I want to introduce you to a technique that is really simple and easy to work with on all timeframes.

I just took this winning scalp trade then on $ETH 3min chart

This works on $BTC $SOL $AXS $MOVR $DOT $MATIC, you name it (shameless reach tags sorry).

I just took this winning scalp trade then on $ETH 3min chart

This works on $BTC $SOL $AXS $MOVR $DOT $MATIC, you name it (shameless reach tags sorry).

Start with your chart on the correct timeframe:

-3min

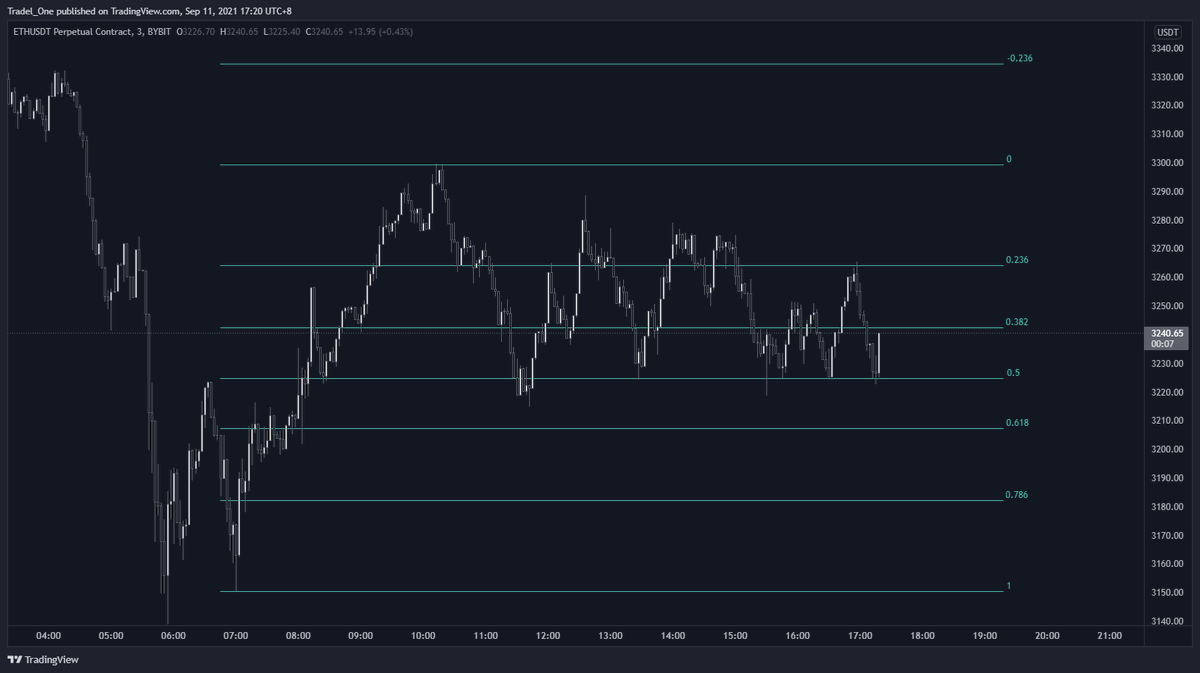

Then pull a set of fibs from the swing low of the move to the swing high as shown

- Use the standard fib suite, but make sure the colours work for you

-3min

Then pull a set of fibs from the swing low of the move to the swing high as shown

- Use the standard fib suite, but make sure the colours work for you

Add the Stochastic RSI tool (SRSI), it's free on @tradingview. If you aren't sure on entry and exit, this will really help you

There are two lines, K, and D.

When the K line (blue) is above the 80 level (shown dashed) & crosses the D (orange) this is a sell signal (overbought)

There are two lines, K, and D.

When the K line (blue) is above the 80 level (shown dashed) & crosses the D (orange) this is a sell signal (overbought)

And vice versa for when below the 20 level shown dashed; this means that the instrument is oversold and price is likley to reach upwards

(Go ahead and check the correlation against price on many charts for the oversold and overbought signals)

(Go ahead and check the correlation against price on many charts for the oversold and overbought signals)

Then add your favourite fib set up for entry targets.

(Go and check my pinned message for threads on these entry points)

- Notice that the 0.236 level of the more global fibs lines up almost perfectly with the 0.705 level?

More below:

(Go and check my pinned message for threads on these entry points)

- Notice that the 0.236 level of the more global fibs lines up almost perfectly with the 0.705 level?

More below:

Not only the fib confluence, but also notice how the SRSI also shows a curving overbought signal which tells us that price is likley to drop?

Based on these factors, I made a short entry per the below at the 0.236 / 0.705 level, with the target being the next key fib down at 0.5

Like clockwork, this is the result:

A successful 1.5R scalp that lasted 18 minutes.

Like clockwork, this is the result:

A successful 1.5R scalp that lasted 18 minutes.

Conclusion:

You don't need 100's of indicators to trade

Horizontal support, price action, & simplicity just make life so much easier IF you are willing to put in the time

Please, comment below if you need a hand, or if you'd like to share success or lessons with this method

You don't need 100's of indicators to trade

Horizontal support, price action, & simplicity just make life so much easier IF you are willing to put in the time

Please, comment below if you need a hand, or if you'd like to share success or lessons with this method

• • •

Missing some Tweet in this thread? You can try to

force a refresh