Production linked incentive (PLI)

Scheme for Textile Sectors

Detailed study about Man made fibres , technical textiles , potential growth of textile sectors , Related stocks . 👇

Like , share , retweet for more reach.

#investing #trading #anshumancharts

Scheme for Textile Sectors

Detailed study about Man made fibres , technical textiles , potential growth of textile sectors , Related stocks . 👇

Like , share , retweet for more reach.

#investing #trading #anshumancharts

👉 10683 cr. Rs incentives will be provide for next 5 years.

👉 Can help to create employment of 7.5lacs people directly and several lacs more for supporting activity.

👉 Can help to create employment of 7.5lacs people directly and several lacs more for supporting activity.

👉 It is expected that this scheme will result in fresh investment of 19000 cr. And additional production turnover of Rs 3 lac crore in five years

👉 According to ministery of textile, Govt aim to increase textile export 3times from the present export value of 33bn $ to 100bn $

👉 According to ministery of textile, Govt aim to increase textile export 3times from the present export value of 33bn $ to 100bn $

👉 PLI scheme , priority for investment in aspirational district and Tier 3/4 towns.

👉First (Any person/ company willing to invest minimum of 300cr. In plant , machinery, equipment and civil work to produce product of man made fibres, garments and product of technical textiles.

👉First (Any person/ company willing to invest minimum of 300cr. In plant , machinery, equipment and civil work to produce product of man made fibres, garments and product of technical textiles.

👉Second , those investors willing to invest minimum 100 cr. In same condition.

👉 Acc. to experts, Textile & Garment is expected to reach 190bn $ atleast by 2025-26 from 103.4bn $ in 2020-21 , and

Govt. is planning to take it to 250bn $ in next 5 years , which is almost double.

👉 Acc. to experts, Textile & Garment is expected to reach 190bn $ atleast by 2025-26 from 103.4bn $ in 2020-21 , and

Govt. is planning to take it to 250bn $ in next 5 years , which is almost double.

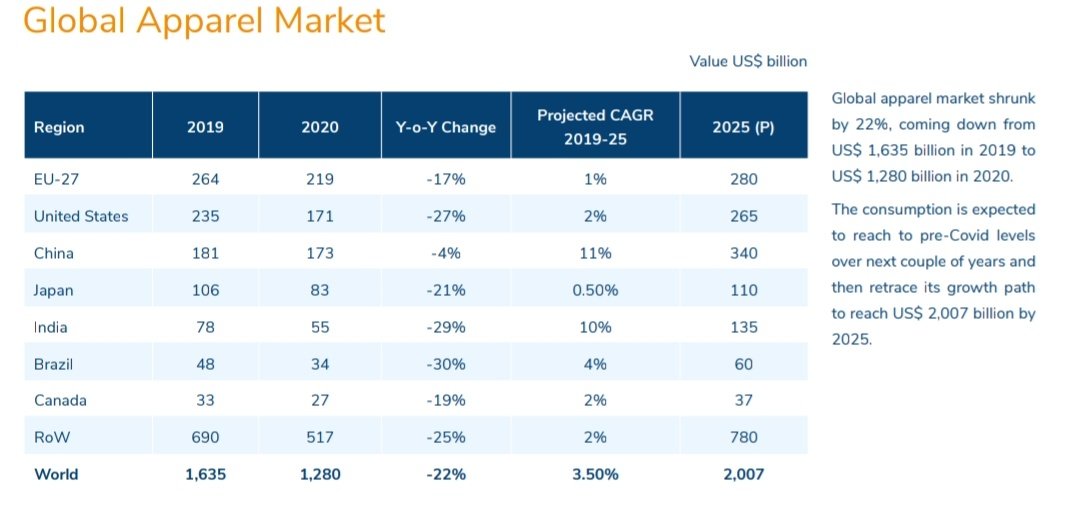

According to Apparel export promotion council ,

Only Apparel market is going to increase from 78bn $ to 135bn $ atleast.

Only Apparel market is going to increase from 78bn $ to 135bn $ atleast.

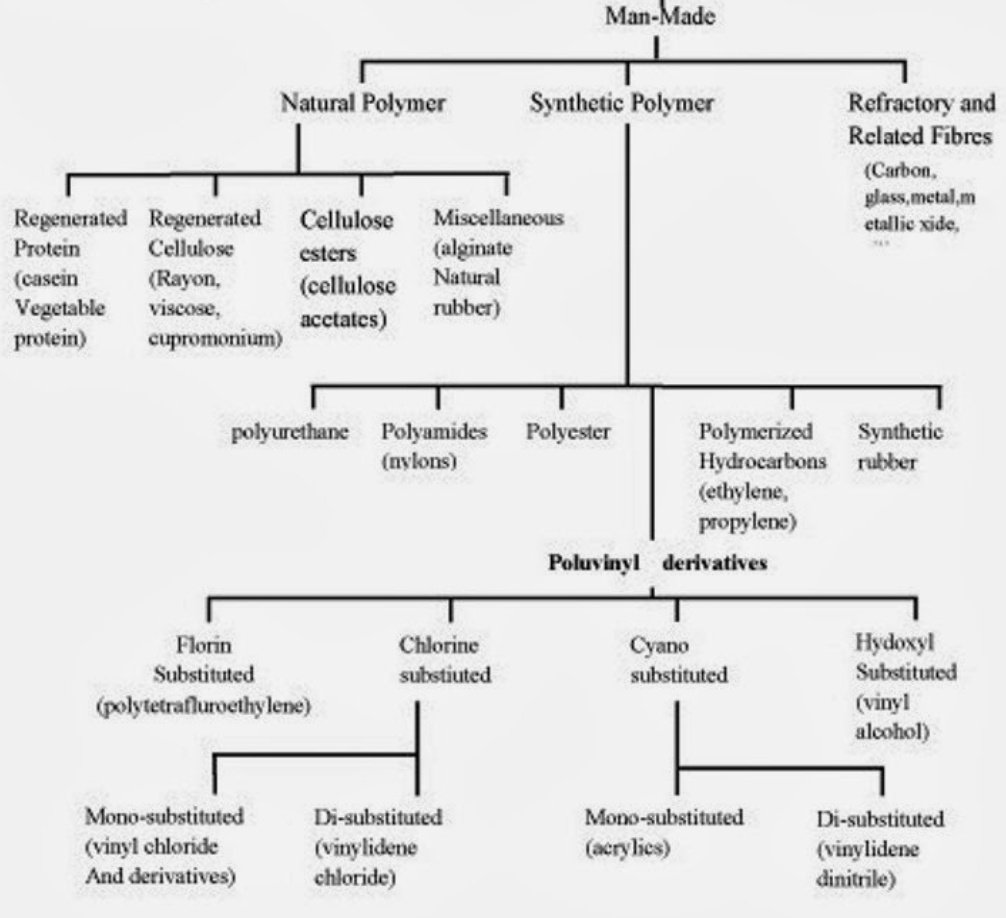

As we know that , PLI scheme in textile is focused on Man Made fibres , Garments n technical textiles .

Now we see about Man made fibre ,

MMF industry mainly comprises of two components Polyester 77.5% & Viscose 16.5%, which total of 94% ( in volume ) ,

Now we see about Man made fibre ,

MMF industry mainly comprises of two components Polyester 77.5% & Viscose 16.5%, which total of 94% ( in volume ) ,

But Govt is planning to increase production of all types of man made fibres like Polyest, Polyamide , Acrylics , Nomex etc.

In this image , U can see Man made fibres classification , which is also related to industrial chemicals like Vinyl chloride ,etc

In this image , U can see Man made fibres classification , which is also related to industrial chemicals like Vinyl chloride ,etc

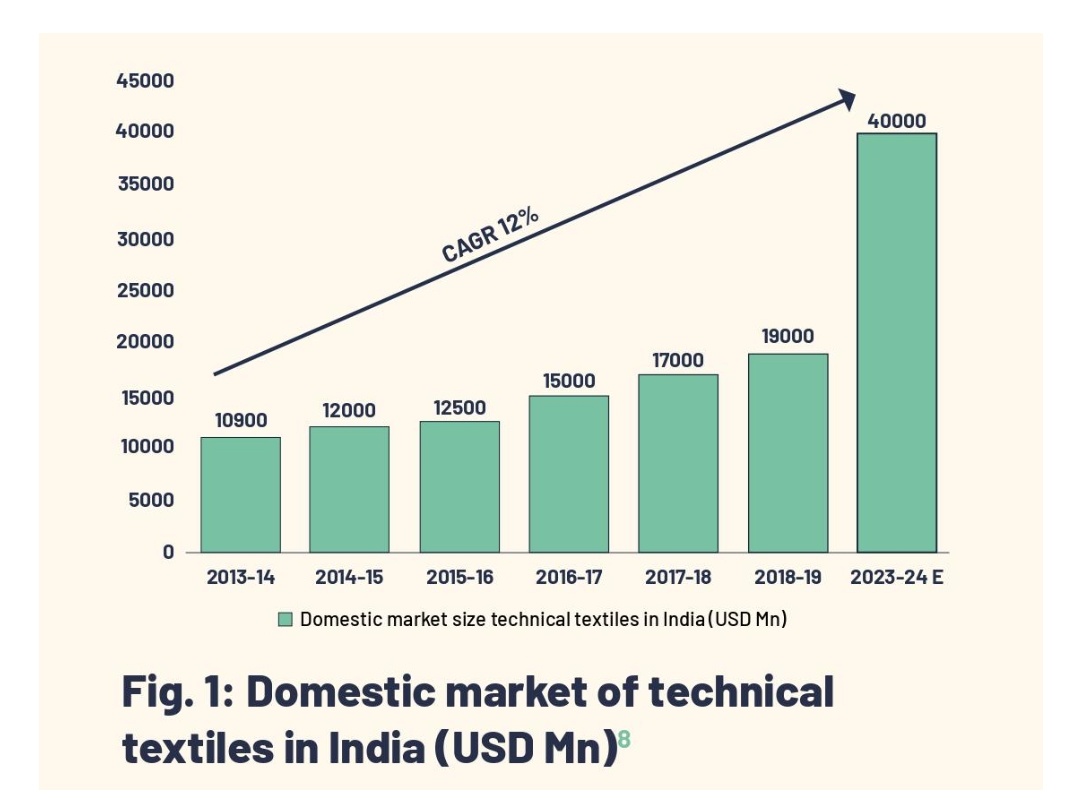

Now technical textiles growth potential is also very strong .

We can expect almost 50% - 2X growth in next 3 to 5 years

We can expect almost 50% - 2X growth in next 3 to 5 years

Top textiles players Are

Sutlej Textiles - leading produces of value added yarn in india , largest product portfolio of spun dyed , cotton blended melange dyed yarns

Arvind ,Vardhman Textiles ,Trident , Bombay dyeing etc are also good .

Sutlej Textiles - leading produces of value added yarn in india , largest product portfolio of spun dyed , cotton blended melange dyed yarns

Arvind ,Vardhman Textiles ,Trident , Bombay dyeing etc are also good .

Top garment textile companies ,

Arvind ltd , bombay dyeing , century textiles , century enka , Dollar , Rupa , Nahar ind ent etc.

Arvind ltd , bombay dyeing , century textiles , century enka , Dollar , Rupa , Nahar ind ent etc.

In textile sector , there is important role of textile chemical , dye , pigments.

Fineotex chemical is only listed pure textile chemical company in India.

Nahar group , Himatsingka , Raymond , Welspun India , Banswara Syntex , vardhaman are it's customers.

Poddar pigments , Vipul organics are also involved in textile play .

Nahar group , Himatsingka , Raymond , Welspun India , Banswara Syntex , vardhaman are it's customers.

Poddar pigments , Vipul organics are also involved in textile play .

• • •

Missing some Tweet in this thread? You can try to

force a refresh