Today from 5pm, we will do a full thread on our analysis of Scangroup from a Financial analysis point of view.

Stay tuned. Stay curious

Stay tuned. Stay curious

1. We start by look at the following items before we delve into WPP SCAN GROUP PLC numbers for 2019 & 2020

i) 5 items that will make you understand the financials of any business

ii) 3 Key financial statements

i) 5 items that will make you understand the financials of any business

ii) 3 Key financial statements

Ice-Breaker- Accounting is a storytelling system. It tells the story of a business.

This is a picture of a butterfly. It is not a butterfly, so the financials of WPP SCAN GROUP PLC simply tell us the story of the company.

This is a picture of a butterfly. It is not a butterfly, so the financials of WPP SCAN GROUP PLC simply tell us the story of the company.

1 (i) Accounting groups items into groups and sub-groups so that the story of a company is simplified.

The 5 items are basically sources of funds and uses of funds. Sources of funds REVENUE, LIABILITIES, and EQUITY whiles uses of funds are for the purchase of ASSETS and EXPENSES

The 5 items are basically sources of funds and uses of funds. Sources of funds REVENUE, LIABILITIES, and EQUITY whiles uses of funds are for the purchase of ASSETS and EXPENSES

a) Assets are the only valuable things in a company and are used to generate value for shareholders.

b)Liabilities are obligations to creditors and suppliers. They are used to fund assets

c)Equity is obligation to owners. It is the only claim that shareholders have on a company

b)Liabilities are obligations to creditors and suppliers. They are used to fund assets

c)Equity is obligation to owners. It is the only claim that shareholders have on a company

d) Revenue-These are value-generating activities for the company with the potential to bring money. Revenue is not money as not all sales are made in cash.

e) Expenses- These are value sacrificing activities necessary for value creation in a company

e) Expenses- These are value sacrificing activities necessary for value creation in a company

ii) 3 Key financial statements

The balance sheet or the statement of financial position describes the assets of the financial entity and how they are funded using liabilities and equity.

The balance sheet or the statement of financial position describes the assets of the financial entity and how they are funded using liabilities and equity.

The Income statement is also known as the profit and loss statement describes the activities that grew or shrunk the value of assets and obligations(liabilities and capital)

The cash flow statement describes what caused cash to move into and outside the company.

Let us delve into WPP Scangroup financials...

For shareholder value(equity) to grow, you need to grow value-generating activities for the business(Revenue) faster than the value that is being sacrificed(expenses)

In 2020 less value was created as revenue dropped by 22%

For shareholder value(equity) to grow, you need to grow value-generating activities for the business(Revenue) faster than the value that is being sacrificed(expenses)

In 2020 less value was created as revenue dropped by 22%

Since less value was generated(revenue dropped), expenses needed to reduce to protect value for shareholders from reducing else it is a loss that eats into equity(shareholder value)

Since the business is all about creating value for shareholders, we now look at equity. In this case, expenses exceeded revenue leading to a deficit that ate into shareholders leading to a drop from Ksh 7bn to Ksh 5.2bn ( a 26% drop in shareholder value).

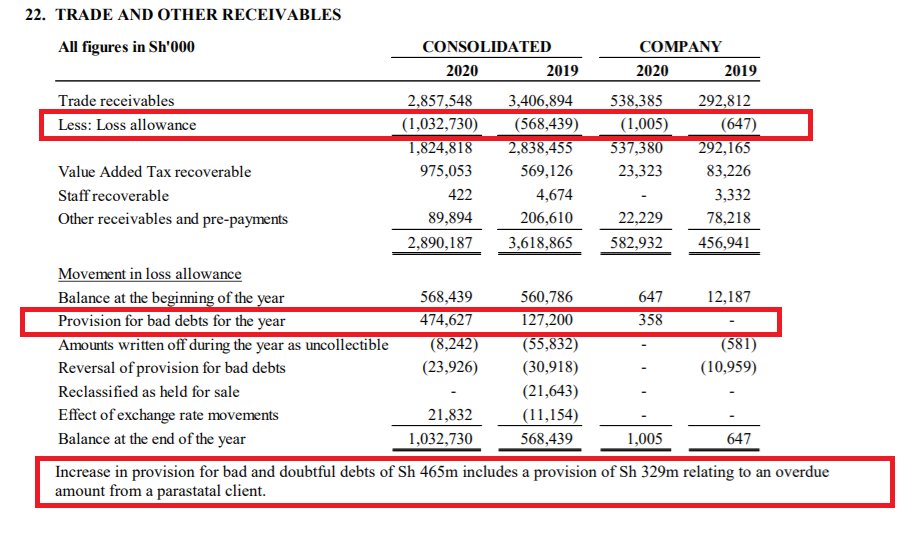

We now look at assets. Assets are the only valuable things in a business. Our main focus will be on receivables which refer to value generated on credited

Since equity is the only obligation that the company has to its shareholders, let us expand on the equity position. Has more value been created for shareholders between '19 & '20?

Can shareholders realize value from the current equity position as it is with -4bn revenue deficits

Can shareholders realize value from the current equity position as it is with -4bn revenue deficits

*credit

• • •

Missing some Tweet in this thread? You can try to

force a refresh