We've already received a lot of great entries for the #deficonnected hackathon

In case you're still looking for inspiration, I've put together a wishlist of ideas that no one is yet building on Terra (as far as I know)

Thread 👇

In case you're still looking for inspiration, I've put together a wishlist of ideas that no one is yet building on Terra (as far as I know)

Thread 👇

(1)Terra name service (TNS)

Human readable names for the Terra network associated to Terra addresses. Essential infra for mainstream adoption

(2) Terra Push Notifications

Allowing push notifications to Terra wallet addresses

(3) Etherscan for Terra - Self explanatory

Human readable names for the Terra network associated to Terra addresses. Essential infra for mainstream adoption

(2) Terra Push Notifications

Allowing push notifications to Terra wallet addresses

(3) Etherscan for Terra - Self explanatory

(4) Data infrastructure on Terra - Making it easy to query data from the Terra blockchain and major dApps (Terraswap, @mirror_protocol , @anchor_protocol ) and create dashboards. Think Graph Protocol / Dune Analytics for Terra

(5) Ideas around interest rate delegation (agora.terra.money/t/value-exchan…)

Allowing users to delegate yield to pay for services / invest into projects. For example, users could delegate part of their @anchor_protocol yield to pay for their @Delphi_Digital subscription

Allowing users to delegate yield to pay for services / invest into projects. For example, users could delegate part of their @anchor_protocol yield to pay for their @Delphi_Digital subscription

(6) mAsset perps/leveraged trading

Allowing users to take leveraged position on mAssets and other Terra assets. Both perpetuals or margin based architectures could work here

Allowing users to take leveraged position on mAssets and other Terra assets. Both perpetuals or margin based architectures could work here

(7) Interest rate swaps

Allowing users to sell unrealised yield and speculate on the direction of interest rates. This could be built on Mirror / Anchor to start with and extended as more yields become available

Allowing users to sell unrealised yield and speculate on the direction of interest rates. This could be built on Mirror / Anchor to start with and extended as more yields become available

(8) Portfolio management

Allowing users to easily view and manage their portfolio across different Terra wallets. As part of this, it'd also be cool for users to tag wallets they can follow similar to @nansen_ai 's token God mode

Allowing users to easily view and manage their portfolio across different Terra wallets. As part of this, it'd also be cool for users to tag wallets they can follow similar to @nansen_ai 's token God mode

(9) DAO Infrastructure

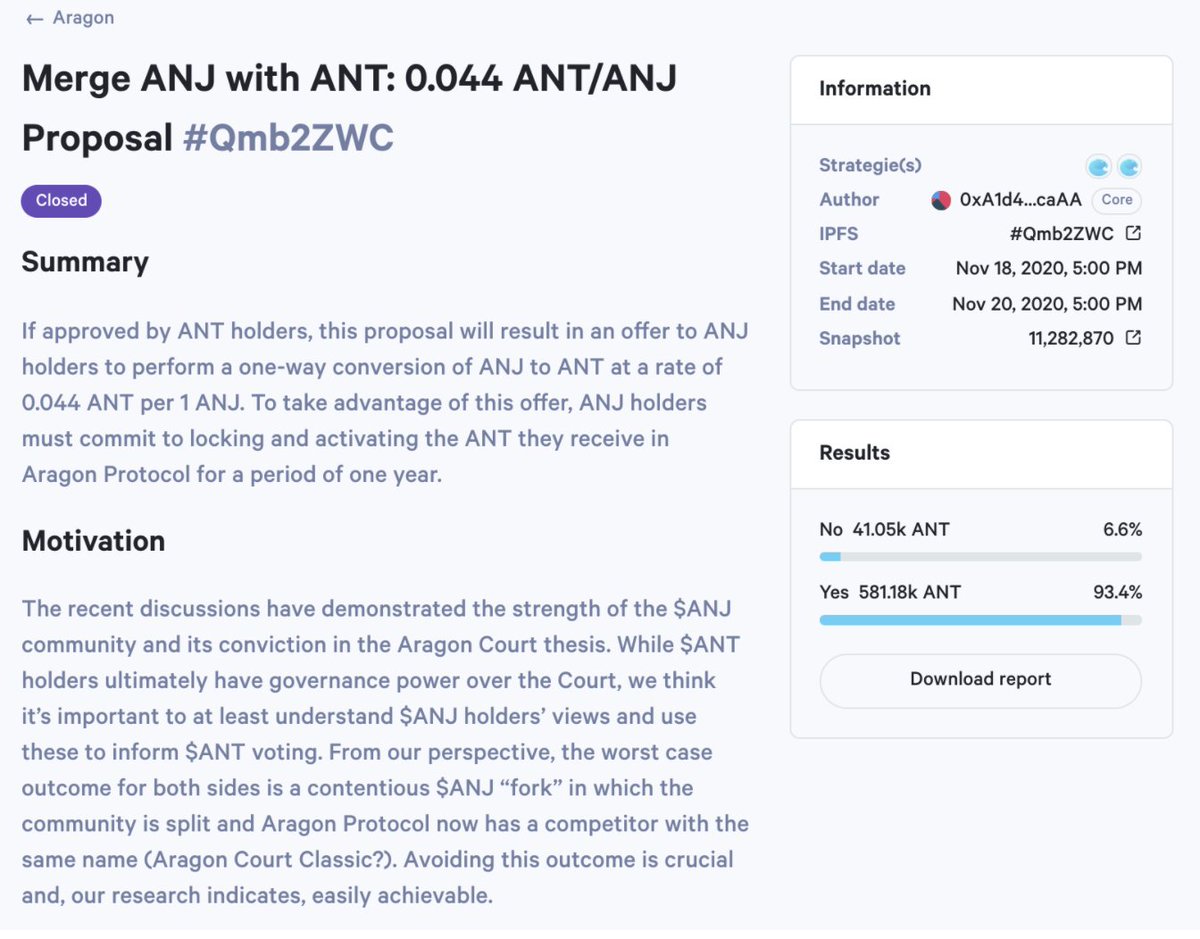

Build governance infrastructure such as Snapshot, Gnosis multi-sig type solutions and other more advanced infra that doesn't yet exist on Ethereum like committee voting a la @joincolony / @OrcaProtocol

Build governance infrastructure such as Snapshot, Gnosis multi-sig type solutions and other more advanced infra that doesn't yet exist on Ethereum like committee voting a la @joincolony / @OrcaProtocol

Obviously, many of these will take longer than a hackathon to build

Both @Delphi_Digital and @IDEOVC are interested in providing long-term funding / support to strong teams tackling these problems

HMU if you want to discuss these or any other ideas. DMs are open

Both @Delphi_Digital and @IDEOVC are interested in providing long-term funding / support to strong teams tackling these problems

HMU if you want to discuss these or any other ideas. DMs are open

• • •

Missing some Tweet in this thread? You can try to

force a refresh