Few realise it, but #TerraAutumn is coming 🌖🍂

The pieces will start falling into place once Columbus 5 goes live in late September

In this thread, I share my mental model for @terra_money and guide to the end of year setup as I see it 👇

The pieces will start falling into place once Columbus 5 goes live in late September

In this thread, I share my mental model for @terra_money and guide to the end of year setup as I see it 👇

1/ Before we begin, it’s important to realise what Terra is

Terra’s product is often misunderstood as an L1

In reality, Terra’s only product is $UST. Everything else, including the L1, simply exists to help make $UST the most useful and decentralised form of money there is

Terra’s product is often misunderstood as an L1

In reality, Terra’s only product is $UST. Everything else, including the L1, simply exists to help make $UST the most useful and decentralised form of money there is

3/ The decentralisation mechanisms are well-covered, so I’ll focus mostly on utility. What makes money useful?

Money can either be spent or held/invested (deferred spending)

Terra aims to make $UST useful for both

Money can either be spent or held/invested (deferred spending)

Terra aims to make $UST useful for both

4/

Investment - TeFi gives users access to a full decentralised financial system (yield, lending, synthetics, asset mgmt, exchange) + wide range of assets to invest in

Spending - Initially Chai and increasingly others are helping to make $UST spendable worldwide

Investment - TeFi gives users access to a full decentralised financial system (yield, lending, synthetics, asset mgmt, exchange) + wide range of assets to invest in

Spending - Initially Chai and increasingly others are helping to make $UST spendable worldwide

5/ The ultimate goal is “closing the loop” such that a user never has to leave $UST. This requires highly developed investment and spending ecosystems

The next few months leading up to and following Columbus 5 will unleash massive progress in both of these areas

The next few months leading up to and following Columbus 5 will unleash massive progress in both of these areas

6/ The first piece of the puzzle is @orion_money's launch. Orion is Terra’s $UST blackhole, exporting Anchor’s 20% savings rate to other chains (starting with Ethereum)

It has already attracted >$70M TVL and will continue to grow significantly as it adds more chains towards EOY

It has already attracted >$70M TVL and will continue to grow significantly as it adds more chains towards EOY

7/ Just as Orion sucks cryptodollars ($USDT/$USDC) into $UST, @anchor_protocol's 20% savings rate will continue to absorb real world dollars into $UST through integrations with wallets and fintech apps

All this $UST will get re-circulated into TeFi via leverage on PoS assets

All this $UST will get re-circulated into TeFi via leverage on PoS assets

8/ $aUST growth will reduce borrowing costs as Anchor continues to cement itself as the go-to credit protocol for staked assets, initially via $bLUNA and $bETH but soon through $bSOL, $bDOT, and $bATOM too

9/ Once Columbus 5 goes live, the real fun begins, with @astroport_fi, @mars_protocol and @nebula_protocol all hitting the scene

Terra’s state of the art AMM @astroport_fi will kickstart #TerraAutumn in earnest with double incentives on mAsset farming ( $ASTRO + $MIR)

Terra’s state of the art AMM @astroport_fi will kickstart #TerraAutumn in earnest with double incentives on mAsset farming ( $ASTRO + $MIR)

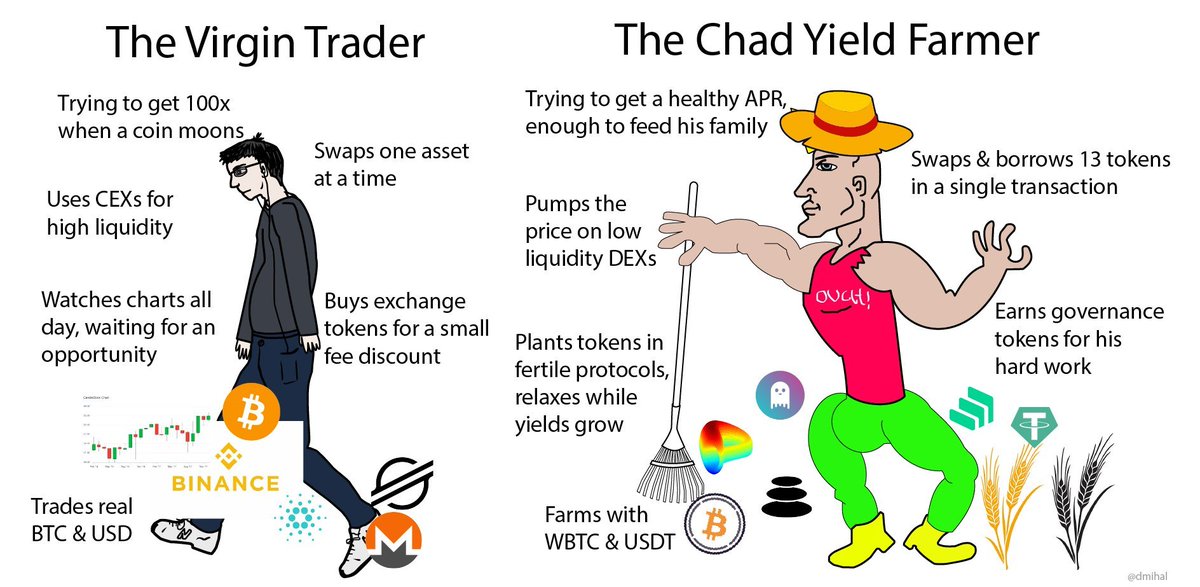

10/ @mars_protocol supercharges this by unlocking $UST leveraged yield farming, allowing users to further multiply their double incentive yield farming while staying long their favourite assets 🔥🧑🌾

https://twitter.com/larry0x/status/1421164692547022853

11/ Built w/ input from @Jump_Labs, Terra’s index protocol @nebula_protocol has imo the most interesting mechanism design out there, with rebalancing via taxes/incentives on trading which punish/reward traders for moving the baskets away/towards their target weights

12/ By allowing anyone to create indexes (“cluster tokens”) and capture some of the underlying fee volume, @nebula_protocol will enable users to create entirely new financial products

L1 staking index

FAANG index

@Delphi_Digital Gaming Index? 👀

The possibilities are endless

L1 staking index

FAANG index

@Delphi_Digital Gaming Index? 👀

The possibilities are endless

13/ Next, @levana_protocol will come to market offering leveraged exposure to any Terra asset, first using leveraged tokens (via @mars_protocol) and later through decentralised perps

https://twitter.com/Levana_protocol/status/1433083964630122501

14/ As $UST establishes itself as the dominant decentralised stablecoin, @Levana_protocol's UST backed leveraged assets will become prime cross-chain collateral

15/ Then, taking advantage of the variety of financial primitives and assets on Terra, @spar_protocol will launch, empowering asset managers to create on-chain, non-custodial funds

Arbitrage funds, yield farming funds, long-short hedge funds, etc can all be created on Spar

Arbitrage funds, yield farming funds, long-short hedge funds, etc can all be created on Spar

17/ Gradually then suddenly, Terra will have created a complete DeFi ecosystem, including strong primitives for synthetic assets, exchange, leveraged farming / trading, and asset management

All with an actual decentralised stablecoin at the heart of it

All with an actual decentralised stablecoin at the heart of it

18/ A financial system is nothing without assets people want

@wormholecrypto, and later IBC, will enable Terra to import the most sought after assets from other chains. It will also enable Terra assets to be exported to other chains, starting with @solana and @ethereum

@wormholecrypto, and later IBC, will enable Terra to import the most sought after assets from other chains. It will also enable Terra assets to be exported to other chains, starting with @solana and @ethereum

19/ @mirror_protocol will continues to port over the highest demand synthetic assets from the real world, including pre and post-IPO stocks, commodities and bonds

20/ Once on Terra, @nebula_protocol / @spar_protocol will help package these assets into products people want

@astroport_fi will make them liquid

@mars_protocol / @Levana_protocol will unlock yield + leverage

@astroport_fi will make them liquid

@mars_protocol / @Levana_protocol will unlock yield + leverage

21/ In parallel, neobanks like @alice_finance, @kado_money ,@kashdefi ,@SuberraProtocol and others will continue to grow and unlock $UST payments utility across the globe

This helps to close the loop while also introducing a non-cyclical source of $UST demand

This helps to close the loop while also introducing a non-cyclical source of $UST demand

22/ At this point, $UST will offer:

- a next-gen, non-custodial financial system complete with all major primitives and a wide variety of assets

- real world payment utility across multiple geographies

All while being decentralised and censorship-resistant

- a next-gen, non-custodial financial system complete with all major primitives and a wide variety of assets

- real world payment utility across multiple geographies

All while being decentralised and censorship-resistant

23/ To flesh out this thesis, I’ll be doing a @PodcastDelphi #TerraAutumn series interviewing builders from all @terra_money's major projects

Will be dropping around Columbus 5 so stay tuned👀

(As always, podcasts go out to @delphi_digital subscribers first)

Will be dropping around Columbus 5 so stay tuned👀

(As always, podcasts go out to @delphi_digital subscribers first)

24/ Disclaimer: Both Delphi Ventures and myself are long $LUNA and $ANC. Delphi Labs is incubating a variety of projects on Terra, many of which are mentioned in this thread

See our transparency board for full disclosures: delphidigital.io/transparency-b…

See our transparency board for full disclosures: delphidigital.io/transparency-b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh