Why Reading and observing different trends matter.

Time for a thread with a live example that is playing out in front of us! 🎵🎵

🧵🧵🧵🧵🧵

Time for a thread with a live example that is playing out in front of us! 🎵🎵

🧵🧵🧵🧵🧵

“What is elementary, worldly wisdom? Well, the first rule is that you can’t really know anything if you just remember isolated facts and try and bang ‘em back. If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form.”- Charlie Munger

Charlie Munger who is the partner of Warren Buffett, has over the years explained the importance of creating a latticework of mental models. That is basically combining theory with live practical examples

One of the most interesting mental models he talked about in his books was that of Autocatalysis (lets understand this and how we can apply it to a live example):

"Disney is an amazing example of autocatalysis. They had all those movies in the can.

"Disney is an amazing example of autocatalysis. They had all those movies in the can.

They owned the copyright. And just as Coke could prosper while refrigeration came, When the video cassette was invented, Disney didn’t have to invent anything or do anything except take the thing out of the can and stick it on the cassette.

And every parent and grandparent wanted his descendants to sit around and watch that stuff at home on videocassette. So Disney got this enormous tail wind from life. And it was billions of dollars worth of tail wind.

Obviously, that’s a marvelous model if you can find it. You don’t have to inventanything. All you have to do is to sit there while the world carries you forward."

A live example is the Music Licensing Businesses like Saregama and TIPS. Both the businesses suffered

A live example is the Music Licensing Businesses like Saregama and TIPS. Both the businesses suffered

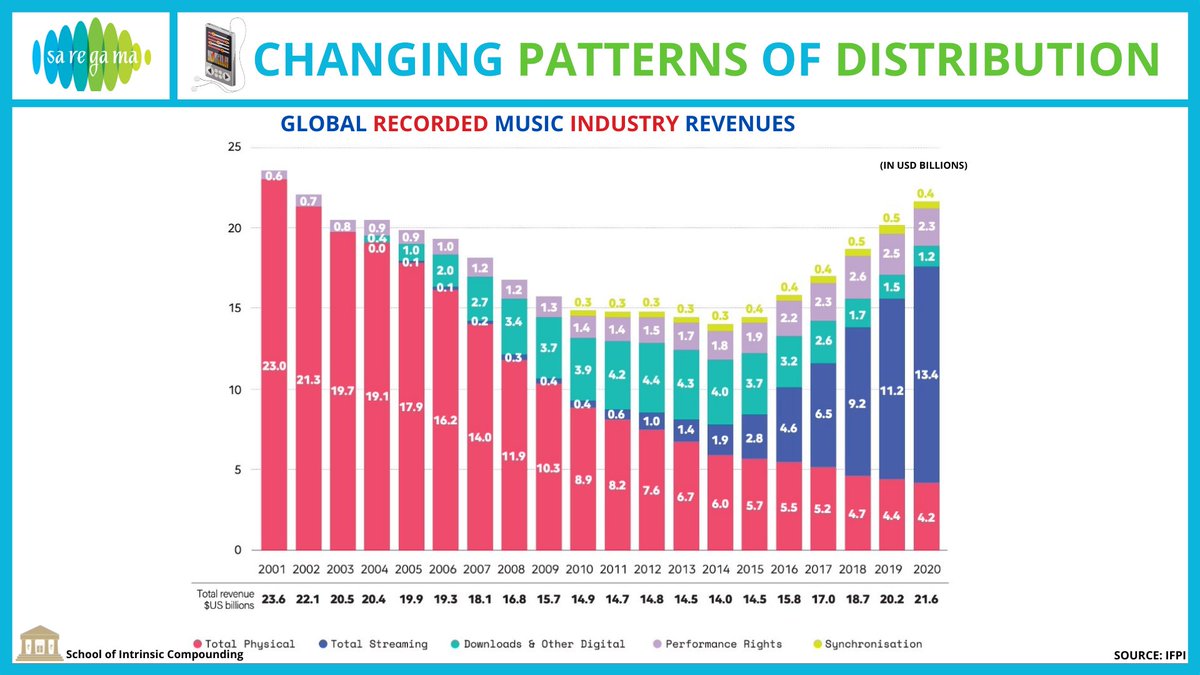

over the years due to rampant piracy. The entire music industry de-grew due to websites like torrents, song-PK and rampant piracy.

However, here is where the idea of autocatalysis comes in. The patterns of distribution changed. Have you observed how youngsters around you are listening to music over streaming applications like Wink Music or Spotify? Growth of streaming applications has acted like

an autocatalysis for Music Library/IP owners like Saregama or Tips. This is just not it, just look at the growth rates of viewership of YouTube :

cnbc.com/2021/04/27/you…

cnbc.com/2021/04/27/you…

Such are the tailwinds. Just check the number of views on recently released song by Saregama (Badshah). It has already crossed a mind boggling 500 VIEWS!

Multiple Lollapalooza come together to create extremely strong trends.

Multiple Lollapalooza come together to create extremely strong trends.

Mini trends completing the lollapalooza here:

1. Growth of streaming business

2. Growth of Youtube viewership in India

3. Increasing internet penetration

4. Usage of retro music and remix in sitcoms, and by OTTs.

5. Insta reels

6. Finally, an optionality of Audio NFT!

1. Growth of streaming business

2. Growth of Youtube viewership in India

3. Increasing internet penetration

4. Usage of retro music and remix in sitcoms, and by OTTs.

5. Insta reels

6. Finally, an optionality of Audio NFT!

Read, read and read. Hope to have a few insights :)

Watch our Saregama Video🎵🎵 to know more about how autocatalysis is playing out! (positively biased)

Watch our Saregama Video🎵🎵 to know more about how autocatalysis is playing out! (positively biased)

• • •

Missing some Tweet in this thread? You can try to

force a refresh