All the companies in the Cement Fibre Products Industry have given huge returns in the past year 👇

Let's understand what drives the industry & the risks.

Hit the 'retweet' to help us educate more investors.

A Thread 🧵

Let's understand what drives the industry & the risks.

Hit the 'retweet' to help us educate more investors.

A Thread 🧵

1/ The Indian roofing industry is worth Rs 42,000 Crores and is expected to grow at the rate of 6-8% cagr.

So, What are the different options & what sets them apart?

So, What are the different options & what sets them apart?

2/ Among the pucca houses, less than half use RCC slabs; the rest utilize ready-to-use house roofing products (fiber cement roofing/ metal roofing).

Comparison between different options 👇

Now, this clears the superiority of Fiber Cement Sheets, let move further.

Comparison between different options 👇

Now, this clears the superiority of Fiber Cement Sheets, let move further.

3/ Fibre Cement sheets have existed for the last 80 years in India.

They represent a convenient roofing product in rural and semi-urban India; as ~50% of the country’s rural population lives in kutcha or semi-pucca dwellings wherein this product represents a convenient fit.

They represent a convenient roofing product in rural and semi-urban India; as ~50% of the country’s rural population lives in kutcha or semi-pucca dwellings wherein this product represents a convenient fit.

4/ It is lightweight, heat & fire-resistant, and weatherproof.

Due to its affordability and reliability as a sturdy material, its demand continues to grow in rural areas, where they are highly preferred for construction.

Note: Zero replacement required for 75+ years.

Due to its affordability and reliability as a sturdy material, its demand continues to grow in rural areas, where they are highly preferred for construction.

Note: Zero replacement required for 75+ years.

5/ Opportunity Size:

The Indian fiber cement roofing sheets market is anticipated to reach a value of 5500crs by FY26, growing at a CAGR of 3% (low growth industry).

Plus it remains highly cyclical, why?

The Indian fiber cement roofing sheets market is anticipated to reach a value of 5500crs by FY26, growing at a CAGR of 3% (low growth industry).

Plus it remains highly cyclical, why?

6/ It's heavily dependent on its end consumer's financial state: Rural Economy.

- Rainfalls of last year

- Cash availability with the farmers

- Social Schemes & incentives by the Government.

Why does rural folk prefer Cement fiber sheets?

- Rainfalls of last year

- Cash availability with the farmers

- Social Schemes & incentives by the Government.

Why does rural folk prefer Cement fiber sheets?

7/ Almost 60% of rural folk in 🇮🇳 use thatched roofs/tiles for their shelters. Thatched roofs need regular replacement and tiled roofs need continued maintenance.

8/ Therefore, whenever the economic conditions improve, the first choice of the rural poor is to replace the roof over their head with affordable and relatively durable products i.e. cement fiber sheets.

9/ Roofing price comparison:

Cement Fiber sheets (Asbestos) x

Fiber green sheets (Non- Asbestos) 1.4x - 1.5x

Metal sheets (Steel, Aluminium, etc) 2x

RCC (re-inforced cement concrete) 5x

Just natural to chose CFS first; note that even GST is the same for all at 18%.

Cement Fiber sheets (Asbestos) x

Fiber green sheets (Non- Asbestos) 1.4x - 1.5x

Metal sheets (Steel, Aluminium, etc) 2x

RCC (re-inforced cement concrete) 5x

Just natural to chose CFS first; note that even GST is the same for all at 18%.

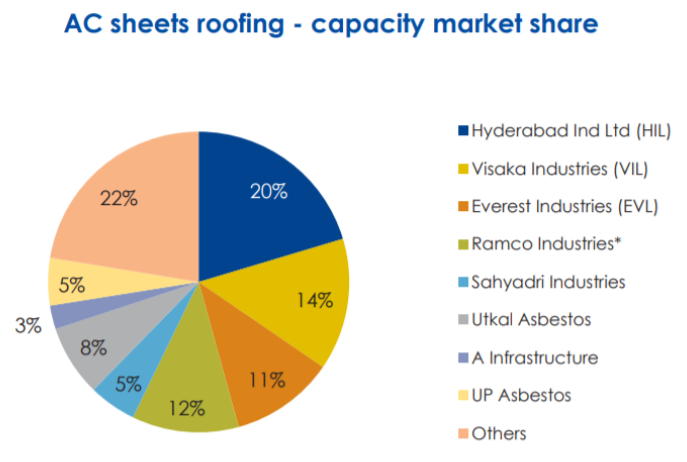

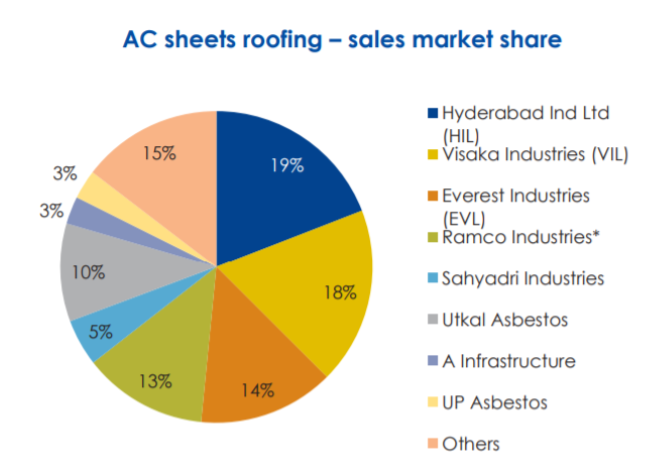

10/ Now that we have established the end-use; let us understand if we can make money in this industry:

Oligopolistic Industry: Top 5-6 control 85-90% of the sales.

Total domestic AC sheet capacity 56 lakh MT, Note: the capacity is stagnant since FY11.

Oligopolistic Industry: Top 5-6 control 85-90% of the sales.

Total domestic AC sheet capacity 56 lakh MT, Note: the capacity is stagnant since FY11.

11/ Any Pricing power? Zero to partial (dependent on demand trends)

Have not been able to pass on RM inflation fully in the past: ranges from 35-45% gross margins.

Have not been able to pass on RM inflation fully in the past: ranges from 35-45% gross margins.

12/ Chrysotile fiber is a key ingredient in the manufacture of AC sheets (ACS); it is ~50-55% of the RM cost and is 100% imported

A limited number of suppliers exist for chrysotile, the cost depends on their demand & currency movements

Low Negotiating power with suppliers.

A limited number of suppliers exist for chrysotile, the cost depends on their demand & currency movements

Low Negotiating power with suppliers.

14/ So what about bargaining power with customers? Again, very little.

As many substitute products exist (though they do get some benefits when steel prices increase) & also, the customer is extremely price-conscious (weak financial background).

As many substitute products exist (though they do get some benefits when steel prices increase) & also, the customer is extremely price-conscious (weak financial background).

15/ So, what separates one company from another?

Marketing & Brand Value (mindshare among the customers)

Sales, Distribution network & manufacturing network

This helps a few players sell at a premium (5-10%) in their respective markets.

Marketing & Brand Value (mindshare among the customers)

Sales, Distribution network & manufacturing network

This helps a few players sell at a premium (5-10%) in their respective markets.

16/ Another risk is a ban on Asbestos; banned in 55+ countries due to the illnesses caused by its exposure mesotheliomahope.com/asbestos/expos…

This decreases the terminal value for all of these companies & only HIL & Everest have given a good plan to replace them with non-asbestos sheets.

This decreases the terminal value for all of these companies & only HIL & Everest have given a good plan to replace them with non-asbestos sheets.

17/ To summarise, What does one need to look for to invest in this sector?

- How is the company decreasing the % exposure to asbestos sheets (for all companies other than HIL, it makes up 60-80% of their rev)

- Rural economy conditions

- Market share movement (emerging leaders?)

- How is the company decreasing the % exposure to asbestos sheets (for all companies other than HIL, it makes up 60-80% of their rev)

- Rural economy conditions

- Market share movement (emerging leaders?)

18/

- Is it using its superior rural distribution network to sell other products & how are they panning out

- Cheap valuations; in most of their history, these companies have traded at less than 0.5 sales due to the reasons mentioned above

Be careful with narratives!

The End.

- Is it using its superior rural distribution network to sell other products & how are they panning out

- Cheap valuations; in most of their history, these companies have traded at less than 0.5 sales due to the reasons mentioned above

Be careful with narratives!

The End.

The world has already moved on from Asbestos due to it's carinogenic nature, other substitutes:

airsafe.net.au/news/asbestos-…

airsafe.net.au/news/asbestos-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh