🫂 The Fed, the Amer Worker, and Labor Day...

Labor Day is to honor the achievements of American workers, but the Fed has been screwing them over for decades

A short thread with some stats and numbers 👇

Labor Day is to honor the achievements of American workers, but the Fed has been screwing them over for decades

A short thread with some stats and numbers 👇

1/ it wasn't that long ago, retirement was possible if you saved some money...

From 1960s to 2007, the avg int paid on a 10yr gov bond was 7%. If you worked hard, saved in a bond portfolio, reinvested interest, $100k would grow to $750k in 30 yrs. Enough to have $52.5k per year

From 1960s to 2007, the avg int paid on a 10yr gov bond was 7%. If you worked hard, saved in a bond portfolio, reinvested interest, $100k would grow to $750k in 30 yrs. Enough to have $52.5k per year

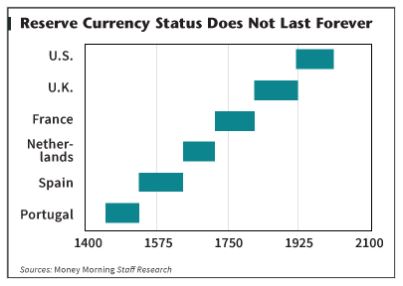

2/ But, when the Fed Res decided to wage a “war” against deflation during the 2008 Financial Crisis, it also waged war on Workers & Savers because to save the stock market, the Fed cut interest rates to near zero.

You and I, the American savers and retiree – got screwed. - How?

You and I, the American savers and retiree – got screwed. - How?

3/ Remember how $750k in bonds would give you $52.5k / year in income?

Well, today with rates so low, instead of making $52.5k/yr, you’ll now make about $9,600.

So you’d now need $4.06 million in bonds to equal what $750k in bonds would’ve paid you before 2008.

Well, today with rates so low, instead of making $52.5k/yr, you’ll now make about $9,600.

So you’d now need $4.06 million in bonds to equal what $750k in bonds would’ve paid you before 2008.

4/ So... it takes 5x more money to maintain the same lifestyle you would’ve had 20 years ago

per Charles Schwab, the avg Amer worker needs to save at least $1.7 M to retire comfortably. but, avg 50 yr old worker has only $203k in savings.

That’s a $1.5 million gap

per Charles Schwab, the avg Amer worker needs to save at least $1.7 M to retire comfortably. but, avg 50 yr old worker has only $203k in savings.

That’s a $1.5 million gap

5/ Even if the S&P 500 rises 20% per year for the next five years… it won’t be enough to bridge the gap.

But even in the longest bull run since 08', S&P 500 has avg 10% annually. If you put $10,000 in the index at the start of the bull market, it’d be worth $66,900 today

But even in the longest bull run since 08', S&P 500 has avg 10% annually. If you put $10,000 in the index at the start of the bull market, it’d be worth $66,900 today

6/ Fed policy is crushing us, To counter this:

Earn more, learn a "High Value" skill, that can be done remotely. Those closest to the money supply or Sales and Marketing.

Exp: Phone Sales, Copywriting, Facebook ads, Video Editing, Marketing, Social Media Mang, Blog Writing, etc

Earn more, learn a "High Value" skill, that can be done remotely. Those closest to the money supply or Sales and Marketing.

Exp: Phone Sales, Copywriting, Facebook ads, Video Editing, Marketing, Social Media Mang, Blog Writing, etc

7/ Then with your savings, needs to beat rate of fed inflation, was 7%, today is closer to 25%.

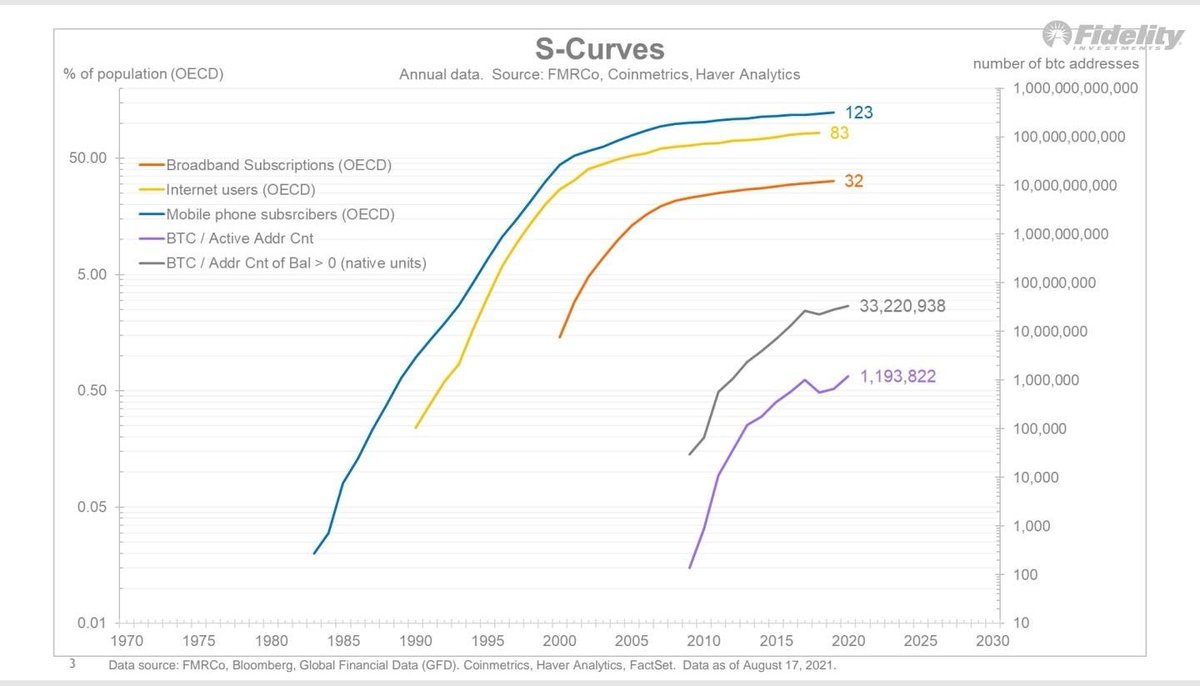

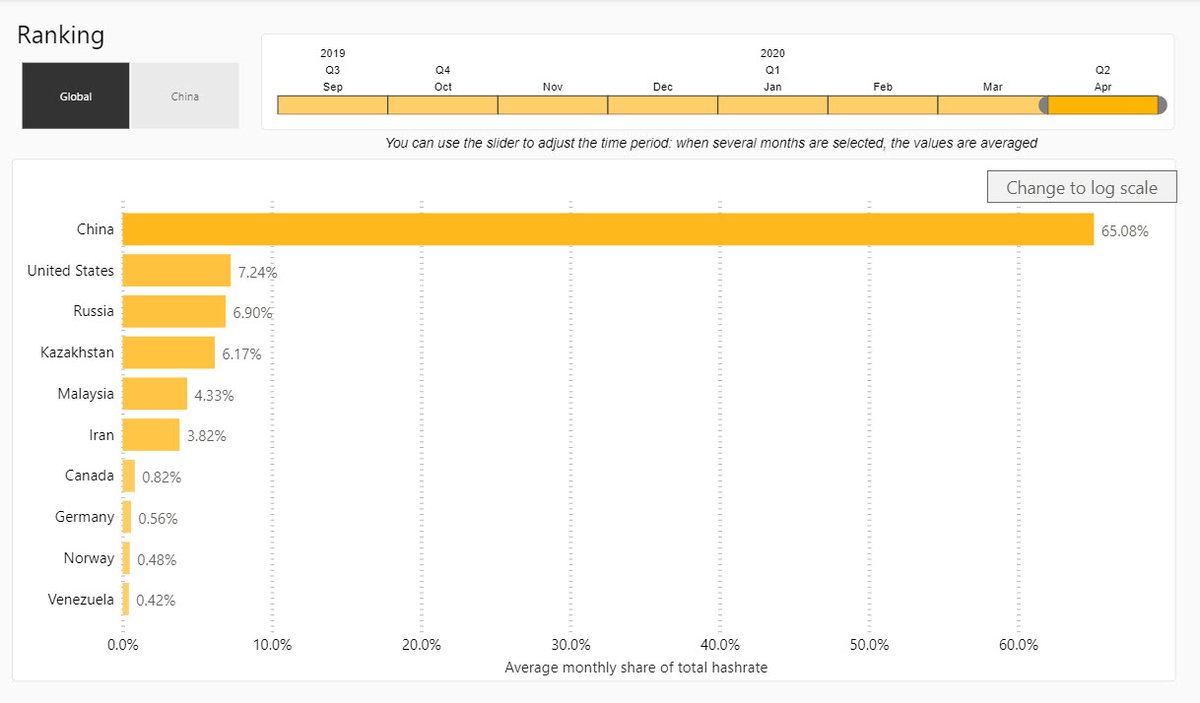

#Bitcoin has avg 200% return each yr for last decade, stocks might have just barely kept up.

If you feel too late and left behind, it's NOT TOO Late. You are still early #endthefed

#Bitcoin has avg 200% return each yr for last decade, stocks might have just barely kept up.

If you feel too late and left behind, it's NOT TOO Late. You are still early #endthefed

• • •

Missing some Tweet in this thread? You can try to

force a refresh