50 Innovative financial companies and products across the globe

A THREAD >>>

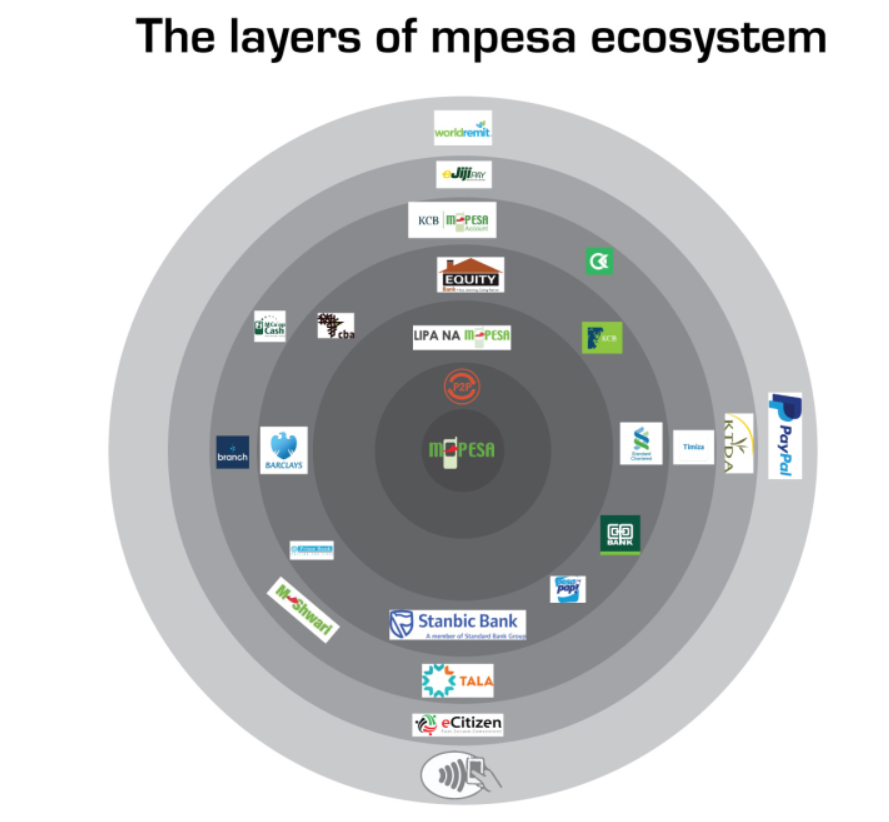

1. M-PESA -Launched in 2007 in Kenya, M-Pesa is today available in Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana, and Egypt.

A THREAD >>>

1. M-PESA -Launched in 2007 in Kenya, M-Pesa is today available in Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana, and Egypt.

2. Flutterwave is an African focussed fintech that allows merchants and consumers to make digital payments domestically, intra-africa and globally. It also allows individuals and business to create online shops

It was founded and graduated from Y Combinator in 2016

It was founded and graduated from Y Combinator in 2016

3. Eversend

Eversend is an Africa-focused fintech company that launched in March 2019. It was founded by @StoneAtwine and Ronald Kasendwa. Eversend provides multiple financial products ranging from multi-currency wallets, cross-border money transfer, currency exchange, trading

Eversend is an Africa-focused fintech company that launched in March 2019. It was founded by @StoneAtwine and Ronald Kasendwa. Eversend provides multiple financial products ranging from multi-currency wallets, cross-border money transfer, currency exchange, trading

4. Pezesha is an Africa-focused fintech that has built

a digital Lending infrastructure & Marketplace for connecting Small and Medium Businesses to working Capital. It was founded by @hildamoraa who is a returning enterprenuer. It is a success story from @CMAKenya Sandbox

a digital Lending infrastructure & Marketplace for connecting Small and Medium Businesses to working Capital. It was founded by @hildamoraa who is a returning enterprenuer. It is a success story from @CMAKenya Sandbox

5. Chipper Cash was founded in San Francisco in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled. The company offers mobile-based, no fee, P2P payment services in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa & Kenya. It raised $30m in Serie B

6. PayPal is an American company founded by Peter Thiel and Elon Musk in 1998.

It is one of the largest e-payment companies, holding money in escrow until internet transactions are successfully completed. In 2002 it was bought by eBay, but spun-off into a separate company in 2015

It is one of the largest e-payment companies, holding money in escrow until internet transactions are successfully completed. In 2002 it was bought by eBay, but spun-off into a separate company in 2015

7. Square is a financial services and mobile payment company based in San Francisco, California. Square was founded in 2009 by @twitter founder Jack Dorsey and Jim McKelvey.

“Payment is another form of communication,” Dorsey said in an interview.

“Payment is another form of communication,” Dorsey said in an interview.

8. Adyen is a Dutch payment company that allows businesses to accept e-commerce,mobile, & point-of-sale payments. It is listed on the stock exchange Euronext. The technology platform acts as a payment gateway, payment service provider & offers risk management and local acquiring

9. Paytm is India's leading financial services company that offers full-stack payments & financial solutions to consumers, offline merchants & online platforms. It was founded by Vijay Shekhar Sharma and is headquartered in Noida, Uttar Pradesh. Warren Buffet is an investor Paytm

10. Afterpay Limited is an Australian financial technology company operating in Australia, the United Kingdom, Canada, the United States, and New Zealand. Afterpay was founded in 2014 by Nick Molnar and Anthony Eisen. Afterpay is best known for its "pay later" service

11. Upstart is an AI lending platform that partners with banks to provide personal loans using non-traditional variables, such as education and employment, to predict creditworthiness. It is listed in the Nasdaq stock exchange and its revenue for Q2 2021 grew by 896.50%

12. M-Akiba is the world's digital service to allow investors to invest in treasury bonds on mobile. M-Akiba is a retail infrastructure bond issued by the Government of Kenya, which seeks to enhance financial inclusion for economic development.

13. StoneCo is a financial technology company operating in Brazil that focuses on merchant payments and financial services. Early investors included Warren Buffet's Berkshire Hathaway & the Walmart family. The company listed in the NASDAQ stock exchange in the US

14. nCino is a financial technology company that provides an end-to-end operating system for the banking industry. It has over 1,200 customers, including Bank of America, Santander, Barclays, Navy Federal, and TD Bank.

15. Affirm Holdings is a rapidly growing player in the Buy Now Pay Later space. It partners with merchants to allow customers to buy products on credit.

It was founded by Max Levchin, an early Paypal employee. Its mission is "building honest financial products to improve lives"

It was founded by Max Levchin, an early Paypal employee. Its mission is "building honest financial products to improve lives"

16. Klarna

Klarna Bank AB, commonly referred to as Klarna, is a Swedish fintech company that provides online financial services such as payments for online storefronts and direct payments along with post-purchase payments

Klarna Bank AB, commonly referred to as Klarna, is a Swedish fintech company that provides online financial services such as payments for online storefronts and direct payments along with post-purchase payments

17. Bill.com is a provider of cloud-based software that automates much-needed back-office financial operations for small and midsize businesses. Their platform creates connections between businesses and their vendors, allowing them to easily send & receive payments

18. Founded in 1999, Axos Financial has the unusual accolade of being "America's oldest and most trusted Internet bank". They offer a variety of traditional banking services plus low checking account minimums, no monthly fees, and unlimited ATM reimbursements to customers.

19. Stripe is an Irish-American financial service & software as a service company dual-headquartered in San Francisco,USA & Dublin, Ireland.The company primarily offers payment processing software and application programming interfaces for e-commerce websites and mobile apps

20. Fuliza is the world's first overdraft on a mobile money wallet. This is a service that allows M-PESA customers to complete their M-PESA transactions when they have insufficient funds in their M-PESA account.

21. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California, known for pioneering commission-free trades of stocks and exchange-traded funds via a mobile app introduced in March 2015. Its mission is to democratize finance for all

22. Sea Money- This is a digital payments platform owned by Sea Limited which is digital gaming and e-commerce company serving Southeast Asia, Latin America, and Europe.

23. Alipay is a third-party mobile and online payment platform, established in Hangzhou, China in February 2004 by Alibaba Group and its founder Jack Ma. In 2015, Alipay moved its headquarters to Pudong, Shanghai, although its parent company Ant Financial remains Hangzhou-based

24. Coinbase Global, Inc., branded Coinbase, is an American company that operates a cryptocurrency exchange platform. Coinbase operates remote-first and lacks an official physical headquarters. It is the first cryptocurrency exchange company to be listed in the NASDAQ exchange

25. MercadoPago is a fast-growing payments platform owned by MercadoLibre which operates an e-commerce platform across Latin America.

26. BlackLine is a leading provider of cloud software that automates and controls the entire financial close process. Its platform automates repetitive and menial tasks, allowing the accounting department to operate more efficiently and with fewer errors.

27. Avalara is a leading provider of cloud-based tax compliance software, helping companies of all sizes automate their transaction taxes, VAT, excise, and other taxes.

28. Ant Group, formerly known as Ant Financial & Alipay, is an affiliate company of the Alibaba Group. The group owns China's largest digital payment platform Alipay, which serves over 1billion users & 80m merchants, with total payment volume reaching CN¥118 trillion in June 2020

29. Future Link Technologies (FLT) is a Ugandan Banking as a Service Fintech that works to improve the financial resilience of low and medium-income earners in Eastern Africa. It has over 1 million B2C MSACCO subscribers, and over 300 SACCOs and Microfinance Institutions

30. PagSeguro is a financial services and digital payments company based in São Paulo, Brazil & incorporated in the Cayman Islands. Founded in 2006, the company primarily offers payment processing software for e-commerce websites and mobile applications, & point of sale terminals

31. Nubank is a Latin American neobank & the largest financial technology bank in Latin America.Its headquarters are located in São Paulo, Brazil.The company also has an engineering office in Berlin, Germany, & an office in Mexico. Warren Buffett's Berkshire Hathaway has invested

32. Mshwari- Is the world's first mobile money savings and lending wallet allowing underserved customers to save and borrow money without the need for a bank account.

33. Intuit-Based in Silicon Valley, Intuit is a software company specializing in financial & tax preparation software for small businesses & individuals. Its most well-known products are personal finance programs Quicken & TurboTax. It is the maker of Quickbooks and acquired Mint

34. Wise (formerly TransferWise) is a London-based financial technology company founded by Estonian businessmen Kristo Käärmann and Taavet Hinrikus in January 2010

35. Monzo Bank Ltd, is an online bank based in the United Kingdom. Monzo was one of the earliest of a number of new app-based challenger banks(neobanks) in the world. It was established in 2015.

36. Silicon Valley Bank is a multinational financial services company that focuses on funding technology startups. Its focus on innovation is clear to see as it backed 50% of US-VC technology and life science IPOs in Q1 of 2021

37. Tinkoff

Neobank Tinkoff,formerly Tinkoff Credit Systems is a Russian commercial bank based in Moscow & founded by Oleg Tinkov in 2006. It was established as a branchless credit card issuer.The neobank offers a digital ecosystem of financial and lifestyle products and services

Neobank Tinkoff,formerly Tinkoff Credit Systems is a Russian commercial bank based in Moscow & founded by Oleg Tinkov in 2006. It was established as a branchless credit card issuer.The neobank offers a digital ecosystem of financial and lifestyle products and services

38. Lemonade is a fintech-focused on insurance. It uses AI-powered bots to create a quick and hassle-free customer experience, handling everything from quotes to claims. It is notable that they donate a % of unclaimed premiums to charitable organizations chosen by their customers

39. Credit Karma is an American multinational personal finance company founded in 2007, which has been a brand of Intuit since December 2020. It gives customers a free credit score and credit report in exchange for information about their spending habits

40. Binance is a cryptocurrency exchange that is currently the largest exchange in the world in terms of daily trading volume of cryptocurrencies. It was founded in 2017 and is registered in the Cayman Islands. It was founded by Changpeng Zhao, is a Chinese-Canadian business exec

41. Paidy is basically a two-sided payments service, acting as a middleman between consumers and merchants in Japan. Using machine learning it determines the creditworthiness of a consumer, and then it underwrites those transactions in seconds, guaranteeing payments to merchants.

42. Venmo is a mobile payment service owned by PayPal. Venmo account holders can transfer funds to others via a mobile phone app; both the sender and receiver have to live in the U.S. It has over 40 million active customers

43. Cash App is a mobile payment service developed by Square, Inc. that allows users to transfer money to one another using a mobile phone app. As of March 21, 2021, the service recorded 36 million active users. In January 2018, the Cash App began supporting Bitcoin.

44. Marcus is a digital app by Goldman Sachs. It offers no-fee, unsecured personal loans, a high-yield Online Savings Account & certificates. It has over $50bn in deposits

45. Plaid is a financial services company based in San Francisco, California. The company builds a data transfer network that powers fintech and digital finance products. Plaid's product, a technology platform, enables applications to connect with users’ bank accounts.

46. SoFi was originally a refinancer of student loans but has since developed into a full-scale financial services platform, providing personal loans, home loans, banking, investing, credit cards, and in-school lending

47. Social Capital Hedosophia Holdings Corp. IV (IPOD) is a special purpose acquisition company(SPAC) that intends to effect a business combination with one or more businesses in the technology industries. It is a partnership between Chamath Palihapitiya and Ian Osborne

48. Naver Pay is a mobile payment service launched by Naver Corporation in South Korea. According to a survey conducted in South Korea in 2020, Naver Pay was the most widely used mobile payment service in South Korea, at 73.8 percent

49. Chime is an American fintech company that provides fee-free mobile banking services provided and owned by The Bancorp Bank. Account-holders are issued Visa debit cards and have access to an online banking system accessible through the company's website or via its mobile apps

50. Sezzle is a publicly-traded financial technology company headquartered in Minneapolis, U.S operating in the United States and Canada. The company provides an alternative payment platform offering interest-free installment plans at selected online stores.

IT IS A WRAP5⃣0⃣

IT IS A WRAP5⃣0⃣

• • •

Missing some Tweet in this thread? You can try to

force a refresh