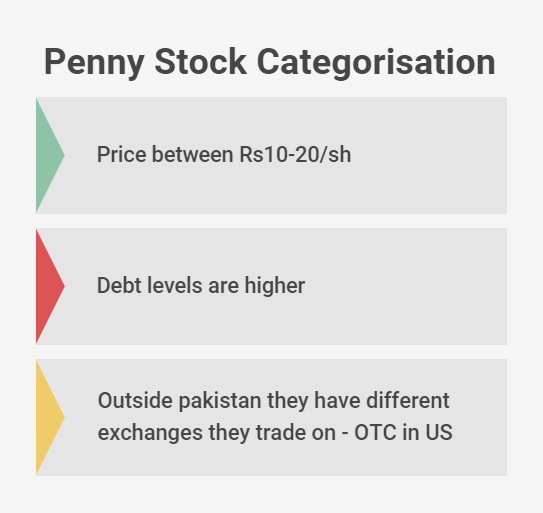

👉Penny stocks12 have gained a lot of popularity in recent years. As investors, we all have been enticed to invest in such stocks, committing relatively smaller capital and waiting and hoping for a turnaround story to emerge to realize large gains.

#pennystocks #PSX

#pennystocks #PSX

These small-cap stocks do become all the more popular when discounts rates are low – remember the rally in 2007 or 2016 or 2021? We try to explain the reasons behind this today.

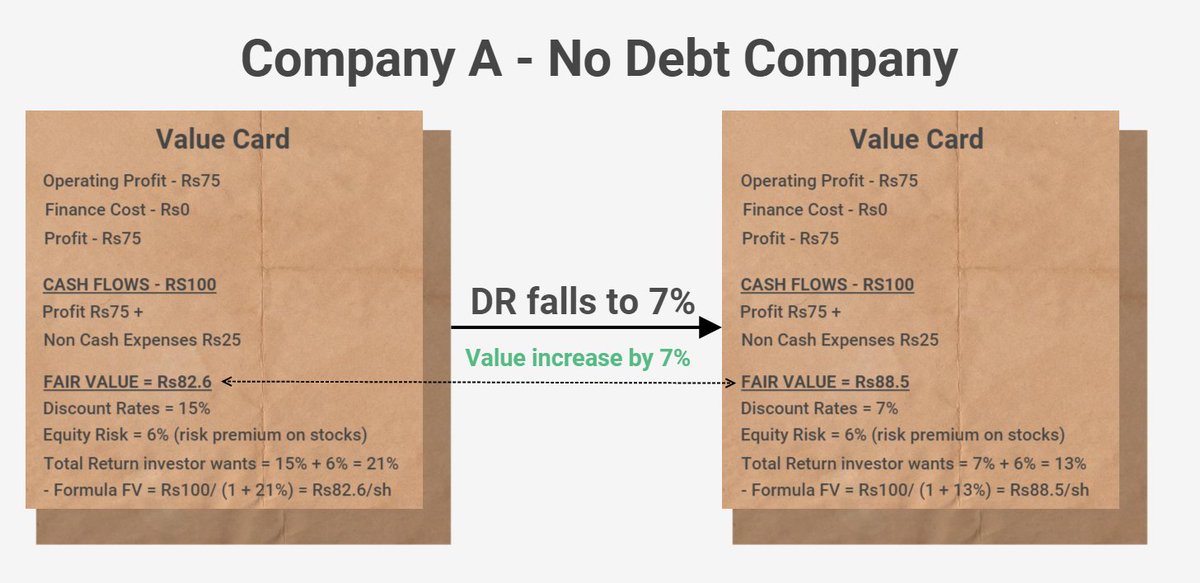

👉DR impacts all but penny stocks more:

Changes in DR impact all the stocks due to the discounting principle at work. Simply put, a company’s fair value will increase in a lower interest rate scenario and vice versa. Let us show you how?

Changes in DR impact all the stocks due to the discounting principle at work. Simply put, a company’s fair value will increase in a lower interest rate scenario and vice versa. Let us show you how?

👉Now in the case of a penny stock, that has high debt:

So, all in all, more money means more valued the stock is and this is the prime reason why penny stocks rally when discount rates come down.

So, all in all, more money means more valued the stock is and this is the prime reason why penny stocks rally when discount rates come down.

👉See the concept play out in 2021

Take a look at the chart below to see that small-cap stocks do much better in terms of price-performance in a lower interest rate scenario.

Take a look at the chart below to see that small-cap stocks do much better in terms of price-performance in a lower interest rate scenario.

👉And that’s not all – low DR pushes investors to take risk

Inflation is 9% and returns on deposits are 4% so safe investments are losing appeal as they are unable to even protect capital, let alone grow it. This is what’s happening right now in Pakistan.

Inflation is 9% and returns on deposits are 4% so safe investments are losing appeal as they are unable to even protect capital, let alone grow it. This is what’s happening right now in Pakistan.

👉Conclusion

Investing is tricky and if you consider penny stocks – well it becomes a lot more difficult.

We advise you to dedicate a portion of your investment portfolio – a number that you are comfortable with and consistent with your risk appetite – to such stocks.

Investing is tricky and if you consider penny stocks – well it becomes a lot more difficult.

We advise you to dedicate a portion of your investment portfolio – a number that you are comfortable with and consistent with your risk appetite – to such stocks.

Read the full blog here > newsletter.investkaar.com

If you like what we write, do subscribe

Happy Investing !!

If you like what we write, do subscribe

Happy Investing !!

• • •

Missing some Tweet in this thread? You can try to

force a refresh