#MarsiliosTA

Bollinger bands

Interesting concept - 20MA, then 2 standard deviations away from it create the bands - you can also edit the MA

It does work - like all market indicators, nuance required for best results

If really interested read the book by the creator

Bollinger bands

Interesting concept - 20MA, then 2 standard deviations away from it create the bands - you can also edit the MA

It does work - like all market indicators, nuance required for best results

If really interested read the book by the creator

Here's BTC with just the daily BBs

So how does this work?

Sometimes taking reversal trade on band is awesome, sometimes slaughtered

Context is key

Slope matters a lot

Divergence is what the pros look for

To explain...

So how does this work?

Sometimes taking reversal trade on band is awesome, sometimes slaughtered

Context is key

Slope matters a lot

Divergence is what the pros look for

To explain...

Power move, up or down, is high & close outside the band with the band sloping strongly in direction of the trend - this usually (not always) means continuation

You have to review charts to get this concept but now I will mark arrows with this power move outside band

You have to review charts to get this concept but now I will mark arrows with this power move outside band

So these arrows are just showing some (not all incidences) of closing outside the daily BB that continued with the trend

There are several "exceptions" not labeled with arrows which is why I don't think this is a standalone technique and combine with pivots, RSI, etc

There are several "exceptions" not labeled with arrows which is why I don't think this is a standalone technique and combine with pivots, RSI, etc

But let's just say for sake of discussion that a strong move up or down is making high or low & close outside the band

Then the trend slows down, and you start to see highs/lows outside but close inside

The trend slows further and high/low & close both inside band

Divergence

Then the trend slows down, and you start to see highs/lows outside but close inside

The trend slows further and high/low & close both inside band

Divergence

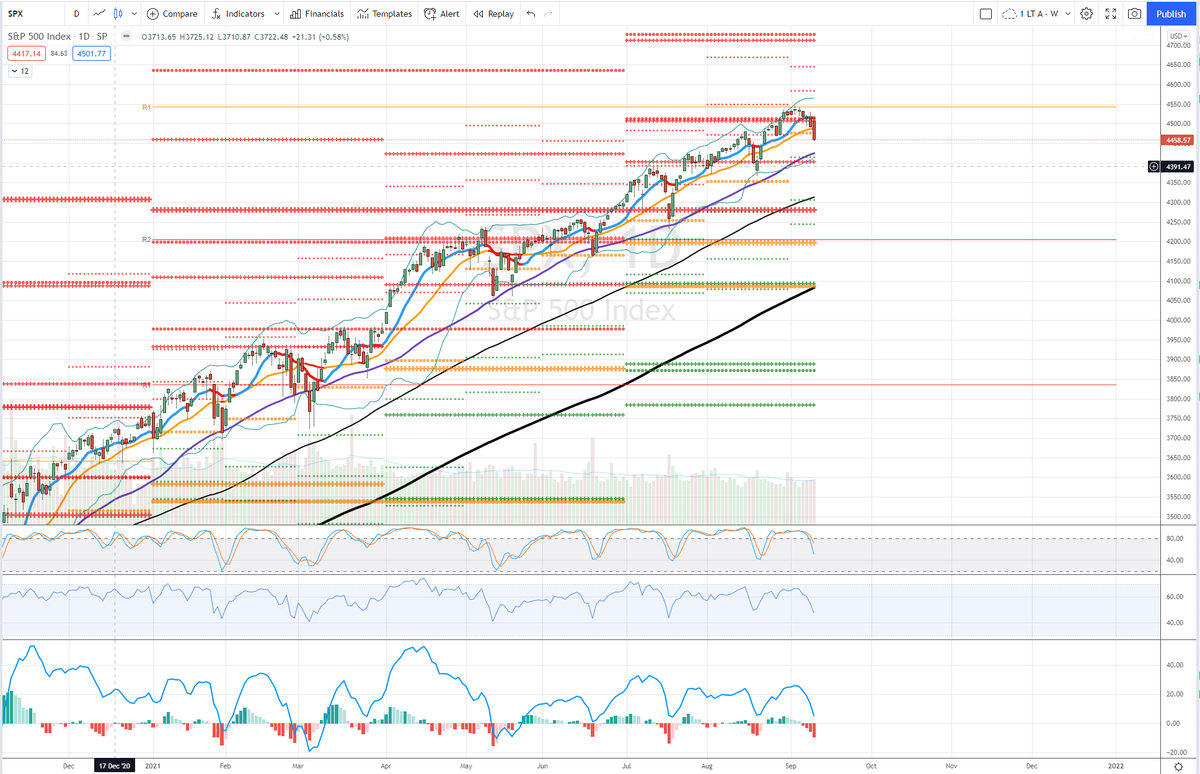

Let's look at recent lows

3 red arrows

1st plunge bar, low far outside band but close well inside, so actually despite the losses the market was not out of control

Next low low outside slightly, close on the band

Then 3rd low near band and close well inside - buying at lows

3 red arrows

1st plunge bar, low far outside band but close well inside, so actually despite the losses the market was not out of control

Next low low outside slightly, close on the band

Then 3rd low near band and close well inside - buying at lows

Just don't need any astro to tell you that dip buyers were in play here

When market is skidding then lows & closes outside band

Often the first stage of new trend is reversal from upper/lower band, after divergence

But we have to add other tools to make this more reliable

When market is skidding then lows & closes outside band

Often the first stage of new trend is reversal from upper/lower band, after divergence

But we have to add other tools to make this more reliable

Same asset, same lows, just different timeframe, 4H

Crash bar massive low & close outside band

Middle low still low & close outside band but not as severe

Recent lows several closes inside band on the red bars

Then next move rally...

Crash bar massive low & close outside band

Middle low still low & close outside band but not as severe

Recent lows several closes inside band on the red bars

Then next move rally...

So on recent lows daily BB bought, 4H BB bought

Add some pivots & RSI and things are getting quite good without any astro at all :)

end

unroll @threadreaderapp

Add some pivots & RSI and things are getting quite good without any astro at all :)

end

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh