Must work continuously....

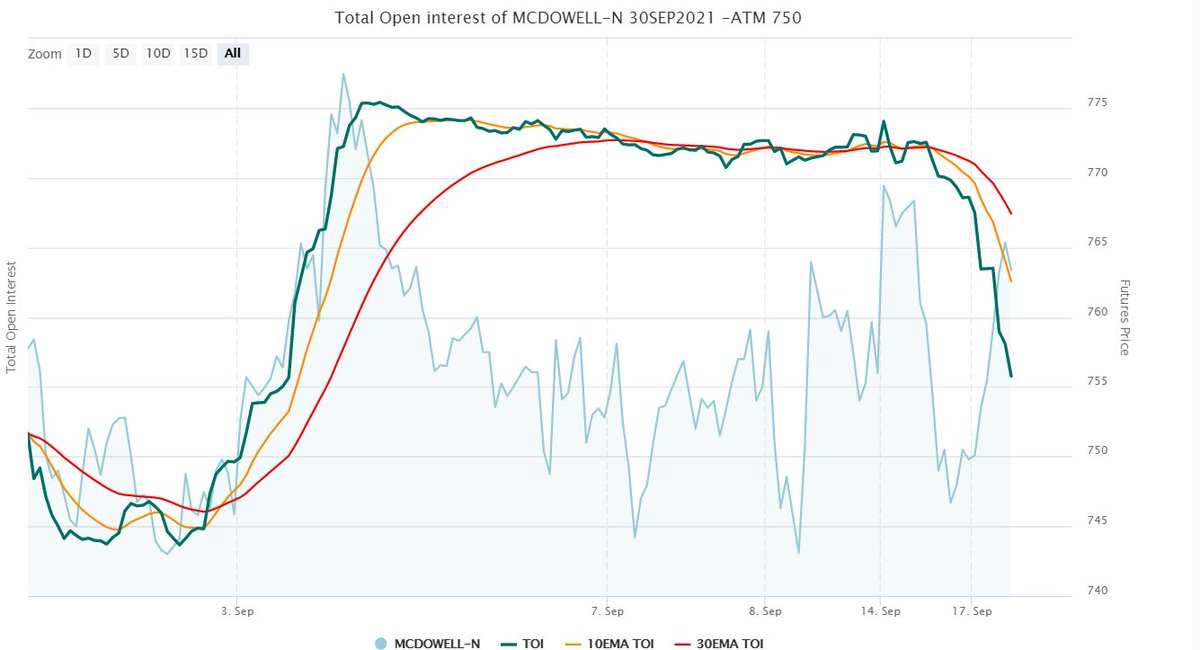

This one has been in a corrective phase with shallow retrace for the last "9 Days"

#McDowell IF holds 735-738 & shows a reversal signal, it would attempt ATH & 800-825.

This one has been in a corrective phase with shallow retrace for the last "9 Days"

#McDowell IF holds 735-738 & shows a reversal signal, it would attempt ATH & 800-825.

#McDowell

Fall was welcomed with open arms..

#Elliottwave gives you clarity

Learn "Elliott Wave Principle" - a free online book-link here- bit.ly/2Zj9v3W

Fall was welcomed with open arms..

#Elliottwave gives you clarity

Learn "Elliott Wave Principle" - a free online book-link here- bit.ly/2Zj9v3W

Worked continuously.

#McDowell spotted much earlier following our own studies...

#Elliottwave

Now, taking rest 🙏🙂

#McDowell spotted much earlier following our own studies...

#Elliottwave

Now, taking rest 🙏🙂

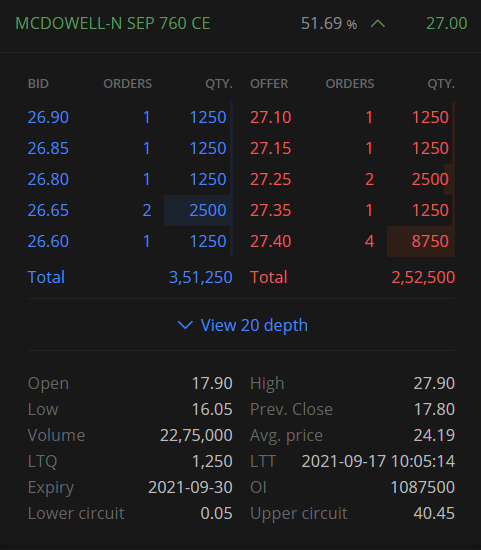

"TOI" didn't help with #McDowell

But, stuck to my studies

#Elliottwave

#Trendindicator combo of 1 Hour & 15 min. (Aggressive Buy generated yesterday;

Conservative buy generated today)

But, stuck to my studies

#Elliottwave

#Trendindicator combo of 1 Hour & 15 min. (Aggressive Buy generated yesterday;

Conservative buy generated today)

• • •

Missing some Tweet in this thread? You can try to

force a refresh