👉The reason behind #TELE’s price rally for the last eight months was finally officiated yesterday - Its wholly-owned subsidiary, Supernet is going for listing at PSX. 1/10

👉Share offering:

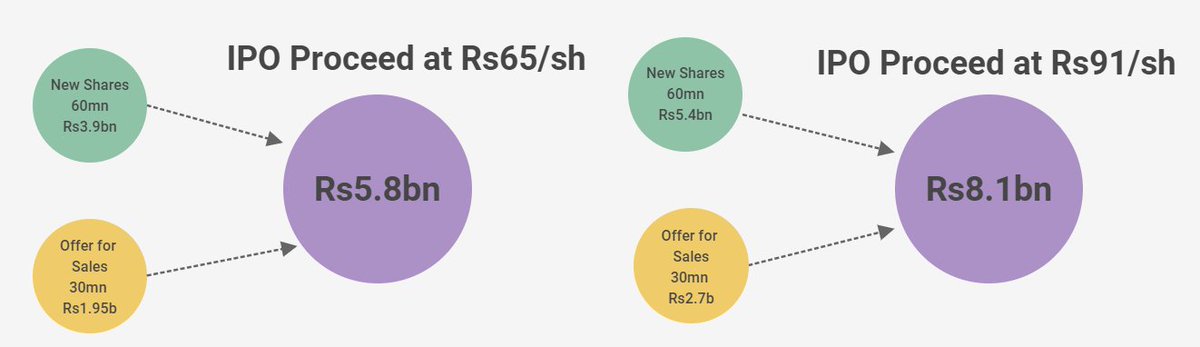

Supernet’s total offering through book building would be 29.5mn shares. Out of the total, 18.3mn shares will be newly issued while the remaining, 11.2mn shares, will be offloaded by Telecard, reducing Tele’s share in Supernet to 75%. 2/10

Supernet’s total offering through book building would be 29.5mn shares. Out of the total, 18.3mn shares will be newly issued while the remaining, 11.2mn shares, will be offloaded by Telecard, reducing Tele’s share in Supernet to 75%. 2/10

The book-building hasn’t been announced yet – Earlier there were rumors that it will be listed on GEMs board – this needs to be followed! 3/10

👉What does Supernet do?

The company is engaged in four main businesses - Call centers, Security services, IT infrastructure, and international connectivity.

You can read up in more detail about their business segments in the following presentation: 4/10

The company is engaged in four main businesses - Call centers, Security services, IT infrastructure, and international connectivity.

You can read up in more detail about their business segments in the following presentation: 4/10

👉Sales and profits over the yrs:

Supernet has grown its top line at a 4yr CAGR of 12% - sales have grown from Rs1.7bn in FY16 to Rs2.7bn as of June 2020.

Profits: CAGR (103%) is much higher due to the low base. As of June 30, 2020, their bottom line was close to Rs34mn 6/10

Supernet has grown its top line at a 4yr CAGR of 12% - sales have grown from Rs1.7bn in FY16 to Rs2.7bn as of June 2020.

Profits: CAGR (103%) is much higher due to the low base. As of June 30, 2020, their bottom line was close to Rs34mn 6/10

and this number has grown by 3x to Rs108mn as of Dec 31, 2020 7/10

👉What does it mean for #TELE?

The base price for the listing has not come out yet. However, assuming a price of Rs10/sh, will allow Telecard to realize a cash inflow of Rs112mn (Rs0.37/sh on a pre-tax basis).

We feel the current price of TELE already reflects the said 8/10

The base price for the listing has not come out yet. However, assuming a price of Rs10/sh, will allow Telecard to realize a cash inflow of Rs112mn (Rs0.37/sh on a pre-tax basis).

We feel the current price of TELE already reflects the said 8/10

development. According to our preliminary workings, Supernet contributes around Rs.12/sh in Tele’s price (1HFY21 earnings annualized, PE of 20x)

This value obviously is based on a set of assumptions, the real value can be worked out when we have more knowledge about the 9/10

This value obviously is based on a set of assumptions, the real value can be worked out when we have more knowledge about the 9/10

financials, industry it operates in, growth opportunities, and risks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh