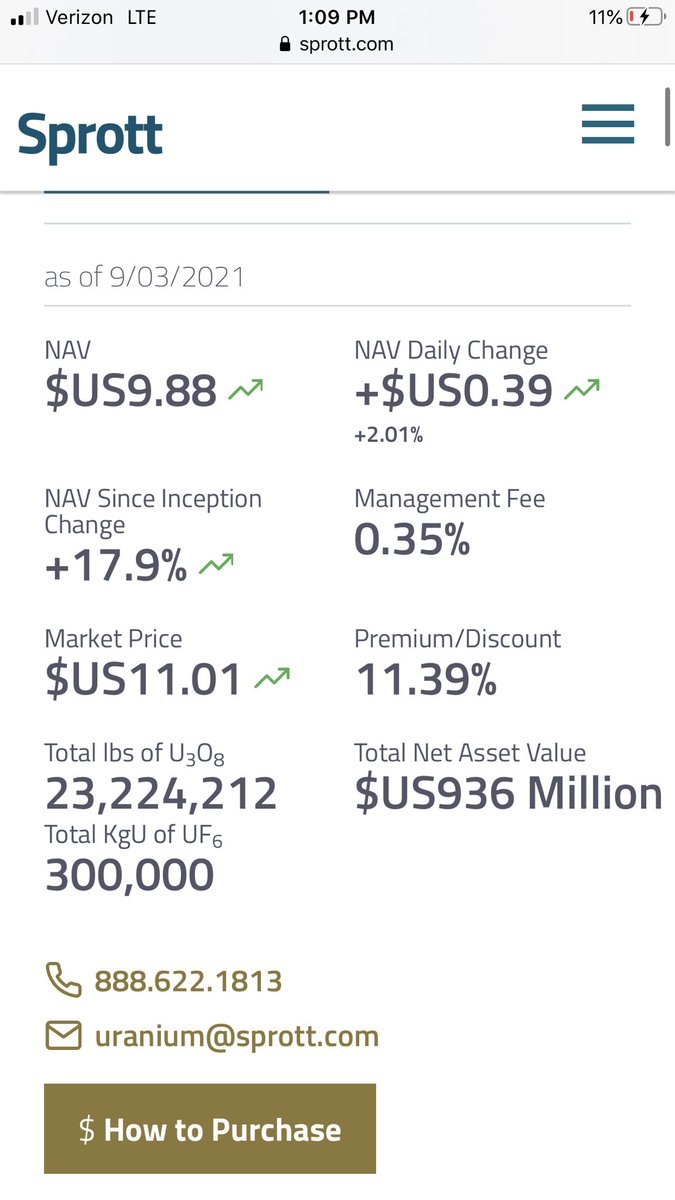

5) For example, currently, the NAV is 9.88/share.

The share price closed Friday at 11.01/share which is an 11.39% premium to NAV

The share price closed Friday at 11.01/share which is an 11.39% premium to NAV

6) This means that Sprott has the ability to sell more shares to raise cash and buy more physical #uranium.

This increases NAV but SPUT share price is entirely depending on the market

This increases NAV but SPUT share price is entirely depending on the market

7) As long as the dollars keep flowing into the stock, SPUT has the ability to purchase up to 300 million dollars worth of #Uranium.

This is not a true limit as they will likely file for another ATM when they need to purchase a potentially even greater dollar amount worth soon.

This is not a true limit as they will likely file for another ATM when they need to purchase a potentially even greater dollar amount worth soon.

8) Because of their ATM they have provided immediate demand for physical #uranium as previously, suppliers had months to fill orders.

9) Even without SPUT’s presence, there was already a significant supply/demand deficit in the space due to increasing demand for nuclear energy and spot price of #Uranium being in a massive bear market since Fukushima, making it unprofitable to mine from the ground.

10/10) SPUT is accelerating and exaggerating what was already looking to be a great #Uranium bull market.

I expect volatility along the way and will be a long term holder in the space.

Cheers

I expect volatility along the way and will be a long term holder in the space.

Cheers

• • •

Missing some Tweet in this thread? You can try to

force a refresh