Today from 10am EAT, we will be doing a thread on the Layers of the M-PESA ecosystem.

Stay tuned. Stay Curious

@mmnjug @SokoAnalyst @sokodirectory @cheruiyotkb

Stay tuned. Stay Curious

@mmnjug @SokoAnalyst @sokodirectory @cheruiyotkb

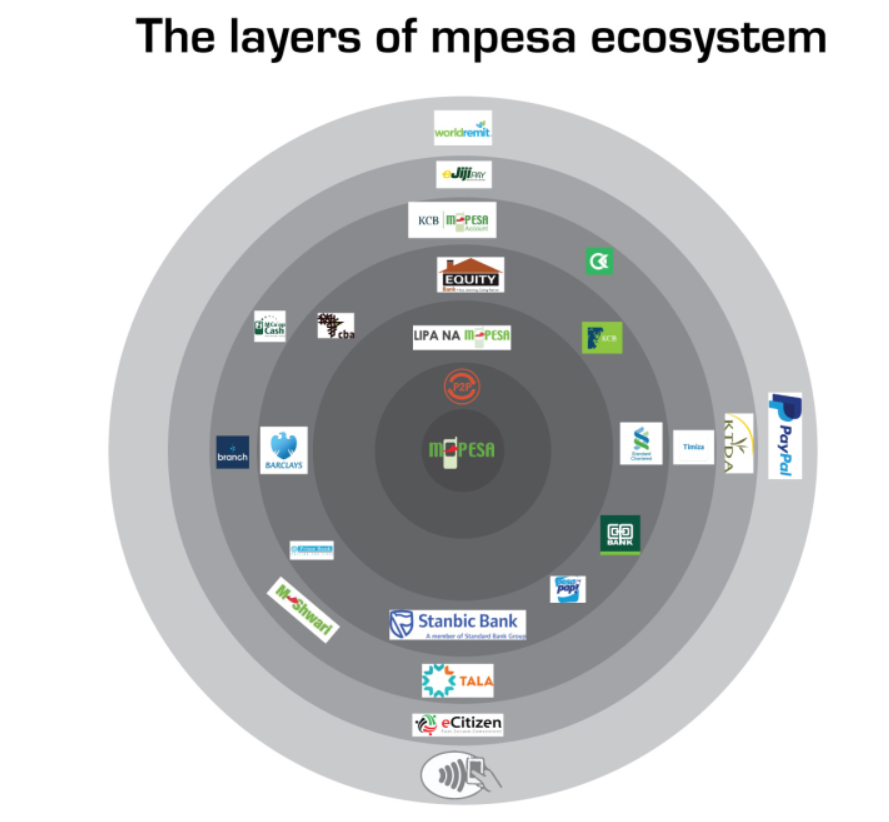

1. Person to Person (P2P)

This refers to person-to-person transfers. To top up an M-PESA wallet, customers can either go to an M-PESA agent and convert hard cash into liquid cash or they can send the money from their bank account to M-PESA in what is known >>

This refers to person-to-person transfers. To top up an M-PESA wallet, customers can either go to an M-PESA agent and convert hard cash into liquid cash or they can send the money from their bank account to M-PESA in what is known >>

as B2C(business to customer transaction). From here one can use the cash for several transactions such as payments, sending to another M-PESA subscriber etc. >>

This layer is driven by a huge M-PESA customer base, growth of cashless payments, social habits of Kenyans such as dependency and rural-urban migration

2. Financial services sector integration layer-

This layer involves major banks, over 30, and other financial sector players. Transactions here include M-PESA to bank/SACCOs etc and bank/SACCOs etc to M-PESA transactions

This layer involves major banks, over 30, and other financial sector players. Transactions here include M-PESA to bank/SACCOs etc and bank/SACCOs etc to M-PESA transactions

3. Mobile lending Layer

This layer involves the payment and reception of mobile loans from mobile lending service providers such as

•Mshwari

•Branch

•Tala

•Timiza

•Okash

•KCB M-PESA

Transactions in this space continue to grow.

This layer involves the payment and reception of mobile loans from mobile lending service providers such as

•Mshwari

•Branch

•Tala

•Timiza

•Okash

•KCB M-PESA

Transactions in this space continue to grow.

4. Bill Payments/Buy Goods

This involves merchant payments from customers. Safaricom earns a commission in each of these transactions. It has become a very popular payment option in the Kenyan retail space and especially with merchants.

This involves merchant payments from customers. Safaricom earns a commission in each of these transactions. It has become a very popular payment option in the Kenyan retail space and especially with merchants.

5. Paybill

Involves payments to merchants, organizations and govt agencies eg betting companies, e-citizen, KPLC tokens, Nairobi water, Insurance premium payments etc

Involves payments to merchants, organizations and govt agencies eg betting companies, e-citizen, KPLC tokens, Nairobi water, Insurance premium payments etc

6. Regional telco partnerships

This layer involves sending money to other mobile money networks in other countries such as

- Vodacom Tanzania,

-MTN Rwanda,

-MTN Uganda

This layer involves sending money to other mobile money networks in other countries such as

- Vodacom Tanzania,

-MTN Rwanda,

-MTN Uganda

7. Mobile money interoperability

This involves incoming and outgoing cross-network mobile money transactions from Telkom’s Tkash, Finserve’s Equitel, and Airtel’s Airtel money.

This involves incoming and outgoing cross-network mobile money transactions from Telkom’s Tkash, Finserve’s Equitel, and Airtel’s Airtel money.

8. M-PESA Global

1. To East Africa: Rwanda, Tanzania & Uganda

2. Globally: To millions of Bank accounts and over 500,000 Western Union locations globally.

3. Paypal: Access funds quickly and shop around the world with PayPal mobile money service with M-PESA.

1. To East Africa: Rwanda, Tanzania & Uganda

2. Globally: To millions of Bank accounts and over 500,000 Western Union locations globally.

3. Paypal: Access funds quickly and shop around the world with PayPal mobile money service with M-PESA.

9. Pochi La Biashara is a product that allows business owners such as food vendors, small kiosk owners, boda-boda operators, second-hand clothes dealers, etc. to receive and separate business funds from personal funds on their M-PESA line.

10. M-Pesa for Business Super App, the Transacting Till that enables businesses to go beyond receiving payments to making business payments

11. The M-Pesa Super App with mini mobile apps which enable customers and businesses to accomplish day-to-day tasks - from shopping to accessing government services - without having to download different apps for each task

• • •

Missing some Tweet in this thread? You can try to

force a refresh